Alright, everyone, take a deep breath and relax. You’ve just been assaulted with a lot of information. Don’t panic. As you view real-world examples of these charts, you’ll become more familiar and comfortable with their interpretations. This and other sites will give you all the additional information you need to continue your current journey and prepare to start another trek toward becoming a charting guru.

Glossary

- Breakout:

- A breakout occurs when a stock’s price moves up quickly above former resistance levels.

- MACD:

- The “moving average convergence/divergence” shows the difference between a fast (like 30 day) and a slow (like 90 day) moving average line of a stock’s prices.

- Moving Average:

- The Moving Average is a line on a chart that smooths out the recent price history by calculating the average price over 30 or 60 days (or any number of days).

- Resistance:

- Resistance in a stock chart forms at an area where the stock’s price seems to not want to move higher. This is due to the presence of sellers at this higher price.

- Support:

- Support in a stock chart forms at an area where the stock’s price seems to not want to move lower. This is due to the presence of buyers at this lower target price.

Further Reading

- How to Read a Stock Trading Chart

- Fundamental vs. Technical Analysis: Pros & Cons, When and How to Use Each

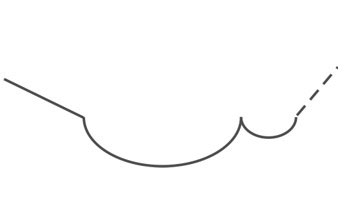

- Cup with Handle Pattern

- Head and Shoulders Top Pattern

- Double Bottom Pattern

- Bearish Continuation Wedge Pattern

- Bullish Continuation Wedge Pattern

- Pennant Patterns

- Candlestick Charting I: Basic Patterns

- Moving Average Convergence Divergence (MACD)

- Fibonacci Ratios in Finance

- 50 Day Moving Averages

- Relative Strength Index (RSI)

- Support & Resistance aka Supply & Demand

- Trade Opportunities using Bollinger Bands

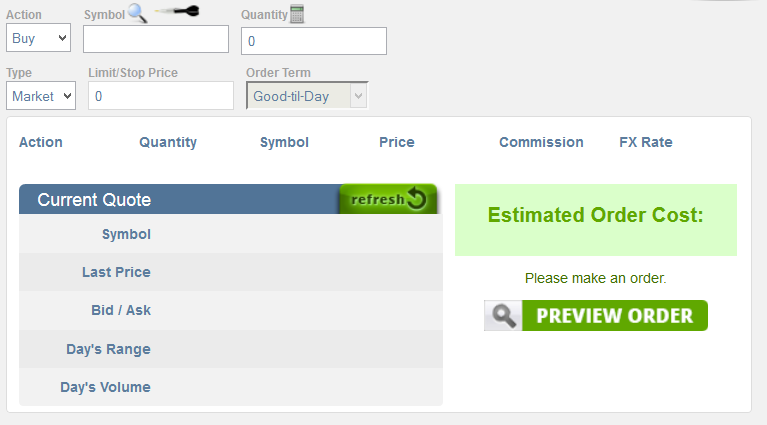

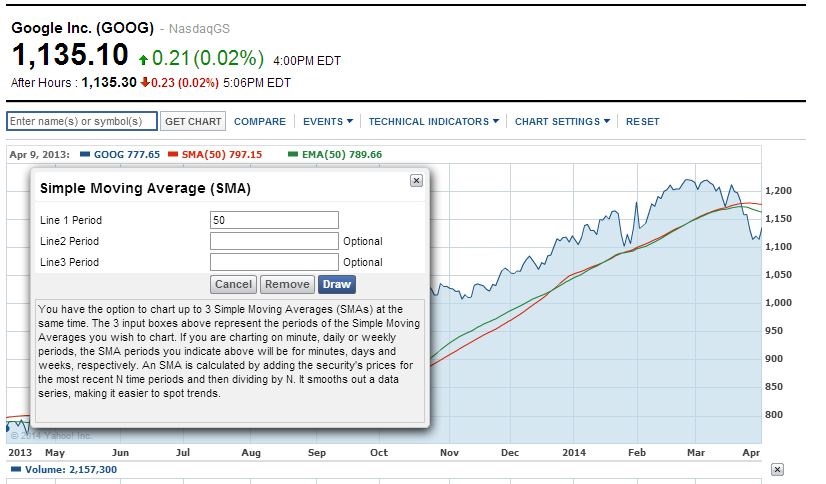

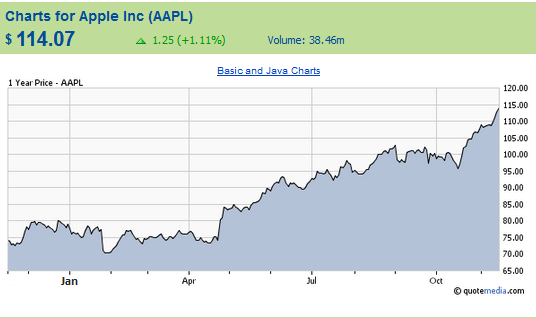

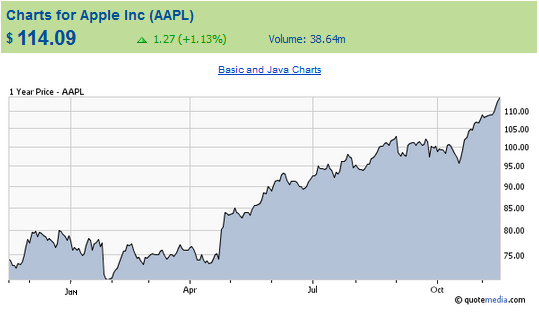

Use the charting tool on you virtual account to generate a graph of one of the stocks in your portfolio and then:

- Change the chart to see how the stock looks on a 1 year graph versus a 1 month chart versus a 1 day chart.

- Change the indicator from line to candlestick

- Change the Chart Type to a logarithmic chart and notice the difference in the Y axis.

- Do you see any type of chart pattern that we mentioned in this chapter? Do you see a cup and handle? Do you see a double bottom pattern?

- Did the stock respond the way you would expect based on the pattern?

- Get a quote on your stock and note the left hand column of the quote page that indicates the current technical pattern. Can you find that pattern?

- Look at the charts of various stocks until you see patterns discussed in this chapter.

- Use the drop down menus to select a new chart style (ie. Candlestick) an upper indicator (ie. SMA or Simple Moving Average) and a lower indicator (ie. MACD).

- Start to become a master of charts and understand what each type of chart has the opportunity to teach you. This is a long process to learn and you should just start to use charts.

In the 1980s, John Bollinger developed a new technical analysis tool to measure the highs and lows of a security price relative to previous trade data. These “trading bands” help investors track and analyze the “bandwidth” of stock prices over a period.

In the 1980s, John Bollinger developed a new technical analysis tool to measure the highs and lows of a security price relative to previous trade data. These “trading bands” help investors track and analyze the “bandwidth” of stock prices over a period.

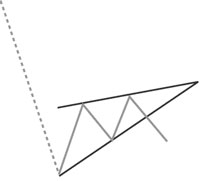

Since the data creating the design is typically slanted against the current trend, a descending flag is considered a “bullish” indicator, while a wedge is viewed as a “bearish” predictor. A typical wedge or flag lasts longer than one month but less than three months. Longer trends will often create designs other than a wedge or a flag.

Since the data creating the design is typically slanted against the current trend, a descending flag is considered a “bullish” indicator, while a wedge is viewed as a “bearish” predictor. A typical wedge or flag lasts longer than one month but less than three months. Longer trends will often create designs other than a wedge or a flag.

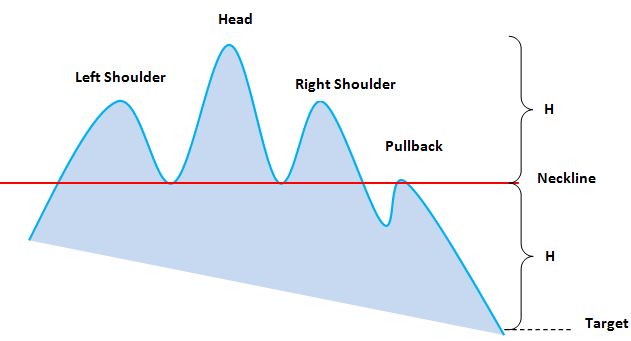

Don’t you love the terminology that pictorially associates these charts with their graphic representations? The Head and Shoulders is an extremely popular pattern among investors because it’s one of the most reliable of all chart formations. It also appears to be an easy one to spot. Novice investors often make the mistake of seeing Head and Shoulders everywhere. Seasoned technical analysts will tell you that it is tough to spot the real occurrences.

Don’t you love the terminology that pictorially associates these charts with their graphic representations? The Head and Shoulders is an extremely popular pattern among investors because it’s one of the most reliable of all chart formations. It also appears to be an easy one to spot. Novice investors often make the mistake of seeing Head and Shoulders everywhere. Seasoned technical analysts will tell you that it is tough to spot the real occurrences.

A company with well-respected and reliable products that have been accepted by the consumer market is often a valuable investment. How many rolls of Charmin toilet paper have you purchased in your lifetime? How many tubes of Colgate toothpaste? How many boxes of Tide laundry detergent? How many gallons of BP gas have you pumped into your car? How many McDonald’s fries have you eaten? These are all strong, stable brands.

A company with well-respected and reliable products that have been accepted by the consumer market is often a valuable investment. How many rolls of Charmin toilet paper have you purchased in your lifetime? How many tubes of Colgate toothpaste? How many boxes of Tide laundry detergent? How many gallons of BP gas have you pumped into your car? How many McDonald’s fries have you eaten? These are all strong, stable brands.

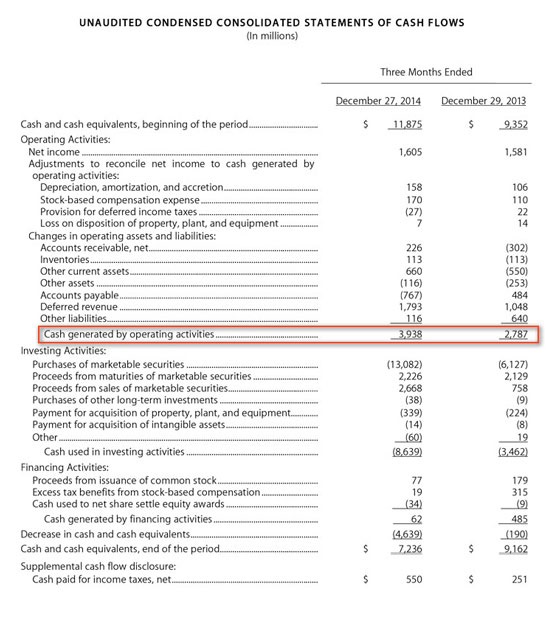

Once you have understood a company’s profitability, take a look at the Statement of Cash Flows because this is the second most important element of Fundamental Analysis and it frequently needs more than a cursory examination. Many experts strongly contend that good cash flow is more important than earnings to ensure company viability for the long-term. Surprised? Don’t be.

Once you have understood a company’s profitability, take a look at the Statement of Cash Flows because this is the second most important element of Fundamental Analysis and it frequently needs more than a cursory examination. Many experts strongly contend that good cash flow is more important than earnings to ensure company viability for the long-term. Surprised? Don’t be.

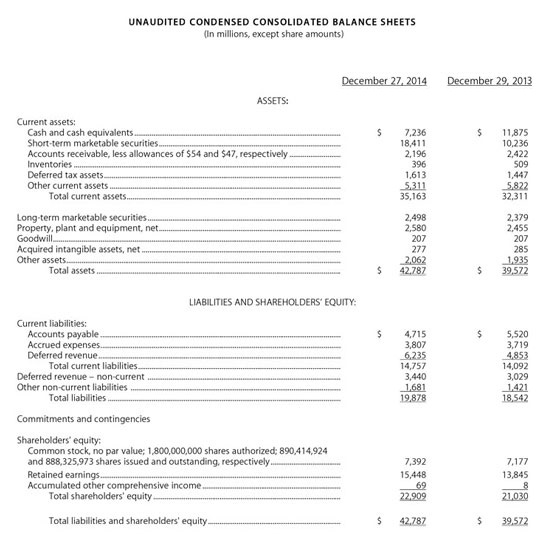

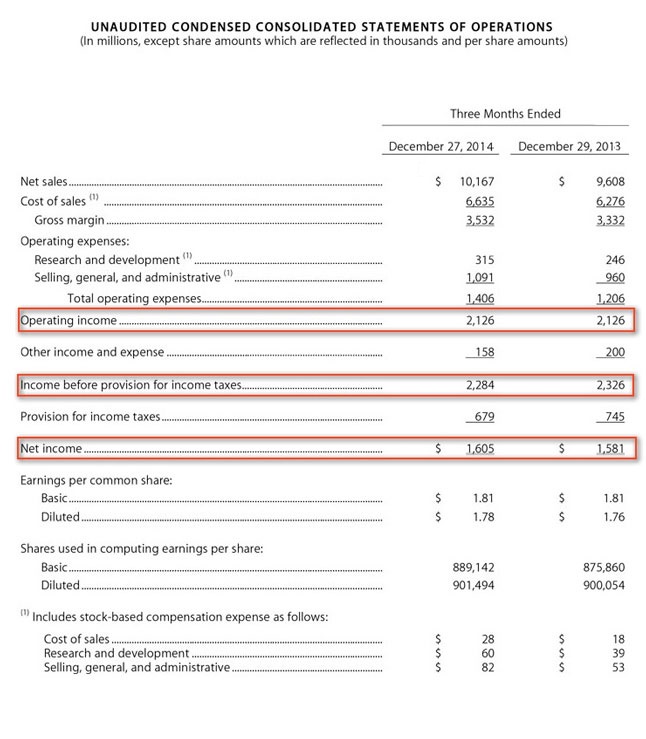

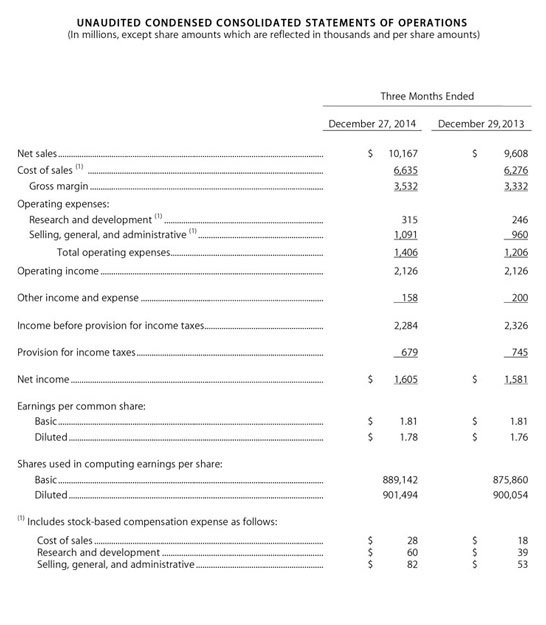

The first place to start analyzing a company is to go straight to the source and review the financial information that the company is publishing about itself.

The first place to start analyzing a company is to go straight to the source and review the financial information that the company is publishing about itself.