Whereas a call option gives the holder the right to buy the stock at a certain price, a put option gives the holder the right to sell the stock at a certain price. A trader that buys a put option The right, but not the obligation, to sell a stock at a certain price before the expiration date. believes that the price of a security will fall in the near future. You are buying the right – not the obligation – to sell the security for an agreed upon strike price The price at which the option contract can be executed. in the future.

Whereas a call option gives the holder the right to buy the stock at a certain price, a put option gives the holder the right to sell the stock at a certain price. A trader that buys a put option The right, but not the obligation, to sell a stock at a certain price before the expiration date. believes that the price of a security will fall in the near future. You are buying the right – not the obligation – to sell the security for an agreed upon strike price The price at which the option contract can be executed. in the future.

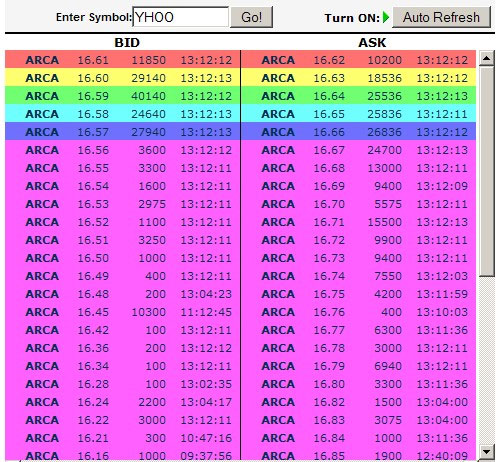

Let’s look at another example using Yahoo! (YHOO) stock. Suppose you think YHOO’s stock price is too high and you expect a sell off. You buy a YHOO October 25 put option at $1, or $100 per contract. This gives you the right to sell 100 shares of YHOO at $25 at any time prior to its expiration on the 3rd Friday in October. If YHOO shares are at $20 by the expiration date The date that the option expires- usually the 3rd Friday of the month in the U.S. in October, then you can exercise your put option and sell shares for $25 when the market is paying only $20 a share, giving you a $5 per share profit and an overall profit of $400 (100 shares x $5 – $100 cost) for that one option contract.

If the price of Yahoo! Is more than $25 by the expiration date, then your option to sell YHOO shares at $25 expires worthless.

Put options offer protection on the downside to limit your losses without severely restricting your profitability. For example, say you already own 100 shares of Yahoo! Stock and you have enjoyed a nice 50% gain in the last 6 months as the stock has gone from $20 to $30 per share. If you buy a put option at the strike price of $30, then you are effectively locking in your price gains for the duration of the options contract without having to sell any of your YHOO shares. There is a cost for this contract, just like there is a cost to be paid for any real-world insurance contract.

Remember this old saying: “stocks slide faster than they glide” meaning that a stock’s price will generally tend to fall quickly while price rises tend to be gradual over time. For me, this has always made put options more attractive to speculate with since the time to see the price of a stock fall is usually shorter than the time to see it rise the same amount.

As with Call options The right, but not the obligation, to buy a stock at a certain price before the expiration date. , you can be a buyer or seller of put options to create protection or arbitrage positions.

Puts are similar to “short positions” (when you sell “borrowed” securities that you do not yet own outright). Don’t worry if it’s a bit confusing, it takes a while for it all to make sense. The best thing to do is keep reading.

Like all other investment strategies, you might win or lose with options. In both put and call options, you must understand the difference between buyers and sellers. The buyers of put or call options are NOT obligated to buy or sell at the agreed upon price. However, call and put sellers (called options “writers”) ARE obligated to fulfill their agreement, in one way or another. That is a significant component in the option world that we will explore next…

OK, that was just a high level introduction. To keep calls and puts straight in your head, just remember that a call option gives you the right to “call” a stock away from someone (think buy), and a put option allows you to “put” a stock to someone (think sell). In the next topic we will look at some real option pricing, trading and strategies.

Generally speaking, options are used in many areas of business and investment. Employees of larger companies frequently get stock options as an incentive to stay with the company for a long time and help the company increase in value. A lot of real estate transactions involve the option to purchase additional neighboring acreage at a certain price within a certain number of years. And even leasing a car usually contains a “purchase option” at the end of the lease term.

Generally speaking, options are used in many areas of business and investment. Employees of larger companies frequently get stock options as an incentive to stay with the company for a long time and help the company increase in value. A lot of real estate transactions involve the option to purchase additional neighboring acreage at a certain price within a certain number of years. And even leasing a car usually contains a “purchase option” at the end of the lease term.

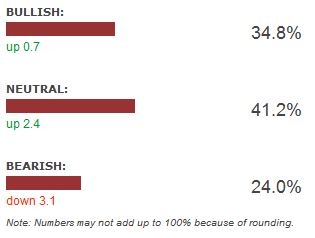

As a newer investor, if you can get a sense of the investment community towards your stocks, you will have good information to make better trades. Even if investor sentiment is bearish (predicting a down market), you can adjust your strategy to make profitable trades in the short-term.

As a newer investor, if you can get a sense of the investment community towards your stocks, you will have good information to make better trades. Even if investor sentiment is bearish (predicting a down market), you can adjust your strategy to make profitable trades in the short-term.

One investor who has literally made millions in busting penny stock “pump and dump” schemes is Timothy Sykes. As a teenager, he turned $10,000 into his first $1,000,000 by spotting and then shorting these pump and dump schemes.

One investor who has literally made millions in busting penny stock “pump and dump” schemes is Timothy Sykes. As a teenager, he turned $10,000 into his first $1,000,000 by spotting and then shorting these pump and dump schemes.

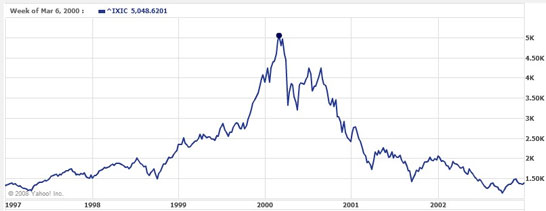

Another way to know if there is an investing mania is to be aware of what is popular, and what is really just way too popular. Remember, prices are nothing more than a reflection of supply and demand, and if everyone wants something, then its price will skyrocket! But as soon as buyers move on to something else, those prices must plummet! Are the news magazines all writing about an investment? Are they on the covers with splashy headlines and creating a feeding frenzy among the masses? If so, then beware…

Another way to know if there is an investing mania is to be aware of what is popular, and what is really just way too popular. Remember, prices are nothing more than a reflection of supply and demand, and if everyone wants something, then its price will skyrocket! But as soon as buyers move on to something else, those prices must plummet! Are the news magazines all writing about an investment? Are they on the covers with splashy headlines and creating a feeding frenzy among the masses? If so, then beware…

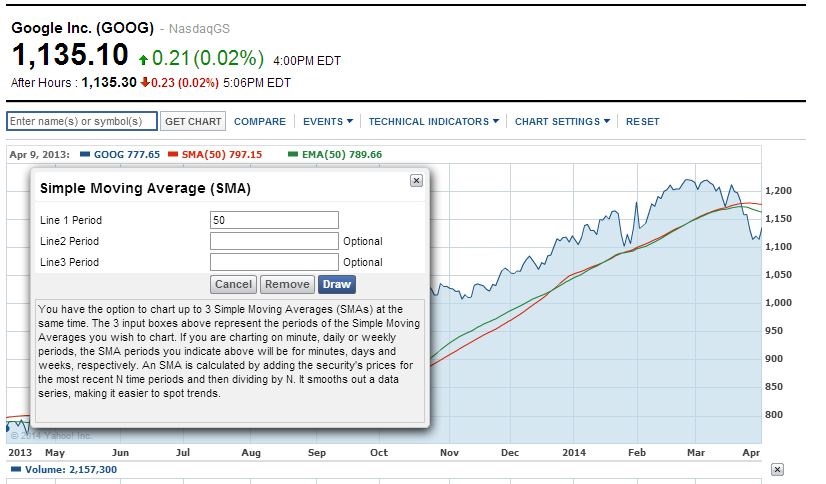

In the 1980s, John Bollinger developed a new technical analysis tool to measure the highs and lows of a security price relative to previous trade data. These “trading bands” help investors track and analyze the “bandwidth” of stock prices over a period.

In the 1980s, John Bollinger developed a new technical analysis tool to measure the highs and lows of a security price relative to previous trade data. These “trading bands” help investors track and analyze the “bandwidth” of stock prices over a period.

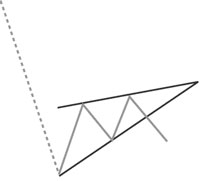

Since the data creating the design is typically slanted against the current trend, a descending flag is considered a “bullish” indicator, while a wedge is viewed as a “bearish” predictor. A typical wedge or flag lasts longer than one month but less than three months. Longer trends will often create designs other than a wedge or a flag.

Since the data creating the design is typically slanted against the current trend, a descending flag is considered a “bullish” indicator, while a wedge is viewed as a “bearish” predictor. A typical wedge or flag lasts longer than one month but less than three months. Longer trends will often create designs other than a wedge or a flag.

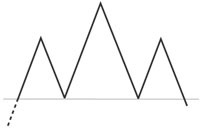

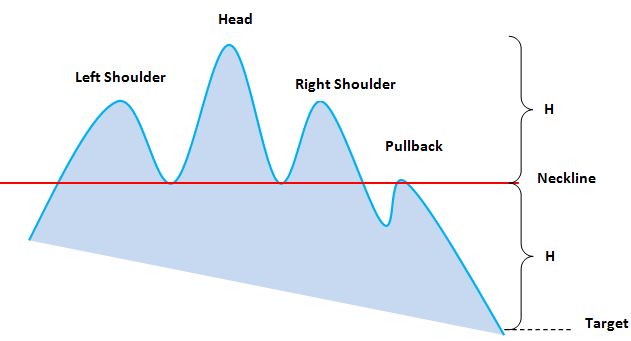

Don’t you love the terminology that pictorially associates these charts with their graphic representations? The Head and Shoulders is an extremely popular pattern among investors because it’s one of the most reliable of all chart formations. It also appears to be an easy one to spot. Novice investors often make the mistake of seeing Head and Shoulders everywhere. Seasoned technical analysts will tell you that it is tough to spot the real occurrences.

Don’t you love the terminology that pictorially associates these charts with their graphic representations? The Head and Shoulders is an extremely popular pattern among investors because it’s one of the most reliable of all chart formations. It also appears to be an easy one to spot. Novice investors often make the mistake of seeing Head and Shoulders everywhere. Seasoned technical analysts will tell you that it is tough to spot the real occurrences.

A company with well-respected and reliable products that have been accepted by the consumer market is often a valuable investment. How many rolls of Charmin toilet paper have you purchased in your lifetime? How many tubes of Colgate toothpaste? How many boxes of Tide laundry detergent? How many gallons of BP gas have you pumped into your car? How many McDonald’s fries have you eaten? These are all strong, stable brands.

A company with well-respected and reliable products that have been accepted by the consumer market is often a valuable investment. How many rolls of Charmin toilet paper have you purchased in your lifetime? How many tubes of Colgate toothpaste? How many boxes of Tide laundry detergent? How many gallons of BP gas have you pumped into your car? How many McDonald’s fries have you eaten? These are all strong, stable brands.

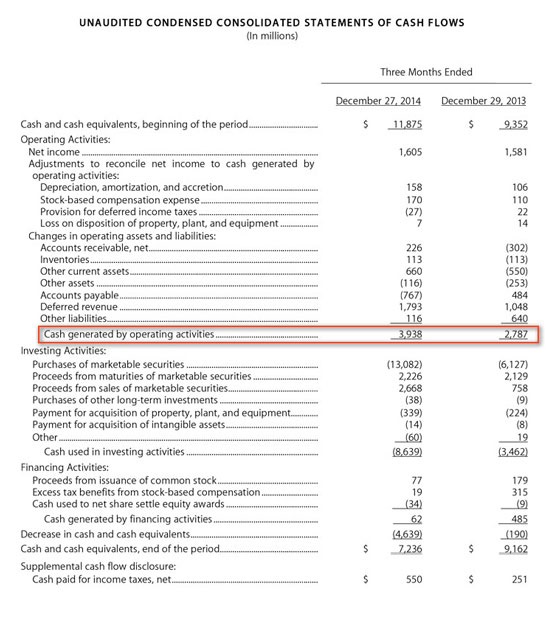

Once you have understood a company’s profitability, take a look at the Statement of Cash Flows because this is the second most important element of Fundamental Analysis and it frequently needs more than a cursory examination. Many experts strongly contend that good cash flow is more important than earnings to ensure company viability for the long-term. Surprised? Don’t be.

Once you have understood a company’s profitability, take a look at the Statement of Cash Flows because this is the second most important element of Fundamental Analysis and it frequently needs more than a cursory examination. Many experts strongly contend that good cash flow is more important than earnings to ensure company viability for the long-term. Surprised? Don’t be.

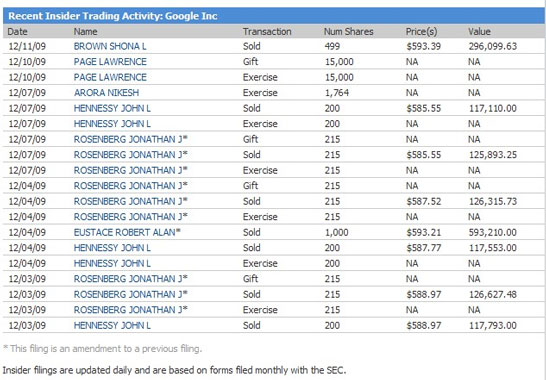

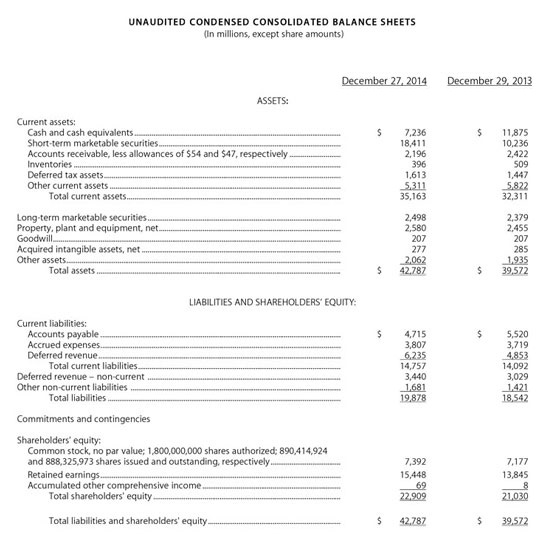

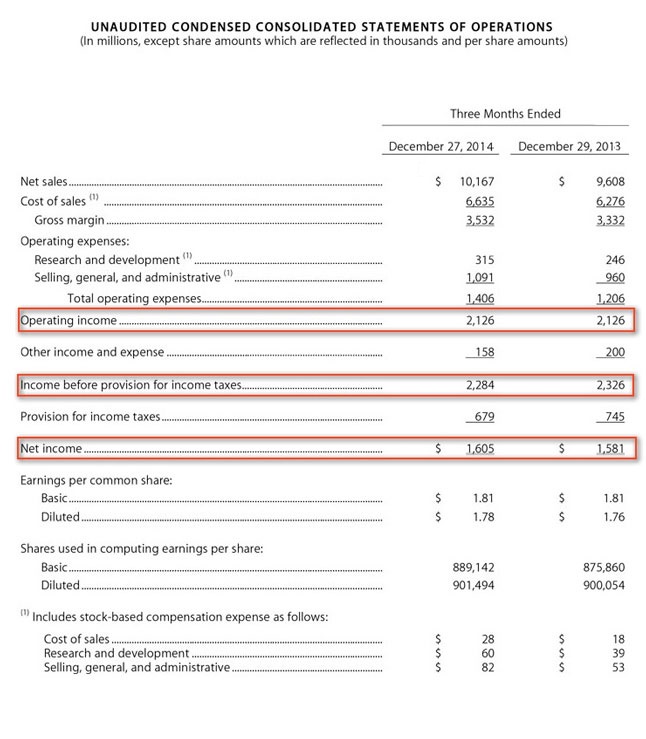

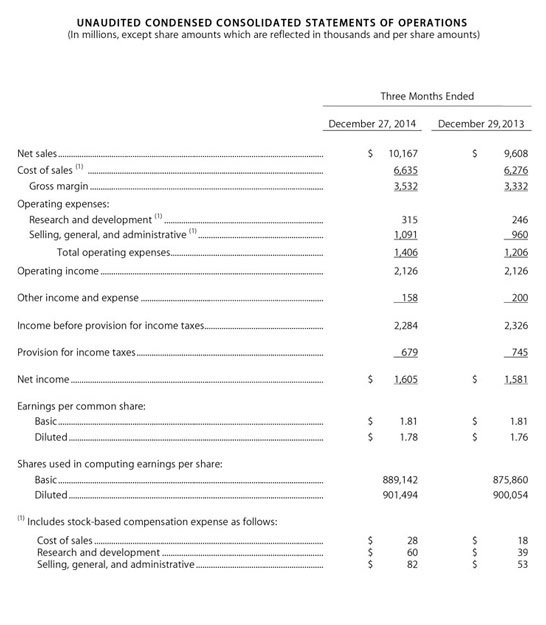

The first place to start analyzing a company is to go straight to the source and review the financial information that the company is publishing about itself.

The first place to start analyzing a company is to go straight to the source and review the financial information that the company is publishing about itself.