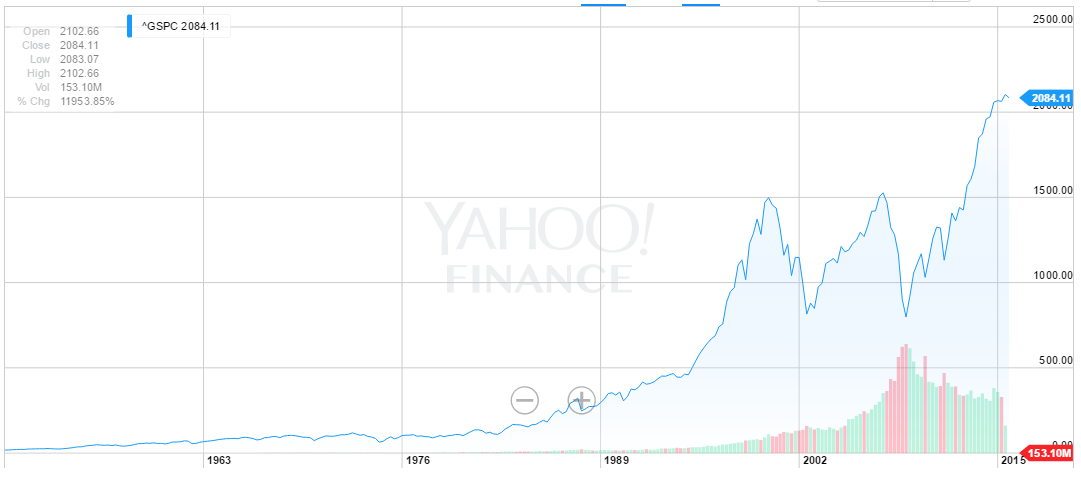

ETFs are collections of assets into bundles you can invest in all at once, the most popular ones follow indecies (such as SPY following the S&P 500), which is one way for an investor to build a diverse portfolio without holding dozens of individual positions.

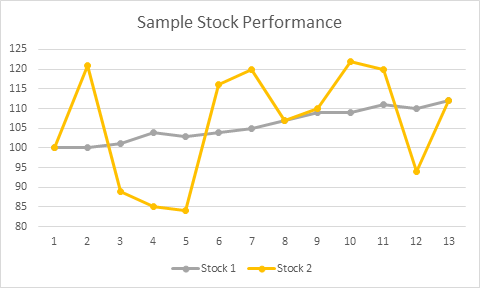

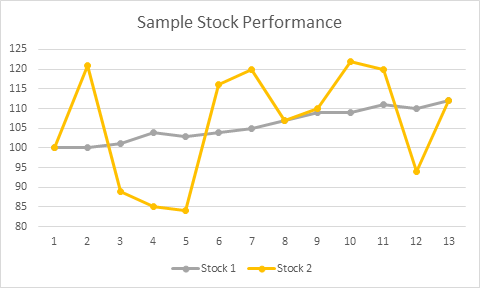

However, using financial derivatives and debt, there are also “Leveraged ETFs”, which amplify the risks, and returns, of whichever index it is following. These ETFs are different from a normal index ETF; instead of trying to mimic the annual return of the index it follows, it tries to double, or even triple, the Daily Return. This means that if the underlying index goes up by 1%, the Double Leveraged ETF would go up by 2% (although these numbers are not exact, the leveraged ETF often performs slightly below the target due to fees and other factors). However, this means that if the index goes down 1%, the leveraged ETF will go down by 2%, so what would have been a relatively small loss can grow very quickly.

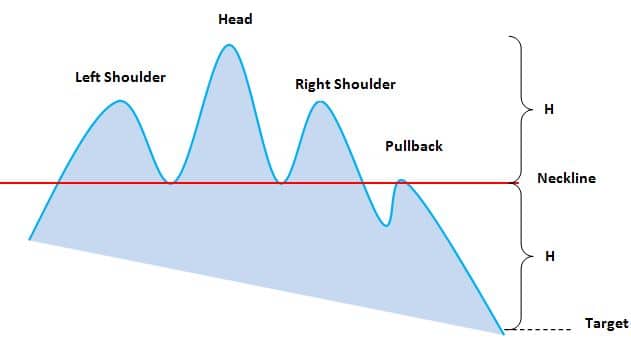

There are many types of leveraged ETFs, from index trackers, to commodity trackers (leveraged oil and gold are among the most popular), and even many inverse ETFs, where when the index goes up by 1%, the ETF goes down by 2% (this is one way to “short” an ETF without actually short-selling).

Despite the risks, leveraged ETFs are very popular for day traders, since the extra volatility, the ups and downs in the price over the course of a day, make it attractive to traders who try to “buy low and sell high” on the same security many times throughout the day.

However, always remember that leveraged ETFs are one of the riskier investments you can make; they are usually designed to be bought and sold within the same day (hence amplifying “daily” returns instead of monthly or annually).

Most Popular Double-Leveraged ETF (2x)

| Symbol | Is It Inverse? | Country Tracked | ETF Name |

|---|---|---|---|

| SDS | Inverse | USA | ProShares UltraShort S&P 500 Fund |

| SSO | USA | ProShares Ultra S&P 500 Fund | |

| TBT | Inverse | USA | ProShares UltraShort 20+ Year Treasury Bond ETF |

| QLD | USA | ProShares Ultra QQQ Fund | |

| QID | Inverse | USA | ProShares UltraShort QQQ Fund |

| SKF | Inverse | USA | ProShares UltraShort Financials Fund |

| SRS | Inverse | USA | ProShares UltraShort Real Estate Fund |

| UYG | USA | ProShares Ultra Financials Fund | |

| DXD | Inverse | USA | ProShares UltraShort Dow 30 Fund |

| URE | USA | ProShares Ultra Real Estate Fund | |

| TWM | Inverse | USA | ProShares UltraShort Russell 2000 Fund |

| DIG | USA | ProShares Ultra Oil & Gas Fund | |

| DDM | USA | ProShares Ultra Dow 30 Fund | |

| UYM | USA | ProShares Ultra Basic Materials Fund | |

| FLGE | USA | Credit Suisse FI Large Cap Growth Enhanced ETN | |

| SYTL | USA | Direxion Daily 7-10 Year Treasury Bull 2x Shares ETF | |

| LLDM | USA | Direxion Daily FTSE Developed Markets Bull 1.25x Shares ETF | |

| LLEM | USA | Direxion Daily FTSE Emerging Markets Bull 1.25x Shares ETF | |

| DUST | Inverse | USA | Direxion Daily Gold Miners Bear 2x Shares ETF |

| NUGT | USA | Direxion Daily Gold Miners Bull 2x Shares ETF | |

| MDLL | USA | Direxion Daily Mid Cap Bull 2x Shares ETF | |

| RETL | USA | Direxion Daily Retail Bull 2x Shares ETF | |

| LLSP | USA | Direxion Daily S&P 500 Bull 1.25x Shares ETF | |

| SPUU | USA | Direxion Daily S&P 500 Bull 2x Shares ETF | |

| LLSC | USA | Direxion Daily Small Cap Bull 1.25x Shares ETF | |

| SMLL | USA | Direxion Daily Small Cap Bull 2x Shares ETF | |

| INDL | USA | Direxion India Bull 2X ETF | |

| BDCL | USA | ETRACS 2x Wells Fargo Business Development Company Index ETN | |

| RWXL | USA | ETRACS Monthly Pay 2x Dow Jones International Real Estate ETN | |

| CEFL | USA | ETRACS Monthly Pay 2x Leveraged Closed-End Fund ETN | |

| DVHL | USA | ETRACS Monthly Pay 2x Leveraged Diversified High Income ETN | |

| DVYL | USA | ETRACS Monthly Pay 2x Leveraged Dow Jones Select Dividend Index ETN | |

| MORL | USA | ETRACS Monthly Pay 2x Leveraged Mortgage REIT ETN | |

| SDYL | USA | ETRACS Monthly Pay 2x Leveraged S&P Dividend ETN | |

| HDLV | USA | ETRACS Monthly Pay 2x Leveraged US High Dividend Low Volatility ETN | |

| LMLP | USA | ETRACS Monthly Pay 2x Leveraged Wells Fargo MLP Ex-Energy ETN | |

| SPLX | USA | ETRACS Monthly Reset 2x Leveraged S&P 500 Total Return ETN | |

| MFLA | USA | iPath Long Enhanced MSCI EAFE Index ETN | |

| EMLB | USA | iPath Long Enhanced MSCI Emerging Markets Index ETN | |

| EMSA | Inverse | USA | iPath Short Enhanced MSCI Emerging Markets Index ETN |

| URR | USA | Market Vectors Double Long Euro ETN | |

| DRR | Inverse | USA | Market Vectors Double Short Euro ETN |

| DAG | USA | PowerShares DB Agriculture Double Long ETN | |

| AGA | Inverse | USA | PowerShares DB Agriculture Double Short ETN |

| BDD | USA | PowerShares DB Base Metals Double Long ETN | |

| BOM | Inverse | USA | PowerShares DB Base Metals Double Short ETN |

| DYY | USA | PowerShares DB Commodity Double Long ETN | |

| DEE | Inverse | USA | PowerShares DB Commodity Double Short ETN |

| DTO | Inverse | USA | PowerShares DB Crude Oil Double Short ETN |

| DGP | USA | PowerShares DB Gold Double Long ETN | |

| DZZ | Inverse | USA | PowerShares DB Gold Double Short ETN |

| UBT | USA | ProShares Ultra 20+ Year Treasury ETF | |

| UST | USA | ProShares Ultra 7-10 Year Treasury ETF | |

| GDAY | USA | ProShares Ultra Australian Dollar ETF | |

| BOIL | USA | ProShares Ultra Bloomberg Natural Gas ETF | |

| UGE | USA | ProShares Ultra Consumer Goods Fund | |

| UCC | USA | ProShares Ultra Consumer Services Fund | |

| UCD | USA | ProShares Ultra DJ-AIG Commodity ETF | |

| UCO | USA | ProShares Ultra DJ-AIG Crude Oil ETF | |

| ULE | USA | ProShares Ultra Euro ETF | |

| XPP | USA | ProShares Ultra FTSE/Xinhua China 25 Index Fund | |

| UGL | USA | ProShares Ultra Gold ETF | |

| RXL | USA | ProShares Ultra Health Care Fund | |

| UJB | USA | ProShares Ultra High Yield ETF | |

| UXI | USA | ProShares Ultra Industrials Fund | |

| IGU | USA | ProShares Ultra Investment Grade Corporate ETF | |

| KRU | USA | ProShares Ultra KBW Regional Banking ETF | |

| MVV | USA | ProShares Ultra MidCap 400 Fund | |

| UBR | USA | ProShares Ultra MSCI Brazil ETF | |

| EFO | USA | ProShares Ultra MSCI EAFE Index Fund | |

| EET | USA | ProShares Ultra MSCI Emerging Markets Index Fund | |

| UPV | USA | ProShares Ultra MSCI Europe ETF | |

| EZJ | USA | ProShares Ultra MSCI Japan Index Fund | |

| UMX | USA | ProShares Ultra MSCI Mexico Investable Market ETF | |

| UXJ | USA | ProShares Ultra MSCI Pacific ex-Japan ETF | |

| BIB | USA | ProShares Ultra Nasdaq Biotechnology ETF | |

| UWM | USA | ProShares Ultra Russell 2000 Fund | |

| USD | USA | ProShares Ultra Semiconductors Fund | |

| AGQ | USA | ProShares Ultra Silver ETF | |

| SAA | USA | ProShares Ultra Small Cap 600 Fund | |

| ROM | USA | ProShares Ultra Technology Fund | |

| LTL | USA | ProShares Ultra Telecommunications ETF | |

| UPW | USA | ProShares Ultra Utilities Fund | |

| UVXY | USA | ProShares Ultra VIX Short-Term Futures ETF | |

| YCL | USA | ProShares Ultra Yen ETF | |

| TBZ | Inverse | USA | ProShares UltraShort 3-7 Year Treasury ETF |

| PST | Inverse | USA | ProShares UltraShort 7-10 Year Treasury Bond ETF |

| CROC | Inverse | USA | ProShares UltraShort Australian Dollar ETF |

| SMN | Inverse | USA | ProShares UltraShort Basic Materials Fund |

| KOLD | Inverse | USA | ProShares UltraShort Bloomberg Natural Gas ETF |

| SZK | Inverse | USA | ProShares UltraShort Consumer Goods Fund |

| SCC | Inverse | USA | ProShares UltraShort Consumer Services Fund |

| CMD | Inverse | USA | ProShares UltraShort DJ-AIG Commodity ETF |

| SCO | Inverse | USA | ProShares UltraShort DJ-AIG Crude Oil ETF |

| EUO | Inverse | USA | ProShares UltraShort Euro ETF |

| FXP | Inverse | USA | ProShares UltraShort FTSE/Xinhua China 25 Fund |

| GLL | Inverse | USA | ProShares UltraShort Gold ETF |

| RXD | Inverse | USA | ProShares UltraShort Health Care Fund |

| SIJ | Inverse | USA | ProShares UltraShort Industrials Fund |

| MZZ | Inverse | USA | ProShares UltraShort MidCap 400 Fund |

| BZQ | Inverse | USA | ProShares UltraShort MSCI Brazil Index Fund |

| EFU | Inverse | USA | ProShares UltraShort MSCI EAFE Fund |

| EEV | Inverse | USA | ProShares UltraShort MSCI Emerging Markets Fund |

| EPV | Inverse | USA | ProShares UltraShort MSCI Europe Index Fund |

| EWV | Inverse | USA | ProShares UltraShort MSCI Japan Fund |

| SMK | Inverse | USA | ProShares UltraShort MSCI Mexico Investable Market Index Fund |

| JPX | Inverse | USA | ProShares UltraShort MSCI Pacific ex-Japan Index Fund |

| BIS | Inverse | USA | ProShares UltraShort Nasdaq Biotechnology ETF |

| DUG | Inverse | USA | ProShares UltraShort Oil & Gas Fund |

| SSG | Inverse | USA | ProShares UltraShort Semiconductors Fund |

| ZSL | Inverse | USA | ProShares UltraShort Silver ETF |

| SDD | Inverse | USA | ProShares UltraShort Small Cap 600 Fund |

| REW | Inverse | USA | ProShares UltraShort Technology Fund |

| TLL | Inverse | USA | ProShares UltraShort Telecommunications ETF |

| TPS | Inverse | USA | ProShares UltraShort TIPS ETF |

| SDP | Inverse | USA | ProShares UltraShort Utilities Fund |

| YCS | Inverse | USA | ProShares UltraShort Yen ETF |

| MLPL | USA | UBS ETRACS Leveraged Long Alerian MLP Infrastructure ETN | |

| FBG | USA | UBS Fisher Enhanced Big Cap Growth ETN | |

| TVIZ | USA | VelocityShares Daily 2x VIX Medium-Term ETN | |

| TVIX | USA | VelocityShares Daily 2x VIX Short-Term ETN | |

| HBU-TSX | Canada | BetaPro COMEX Gold Bullion Bull+ ETF | |

| HZU-TSX | Canada | BetaPro COMEX Silver Bull+ ETF | |

| HJU-TSX | Canada | BetaPro MSCI Emerging Markets Bull+ ETF | |

| HPD-TSX | Canada | BetaPro MSCI Japan Bear+ ETF | |

| HPU-TSX | Canada | BetaPro MSCI Japan Bull+ ETF | |

| HQU-TSX | Canada | BetaPro NASDAQ-100 Bull+ ETF | |

| HOU-TSX | Canada | BetaPro NYMEX Crude Oil Bull+ ETF | |

| HNU-TSX | Canada | BetaPro NYMEX Natural Gas Bull+ ETF | |

| HSU-TSX | Canada | BetaPro S&P 500 Index Bull+ ETF | |

| HVU-TSX | Canada | BetaPro S&P 500 VIX Short-Term Futures Bull+ ETF | |

| HXU-TSX | Canada | BetaPro S&P/TSX 60 Bull+ ETF | |

| HEU-TSX | Canada | BetaPro S&P/TSX Capped Energy Bull+ ETF | |

| HFU-TSX | Canada | BetaPro S&P/TSX Capped Financials Bull+ ETF | |

| HMU-TSX | Canada | BetaPro S&P/TSX Global Base Metal Bull+ ETF | |

| HGU-TSX | Canada | BetaPro S&P/TSX Global Gold Bull+ ETF | |

| HTD-TSX | Canada | BetaPro U.S. 30-Year Bond Bear+ ETF | |

| HZD-TSX | Canada | COMEX Silver Bear Plus ETF | |

| HBD-TSX | Canada | Horizons BetaPro COMEX Gold Bullion Bear Plus ETF | |

| HOD-TSX | Canada | Horizons BetaPro NYMEX Crude Oil Bear Plus ETF | |

| HND-TSX | Canada | Horizons BetaPro NYMEX Natural Gas Bear Plus ETF | |

| HXD-TSX | Canada | Horizons BetaPro S&P/TSX 60 Bear ETF | |

| HED-TSX | Canada | Horizons BetaPro S&P/TSX Capped Energy Bear Plus ETF | |

| HFD-TSX | Canada | Horizons BetaPro S&P/TSX Capped Financials Bear Plus ETF | |

| HGD-TSX | Canada | Horizons BetaPro S&P/TSX Global Gold Bear Plus ETF | |

| HMD-TSX | Canada | Horizons BetaPro S&P/TSX Global Mining Bear Plus ETF | |

| HJD-TSX | Canada | MSCI Emerging Markets Bear Plus ETF | |

| HQD-TSX | Canada | NASDAQ-100 Bear Plus ETF | |

| HSD-TSX | Canada | S&P 500 Bear Plus ETF | |

| LAGR-LSE | Great Britain | ETFS Leveraged Agriculture ETF | |

| LALL-LSE | Great Britain | ETFS Leveraged All Commodities ETF | |

| LALU-LSE | Great Britain | ETFS Leveraged Aluminium ETF | |

| LCOC-LSE | Great Britain | ETFS Leveraged Cocoa ETF | |

| LCFE-LSE | Great Britain | ETFS Leveraged Coffee ETF | |

| LCOP-LSE | Great Britain | ETFS Leveraged Copper ETF | |

| LCOR-LSE | Great Britain | ETFS Leveraged Corn ETF | |

| LCTO-LSE | Great Britain | ETFS Leveraged Cotton ETF | |

| LOIL-LSE | Great Britain | ETFS Leveraged Crude Oil ETF | |

| LNRG-LSE | Great Britain | ETFS Leveraged Energy ETF | |

| LNEY-LSE | Great Britain | ETFS Leveraged Ex-Energy ETF | |

| LGAS-LSE | Great Britain | ETFS Leveraged Gasoline ETF | |

| LBUL-LSE | Great Britain | ETFS Leveraged Gold ETF | |

| LGRA-LSE | Great Britain | ETFS Leveraged Grains ETF | |

| LHEA-LSE | Great Britain | ETFS Leveraged Heating Oil ETF | |

| LIME-LSE | Great Britain | ETFS Leveraged Industrial Metals ETF | |

| LLEA-LSE | Great Britain | ETFS Leveraged Lead ETF | |

| LLHO-LSE | Great Britain | ETFS Leveraged Lean Hogs ETF | |

| LLCT-LSE | Great Britain | ETFS Leveraged Live Cattle ETF | |

| LLST-LSE | Great Britain | ETFS Leveraged Livestock ETF | |

| LNGA-LSE | Great Britain | ETFS Leveraged Natural Gas ETF | |

| LNIK-LSE | Great Britain | ETFS Leveraged Nickel ETF | |

| LPET-LSE | Great Britain | ETFS Leveraged Petroleum ETF | |

| LPLA-LSE | Great Britain | ETFS Leveraged Platinum ETF | |

| LPMT-LSE | Great Britain | ETFS Leveraged Precious Metals ETF | |

| LSIL-LSE | Great Britain | ETFS Leveraged Silver ETF | |

| LSFT-LSE | Great Britain | ETFS Leveraged Softs ETF | |

| LSYO-LSE | Great Britain | ETFS Leveraged Soybean Oil ETF | |

| LSOB-LSE | Great Britain | ETFS Leveraged Soybeans ETF | |

| LSUG-LSE | Great Britain | ETFS Leveraged Sugar ETF | |

| LTIM-LSE | Great Britain | ETFS Leveraged Tin ETF | |

| LWEA-LSE | Great Britain | ETFS Leveraged Wheat ETF | |

| LZIC-LSE | Great Britain | ETFS Leveraged Zinc ETF | |

| DEL2-LSE | Great Britain | ETFX DAX 2X Long ETF | |

| Sterling | Great Britain | ETFX DAX 2X Long ETF | |

| DES2-LSE | Great Britain | ETFX DAX 2X Short ETF | |

| Sterling | Great Britain | ETFX DAX 2X Short ETF | |

| SEU2-LSE | Great Britain | ETFX Dow Jones EURO STOXX 50 Double Short ETF | |

| Sterling | Great Britain | ETFX Dow Jones EURO STOXX 50 Double Short ETF | |

| LEU2-LSE | Great Britain | ETFX Dow Jones EURO STOXX 50 Leveraged ETF | |

| Sterling | Great Britain | ETFX Dow Jones EURO STOXX 50 Leveraged ETF | |

| LUK2-LSE | Great Britain | ETFX FTSE 100 Leveraged ETF | |

| SUK2-LSE | Great Britain | ETFX FTSE 100 Super Short Strategy ETF |

Triple-Leveraged ETFs (3x)

| Symbol | Is It Inverse? | Country Tracked | ETF Name |

|---|---|---|---|

| FAZ | Inverse | USA | Direxion Financial Bear 3X – Triple-Leveraged ETF |

| FAS | USA | Direxion Financial Bull 3X – Triple-Leveraged ETF | |

| TZA | Inverse | USA | Direxion Small Cap Bear 3X – Triple-Leveraged ETF |

| TNA | USA | Direxion Small Cap Bull 3X – Triple-Leveraged ETF | |

| TYO | Inverse | USA | Direxion 10-Year Treasury Bear 3X – Triple-Leveraged ETF |

| TYD | USA | Direxion 10-Year Treasury Bull 3X – Triple-Leveraged ETF | |

| TMV | Inverse | USA | Direxion 30-Year Treasury Bear 3X – Triple-Leveraged ETF |

| TMF | USA | Direxion 30-Year Treasury Bull 3X – Triple-Leveraged ETF | |

| MATL | USA | Direxion Daily Basic Materials Bull 3x Shares ETF | |

| BRZU | USA | Direxion Daily Brazil Bull 3X Shares ETF | |

| YANG | Inverse | USA | Direxion Daily FTSE China Bear 3x Shares ETF |

| YINN | USA | Direxion Daily FTSE China Bull 3X Shares ETF | |

| EURL | USA | Direxion Daily FTSE Europe Bull 3x Shares ETF | |

| BAR | USA | Direxion Daily Gold Bull 3x Shares ETF | |

| CURE | USA | Direxion Daily Healthcare Bull 3x Shares ETF | |

| JPNL | USA | Direxion Daily Japan Bull 3x Shares ETF | |

| JDST | Inverse | USA | Direxion Daily Junior Gold Miners Index Bear 3x Shares ETF |

| JNUG | USA | Direxion Daily Junior Gold Miners Index Bull 3x Shares ETF | |

| MIDZ | Inverse | USA | Direxion Daily Mid Cap Bear 3x Shares ETF |

| MIDU | USA | Direxion Daily Mid Cap Bull 3x Shares ETF | |

| GASL | USA | Direxion Daily Natural Gas Related Bull 3x Shares ETF | |

| RUSS | Inverse | USA | Direxion Daily Russia Bear 3x Shares ETF |

| RUSL | USA | Direxion Daily Russia Bull 3x Shares ETF | |

| SPXS | Inverse | USA | Direxion Daily S&P 500 Bear 3x Shares ETF |

| SPXL | USA | Direxion Daily S&P 500 Bull 3x Shares ETF | |

| KORU | USA | Direxion Daily South Korea Bull 3x Shares ETF | |

| TECS | Inverse | USA | Direxion Daily Technology Bear 3x Shares ETF |

| TECL | USA | Direxion Daily Technology Bull 3x Shares ETF | |

| DPK | Inverse | USA | Direxion Developed Markets Bear 3X – Triple-Leveraged ETF |

| DZK | USA | Direxion Developed Markets Bull 3X – Triple-Leveraged ETF | |

| EDZ | Inverse | USA | Direxion Emerging Markets Bear 3X – Triple-Leveraged ETF |

| EDC | USA | Direxion Emerging Markets Bull 3X – Triple-Leveraged ETF | |

| ERY | Inverse | USA | Direxion Energy Bear 3X – Triple-Leveraged ETF |

| ERX | USA | Direxion Energy Bull 3X – Triple-Leveraged ETF | |

| LBJ | USA | Direxion Latin America Bull 3X – Triple-Leveraged ETF | |

| DRV | Inverse | USA | Direxion Real Estate Bear 3X – Triple-Leveraged ETF |

| DRN | USA | Direxion Real Estate Bull 3X – Triple-Leveraged ETF | |

| SOXS | Inverse | USA | Direxion Semiconductor Bear 3X – Triple-Leveraged ETF |

| SOXL | USA | Direxion Semiconductor Bull 3X – Triple-Leveraged ETF | |

| ROLA | USA | iPath Long Extended Russell 1000 TR Index ETN | |

| RTLA | USA | iPath Long Extended Russell 2000 TR Index ETN | |

| SFLA | USA | iPath Long Extended S&P 500 TR Index ETN | |

| BUNT | USA | PowerShares DB 3x German Bund Futures ETN | |

| JGBD | USA | PowerShares DB 3x Inverse Japanese Govt Bond Futures ETN | |

| ITLT | USA | PowerShares DB 3x Italian Treasury Bond Futures ETN | |

| JGBT | USA | PowerShares DB 3x Japanese Govt Bond Futures ETN | |

| LBND | USA | PowerShares DB 3x Long 25+ Year Treasury Bond ETN | |

| UUPT | USA | PowerShares DB 3x Long US Dollar Index Futures ETN | |

| SBND | Inverse | USA | PowerShares DB 3x Short 25+ Year Treasury Bond ETN |

| UDNT | USA | PowerShares DB 3x Short US Dollar Index Futures ETN | |

| UDOW | USA | ProShares UltraPro Dow 30 ETF | |

| FINU | USA | ProShares UltraPro Financials ETF | |

| UMDD | USA | ProShares UltraPro MidCap 400 ETF | |

| TQQQ | USA | ProShares UltraPro NASDAQ 100 ETF | |

| URTY | USA | ProShares UltraPro Russell 2000 ETF | |

| UPRO | USA | ProShares UltraPro S&P 500 Index Fund | |

| TTT | Inverse | USA | ProShares UltraPro Short 20+ Year Treasury ETF |

| SDOW | Inverse | USA | ProShares UltraPro Short Dow 30 ETF |

| FINZ | Inverse | USA | ProShares UltraPro Short Financials ETF |

| SQQQ | Inverse | USA | ProShares UltraPro Short NASDAQ 100 ETF |

| SRTY | Inverse | USA | ProShares UltraPro Short Russell 2000 ETF |

| SPXU | Inverse | USA | ProShares UltraPro Short S&P 500 Index Fund |

| SMDD | Inverse | USA | ProShares UltraPro Short S&P MidCap 400 ETF |

| DWTI | Inverse | USA | VelocityShares 3x Inverse Crude Oil ETN |

| DGLD | Inverse | USA | VelocityShares 3x Inverse Gold ETN |

| DGAZ | Inverse | USA | VelocityShares 3x Inverse Natural Gas ETN |

| DSLV | Inverse | USA | VelocityShares 3x Inverse Silver ETN |

| UWTI | USA | VelocityShares 3x Long Crude Oil ETN | |

| UGLD | USA | VelocityShares 3x Long Gold ETN | |

| UGAZ | USA | VelocityShares 3x Long Natural Gas ETN | |

| USLV | USA | VelocityShares 3x Long Silver ETN |