Most traders do not learn about stock trading Risk Management until it is too late, and they experiences losses of varying degrees. Insurance, options, and other tools exist – learn to use them!

An REITs or Real Estate Investment Trusts own, and often operate, real estate but are publicly traded like stock. Profit is paid as dividend to stock owners.

By measuring the compilation of similar stocks instead of just one or two stocks, a Stock Index provides information about that particular market or segment.

Many stock analysts have identified market trends related to specific times of the year. The success ratios of these trends are often far stronger than most other indicators.

A Sole Proprietorship is the simplest, oldest, and most common form of business ownership in which only one individual acquires all the benefits and risks of running an enterprise.

Retained Earnings is calculated by adding the net income to (or subtracting it from) the beginning retained earnings and then subtracting the dividends that were paid to shareholders.

The total amount that the federal government has borrowed including internal debt (borrowed from national creditors) and external debt (borrowed from foreign creditors).

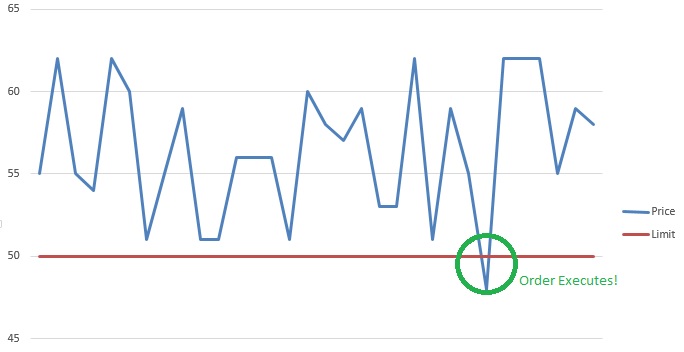

A Stop Limit is an order that combines the features of stop order with the features of a limit order. A stop limit order executes at a specified price (or better) after a specified stop price is reached.

US federal legislation of 1890 that prohibited the creation of monopolies by outlawing direct or indirect attempts to interfere with the free and competitive nature of the production and distribution of goods. Amended by the Clayton Act of 1914. Also called Sherman Act.

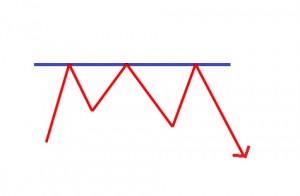

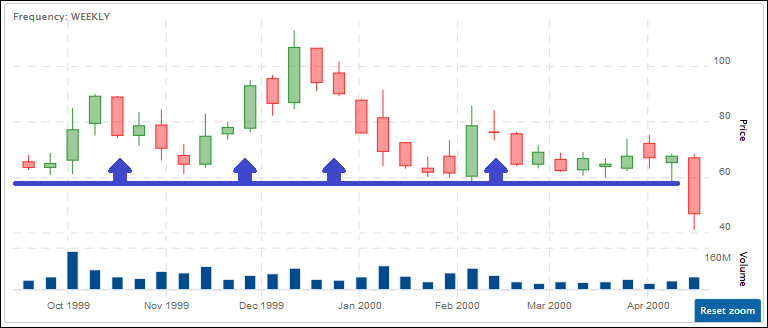

In technical analysis, “Support” is a price trend line that a stock usually won’t fall below (at least in the short term), while “Resistance” is a price trend line that it has trouble rising above

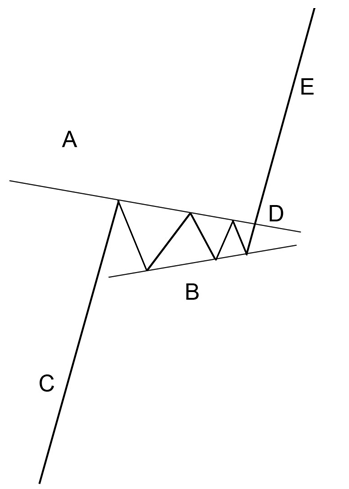

The pennant resembles the symmetrical triangle, but it’s characteristics are not the same. The pennants is shaped like a wedge of consolidation and normally appears after a sudden upward or downward movement.

A Trailing Stop Loss is calculated in a manner like the way we calculated our initial stop loss, the difference being that while we calculated our stop loss from the entry price, we’re calculating our trailing stop loss from the highest price since entry.

Market Orders, Limit Orders, Stop Market Orders, Stop Limit Orders and Trailing Stop Orders! Each one is used differently to balance a trading strategy – usually so you can place your orders and wait for prices to match your conditions

This term is generally used to refer to stocks with a price below $5. The name also comes from the fact that most penny stocks have either started or will end at $0.01 (a penny).

Screeners are a tool that investors and traders can use to filter ETFs based on user-defined metrics. ETF screeners are offered on many websites and trading platforms, and they allow users to select trading instruments that fit a certain profile set of criteria.

A Trading Halt is the temporary suspension of trading of a security for a specific period of time. Trading Halts typically last for an hour, but can extend into days.

Time Decay is the inclination for options to decrease in worth as the expiration date draws near. The extent of the time decay is inversely connected to the changeability of that option.

The Sharpe Ratio looks at a portfolio’s return over time, then gives it a rating based on how volatile the returns are. Portfolios with steady returns have a better Sharpe Ratio than portfolios with high returns but big swings

The basic form of short selling is selling stock that you borrow from an owner and do not own yourself. In essence, you deliver the borrowed shares. Another form is to sell stock that you do not own and are not borrowing from someone. Here you owe the shorted shares to the buyer but “fail to deliver.”

The cash received from the short sale of a security. The interest return from investment of the short proceeds is usually divided between the short seller, who gets partial “use of proceeds,” and the securities lender.

Short selling is the act of borrowing a security from someone else, usually a broker, selling it and later repurchasing the stock in the hopes that it will be cheaper.

A Stop Loss Order is placed with a broker to sell a security when it reaches a certain price. A stop-loss order is designed to limit an investor’s loss on a security position.

A Stop Order is an order to buy or sell a stock when the stock price reaches a specified price, which is known as a stop price. When the specified price is reached, the stop order becomes a market order.

Preferred stock is a special class of stock issued by a company that pays dividends. Preferred stock is more like a bond than true stock because the main appeal is dividend income. Most preferred stocks are limited in the total profit they can earn.

Technical Analysis is the use of technical indicators comprising of statistics using past market information to predict which direction the security price will move. Read this post to learn about the 6 principles that formed the foundation of technical analysis, and some of its purposes and uses.

Trailing Stop is a Stop Loss order which is placed as a percentage value as opposed to an absolute dollar value. The order will only execute if the price of the security falls by a certain percentage.

A dollar Trailing Stop is a Stop Loss order which is placed as a dollar value. The order will only execute if the price of the security falls by that dollar amount.

Treasury bills, often referred to as T-bills, are short-term securities (maturities of less than one year) offered and guaranteed by the federal government. They are issued at a discount and pay their full face value at maturity.

A percentage Trailing Stop is a Stop Loss order which is placed as a percentage value as opposed to an absolute dollar value. The order will only execute if the price of the security falls by a certain percentage.

Tick refers to a change in price, either up or down.

S&P 500 Index (Standard and Poor’s 500 Index) is a composite of the 500 most actively traded public companies in all ten economic sectors of the U.S. It is maintained by Standard and Poor’s, a division of the Parent company McGraw-Hill.

A Short Sale is a trade in which the investor borrows a security and sells it to another investor in the market.

Security is any financial instrument that represents a financial value.

Recession is generally described as a slowdown of economic growth over a sustained period of time.

Quick Ratio is the ratio that measures the ability of a firm to cover its current liabilities with their most liquid current assets. Quick Ratio = (Current Assets – Inventory) / Current Liabilities

A Put Option gives the holder the right to sell the underlying stock or futures contract at a specified strike price.

Pink Sheets refer to the trading of stocks that are not listed on a major exchange or the OTCBB due to a lack of minimum listing requirements or filing financial statements with the SEC (Securities Exchange Commission)

Par Value is the amount that the issuer of a bond agrees to pay at the date of maturity.

Out-Of-The-Money refers to an option that is unfavourable to exercise.

An Options Contract is a contract which specifies how much of the underlying asset can be bought or sold at a specific price. An option contract to buy the underlying is a call option, and to sell the underlying is a put option. Most stock options contracts represent 100 underlying shares.

Return on Equity (ROE) is used to measure how much profit a company is able to generate from the money invested by shareholders. Click on this post to see how it is calculated, what kind of ROE you should look for, and more!