This document was part of the lease you signed after moving into your apartment.

Lease Terms

QUIET ENJOYMENT: Tenant shall be entitled to quiet enjoyment of the Premises and Landlord will not interfere with that right, as long as Tenant pays the rent in a timely manner and performs all other obligations under this Lease.

POSSESSION AND SURRENDER OF PREMISES: Tenant shall be entitled to possession of the Premises on the 1st day of the Lease Term. At the expiration of the Lease, Tenant shall peaceably surrender the Premises to the Landlord or Landlord’s agent in good condition, as it was at the commencement of the Lease, reasonable wear and tear excepted.

USE OF PREMISES: Tenant shall only use the Premises as a residence. The Premises shall not be used to carry on any type of business or trade without prior written consent of the Landlord. Tenant will comply with all laws, rules, ordinances, statutes and orders regarding the use of the Premises.

OCCUPANTS: Tenant agrees that no guests not as a signed tenant on this lease may live at the Premises for more than 5 days without prior written consent of the Landlord.

CONDITION OF PREMISES: Tenant or Tenant’s agent has inspected the Premises, the fixtures, the grounds, building and improvements and acknowledges that the Premises are in good and acceptable condition and are habitable. If at any time during the term of this Lease, in Tenant’s opinion, the conditions change, Tenant shall promptly provided reasonable notice to Landlord.

ASSIGNMENT AND SUBLEASE: Tenant ☐ shall ☐ shall not assign or sublease any interest in this Lease. All sublease arrangement must be made with prior written consent of the Landlord, which consent shall not be unreasonably withheld. Any assignment or sublease without Landlord’s written prior consent shall, at Landlord’s option, terminate this Lease.

DANGEROUS MATERIALS: Tenant shall not keep or have on or around the Premises any item of a dangerous, flammable or explosive nature that might unreasonably increase the risk of fire or explosion on or around the Premises or that might be considered hazardous by any responsible insurance company.

UTILITIES ANDS SERVICES: Charge for ☐ electricity, ☐ telephone service, ☐ cable television, ☐ heat, ☐ hot water, ☐ water, ☐ garbage pick-up, X snow-removal and ☐ lawn maintenance are services/utilities provided to the apartment are included as a part of this Lease and shall be borne by the Landlord in addition to the following: $35 per month of services rendered.

PETS: Tenant shall not keep any pets on the Premises without the prior written consent of the Landlord. If Landlord grants permission to Tenant to keep pets, an additional security deposit of $250 will be required by the Landlord to keep in trust for potential damage to the Premises caused by Tenant’s pets.

ALTERATIONS AND IMPROVEMENTS: Tenant agrees not to make any improvements or alterations to the Premises without prior written consent of the Landlord. If any alterations, improvement or changes are made to or built on or around the Premises, with the exception of fixtures and personal property that can be removed without damage to the Premises, they shall become the property of Landlord and shall remain at the expiration of the Lease, unless otherwise agreed in writing.

DAMAGE TO PREMISES: If the Premises or part of the Premises are damaged or destroyed by fire or other casualty not due to Tenant’s negligence, the rent will be abated during the time that the Premises are uninhabitable. If Landlord decides not to repair or rebuild the Premises, then this Lease shall terminate and the rent shall be prorated up to the time of the damage. Any unearned rent paid in advance shall be refunded to Tenant.

MAINTENANCE AND REPAIR: Tenant will, at Tenant’s sole expense, keep and maintain the Premises in good, clean and sanitary condition and repair during the term of this Lease and any renewal thereof. Tenant shall be responsible to make all repairs to the Premises, fixtures, appliances and equipment therein that may have been damaged by Tenant’s misuse, waste or neglect, or that of the Tenant’s family, agents or visitors. Tenant agrees that no painting will be done on or about the Premises without the prior written consent of Landlord. Tenant shall promptly notify Landlord of any damage, defect or destruction of the Premises or in the event of the failure of any of the appliances or equipment. Landlord will use its best efforts to repair or replace any such damaged or defective areas, appliances or equipment.

RIGHT OF INSPECTION: Tenant agrees to make the Premises available to Landlord or Landlord’s agents for the purposes of inspection, making repairs or improvements, or to supply agreed services or show the premises to prospective buyers or tenants, or in case of emergency. Except in case of emergency, Landlord shall give Tenant reasonable notice of intent to enter. Tenant shall not, without Landlord’s prior written consent, add, alter or re-key any locks to the Premises. At all times Landlord shall be provided with a key or keys capable of unlocking all such locks and gaining entry. Tenant further agrees to notify Landlord in writing if Tenant installs any burglar alarm system, including instructions on how to disarm it in case of emergency entry.

HOLDOVER: In the event Tenant remains in possession the Premises for any period after the expiration of the Lease Term (“Holdover Period”) a new month-to-month tenancy shall be created subject to the same terms and conditions of this Lease at a monthly rental rate of the same in this agreement unless otherwise agreed by the Parties in writing. Such month-to-month tenancy shall be terminable on thirty (30) days notice by either Party or on longer notice if required by law.

ABANDONMENT: If Tenant abandons the Premises of any personal property during the term of this Lease, Landlord may at is option enter the Premises by any legal means without liability to Tenant and may at Landlord’s option terminate the Lease. Abandonment is defined as absence of the Tenants from the Premises for at least 25 consecutive days without notice to Landlord. If Tenant abandons the Premises while the rent is outstanding for more than 60 days and there is not reasonable evidence, other than the presence of the Tenants’ personal property, that the Tenant is occupying the unit, Landlord may at Landlord’s option terminate this Lease Agreement and regain possession in the manner prescribed by law. Landlord will dispose of all abandoned personal property on the Premises in any manner allowed by law.

EXTENDED ABSENCES: In the event Tenant will be away from the Premises for more than 7 consecutive days, Tenant agrees to notify Landlord in writing of such absence. During such absence, Landlord may enter the premises at times reasonable necessary to maintain the property and inspect for damages and needed repairs.

SECURITY: Tenant understands that Landlord does not provide any security alarm system or other security for Tenant or the Premises. In the event any alarm system is provided, Tenant understands that such alarm system is not warranted to be complete in all respects or to be sufficient to protect Tenant on the Premises. Tenant releases Landlord from any loss, damage, claim or injury resulting from the failure of any alarm system, security or from the lack of any alarm system or security.

SEVERABILITY: If any part of this Lease shall be held unenforceable for any reason, the remainder of this Agreement shall continue in full force and effect. If any provision of this Lease is deemed invalid or unenforceable by any court of competent jurisdiction, and if limiting such provision would make the provision valid, then such provision shall be deemed to be construed as so limited.

INSURANCE: Landlord and Tenant shall each be responsible to maintain appropriate insurance for their respective interests in the Premises and property located on the Premises. Tenant understands that Landlord will not provide any insurance coverage for Tenant’s property. Landlord will not be responsible for any loss of Tenant’s property, whether by theft, fire, riots, strikes, acts of God or otherwise. Landlord encourages Tenant to obtain renter’s insurance or other similar coverage to protect against risk of loss.

BINDING EFFECT: The covenants and conditions contained in the Lease shall apply to the Parties and the heirs, legal representatives, successors and permitted assigns of the Parties.

GOVERNING LAW: This Lease shall be governed by and construed in accordance with the laws of the State of Illinois.

ENTIRE AGREEMENT: This Lease constitutes the entire Agreement between the Parties and supersedes any prior understanding or representation of any kind preceding the date of this Agreement. There are no other promises, conditions, understandings or other Agreements, whether oral or written, relating to the subject matter of this Lease. This Lease may be modified in writing and must be signed by both Landlord and Tenant.

NOTICE: Any notice required or otherwise given pursuant to this Lease shall be in writing and mailed certified return receipt requested, postage prepaid, or delivered by overnight delivery service, if to Tenant, at the Premise and if to Landlord, at the address for payment of rent. Either party may change such addresses from time to time by providing notice as set forth above.

CUMULATIVE RIGHTS: Landlord’s and Tenant’s rights under this Lease are cumulative and shall not be construed as exclusive of each other unless otherwise required by law.

WAIVER: The failure of either Party to enforce any provisions of the Lease shall not be deemed a waiver of limitation of that Party’s right to subsequently enforce and compel strict compliance with every provision of this Lease. The acceptance of rent by Landlord does not waive Landlord’s right to enforce any provisions of this Lease.

INDEMNIFICATION: To the extent permitted by law, Tenant will indemnify and hold Landlord and Landlord’s property, including the Premises, free and harmless from any liability for losses, claims, injury to or death of any person, including Tenant, or for damage to property arising from Tenant using and occupying the Premises or from the acts or omissions of any person or persons, including Tenant, in or about the Premises with Tenant’s express or implied consent except Landlord’s act or negligence.

LEGAL FEES: In the event that the Tenant violates the terms of the Lease or defaults in the performance of any covenants in the Lease and the Landlord engages an attorney or institutes a legal action, counterclaim, or summary proceeding against Tenants based upon such violation or default, Tenants shall be liable to Landlord for the costs and expenses incurred in enforcing this Lease, including reasonable attorney fees and costs. In the event the Tenants bring any action against the Landlord pursuant to this Lease and the Landlord prevails, Tenant shall be liable to Landlord for costs and expenses of defending such action, including reasonable attorney fees and costs.

ADDITIONAL TERMS AND CONDITIONS:

DISPLAY OF SIGNS: Landlord or Landlord’s agent may display “For Sale” or “For Rent” or “Vacancy” or similar signs on or about the Premises and enter to show the Premises to prospective tenants during the last 30 days of this Lease. Tenant agrees that no signs shall be placed on the Premises without the prior written consent of the Landlord.

NOISE: Tenant shall not cause or allow any unreasonably loud noise or activity in the Premises that might disturb the rights, comforts and conveniences of other persons. No lounging or visiting will be allowed in the common areas. Furniture delivery and removal will take place between 8a.m. and 8p.m.

PARKING: Tenant is ☐ granted X not granted permission to use parking space(s) that may be found at the property for the purpose of parking 2 motor vehicle(s) during the term of this Lease. Landlord is not responsible for, nor does it assume any liability for damages caused by fire, theft, casualty or any other cause whatsoever with respect to any car or its contents.

BALCONIES: Tenant ☐ shall X shall not use balcony for the purpose of storage, drying clothes, or cleaning rugs. Use of balcony for this purpose shall result in a $25 fine per day.

BICYCLES: All bicycles owned by the Tenant shall be stored only in the areas designated by the Landlord and not in any other parts of the building including the hallways, entrances and lobbies.

DWELLING: Tenant is only entitled to occupy the dwelling listed above. This Lease does not entitle the Tenant to use of any area outside of the dwelling including, but not limited to, the attic, basement or the garage without written permission from the Landlord. Tenant is not to paint any part of the apartment without prior written permission from the Landlord.

WATER LEAKS: Tenant is to notify the Landlord immediately if Tenant notices any running water in the faucets in the kitchen, bathroom-sink, bathtub or any other faucets. If the toilet is running and does not shut off properly, Tenant is to notify Landlord immediately. If Tenant does not notify Landlord of any water leaks and it is determined that the water bill is in excess because of this leak, Tenant will be responsible financially for paying the difference in the water bill.

LATE FEES: If Tenant fails to pay any additional fines within 15 days of notice, an additional $35 fine will be levied for late payment.

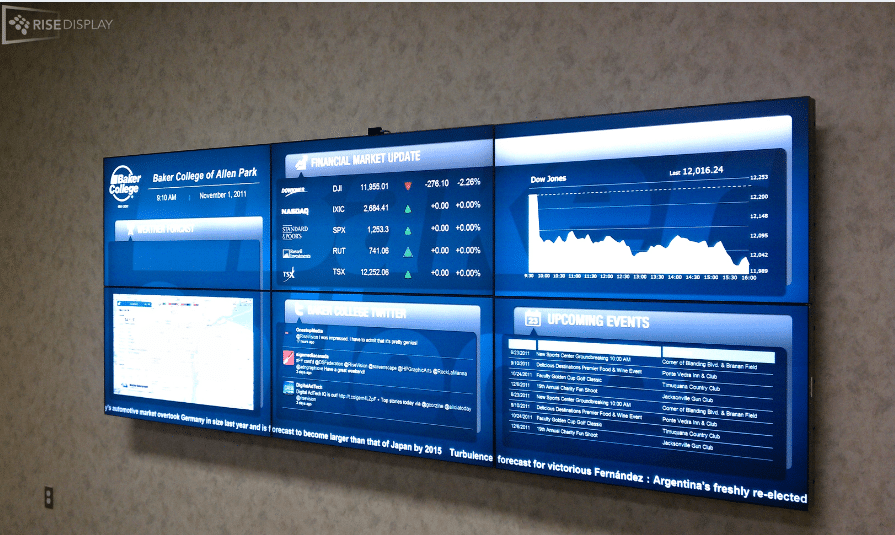

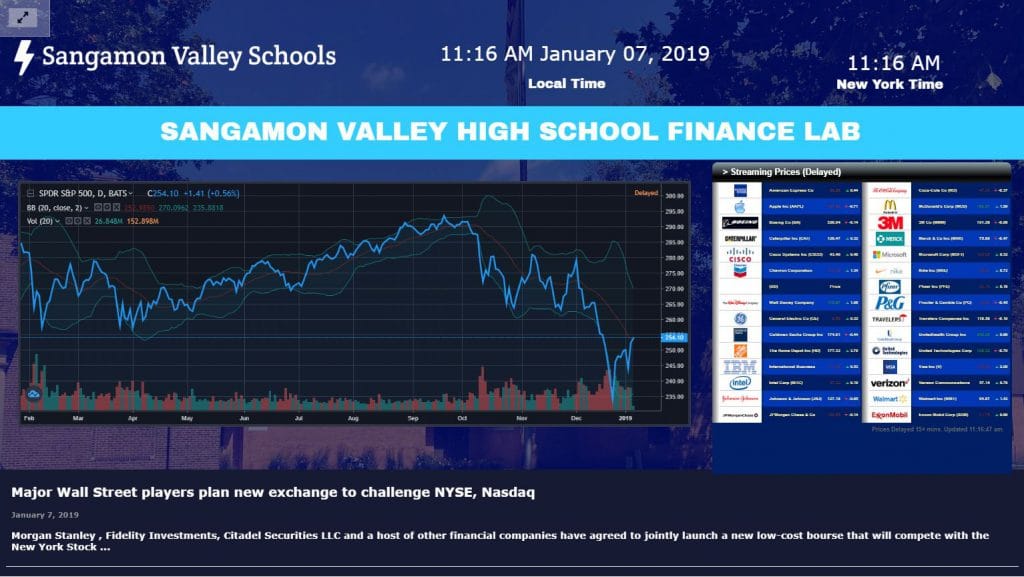

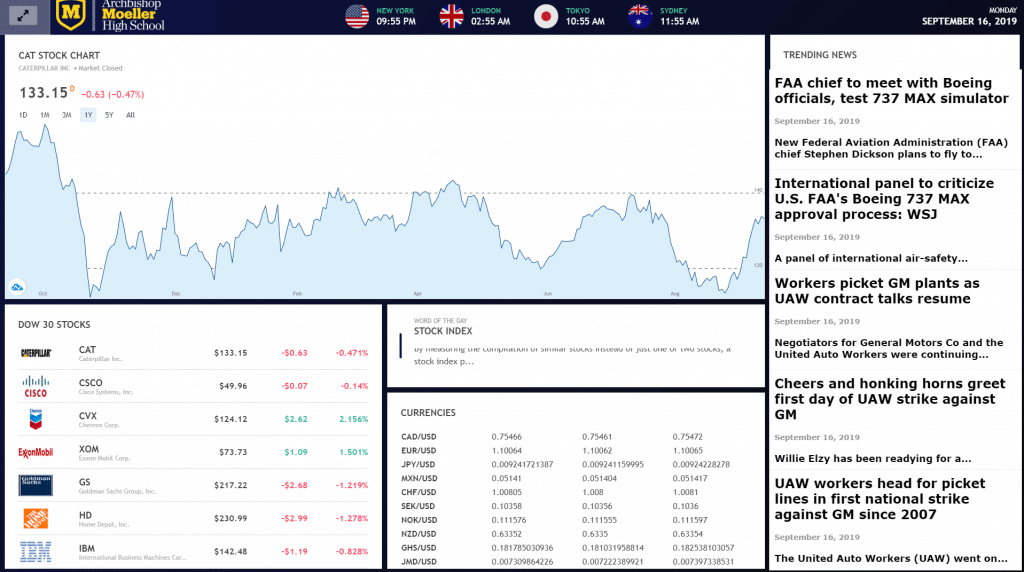

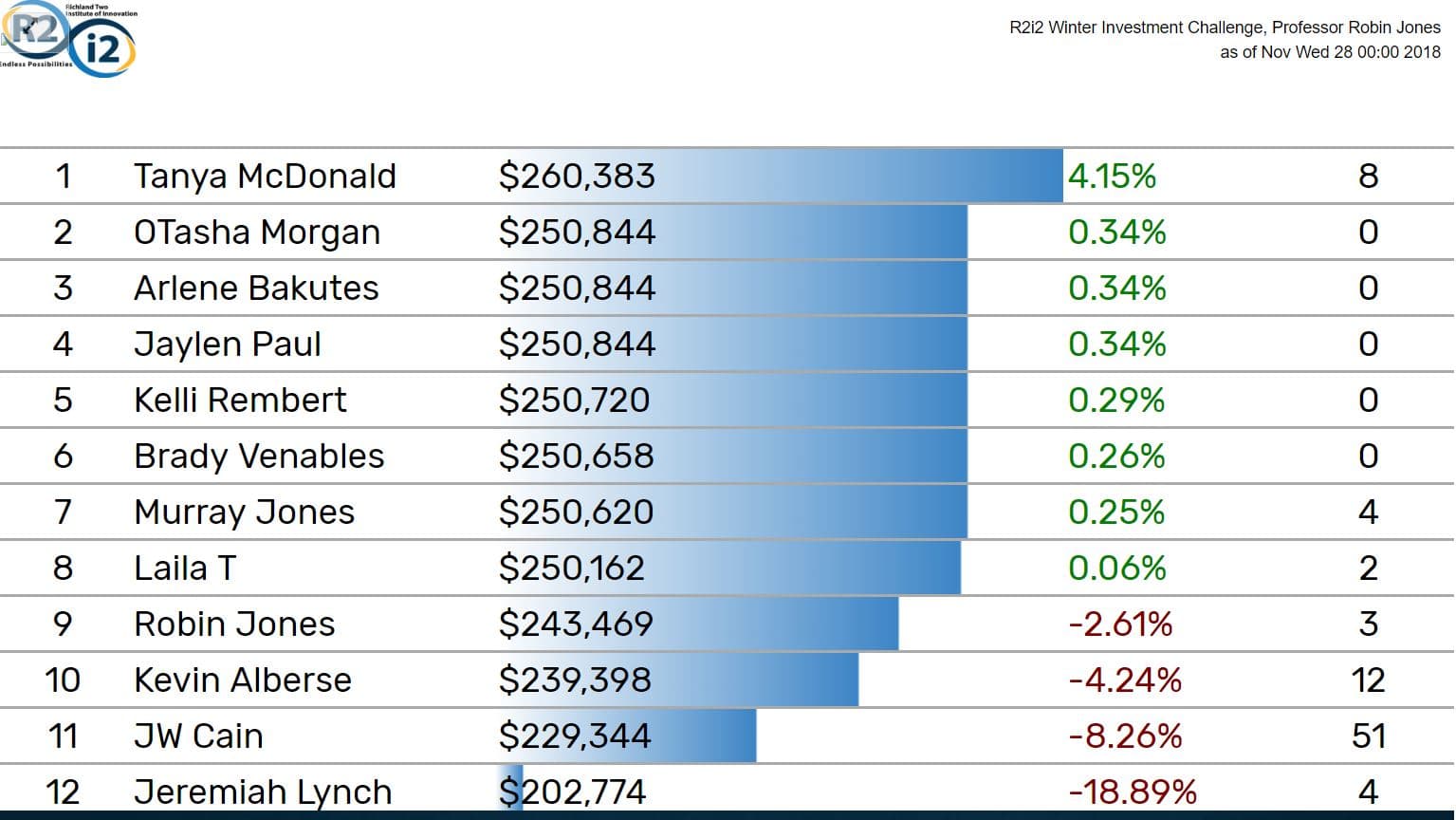

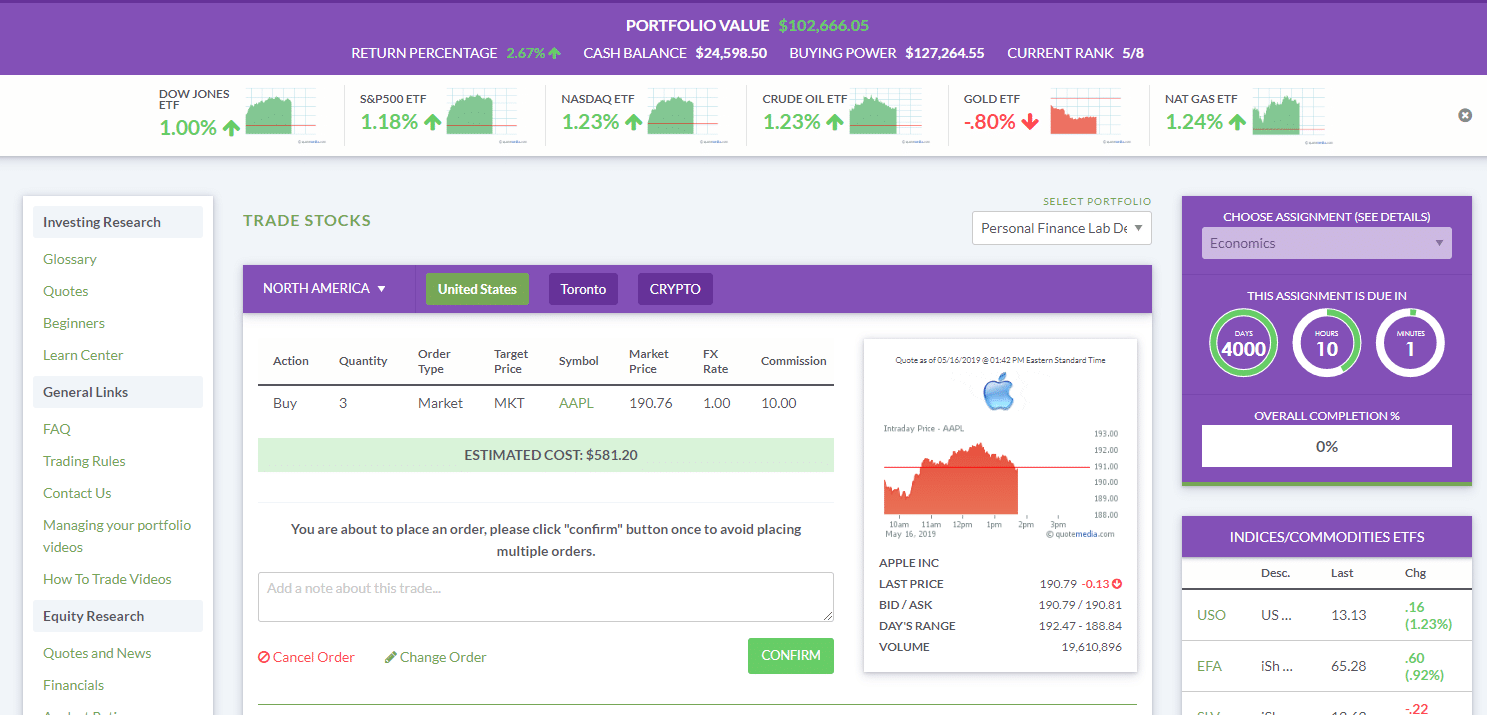

When we talk to teachers, we sometimes see teachers who are very comfortable investing on their own that still avoid stock games in class. Their reasoning is that the length of a class is not long enough for students to tell the difference between a “good” investor or “bad” investor. This criticism comes up most often when teachers are considering using a stock game just during their 2 week unit on Investments. And they are right!

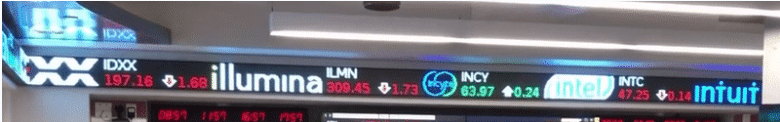

When we talk to teachers, we sometimes see teachers who are very comfortable investing on their own that still avoid stock games in class. Their reasoning is that the length of a class is not long enough for students to tell the difference between a “good” investor or “bad” investor. This criticism comes up most often when teachers are considering using a stock game just during their 2 week unit on Investments. And they are right! Using stock games in class gives your students a whole new perspective on the world around them. By the end of your class simulation, your student’s thought process gets transformed from “I’m going to the store to buy some food” to “I’m going outside in my Nike (NKE) shoes, Wrangler (VFC) Jeans, and Abercrombie & Fitch (ANF) t-shirt, to the Bank of America (BAC) ATM to get cash, then drive my Ford (F) car rolling on Goodyear (GT) tires with BP (BP) gas to Walmart (WMT) to buy Charmin (PG) toilet paper, Crest (PG) toothpaste, Coca-Cola (KO), and Ben and Jerry’s (UL) Ice Cream.

Using stock games in class gives your students a whole new perspective on the world around them. By the end of your class simulation, your student’s thought process gets transformed from “I’m going to the store to buy some food” to “I’m going outside in my Nike (NKE) shoes, Wrangler (VFC) Jeans, and Abercrombie & Fitch (ANF) t-shirt, to the Bank of America (BAC) ATM to get cash, then drive my Ford (F) car rolling on Goodyear (GT) tires with BP (BP) gas to Walmart (WMT) to buy Charmin (PG) toilet paper, Crest (PG) toothpaste, Coca-Cola (KO), and Ben and Jerry’s (UL) Ice Cream.