A national government that owes money to international financial institutions such as the World Bank, foreign governments, or to foreign lenders.

Many stock analysts have identified market trends related to specific times of the year. The success ratios of these trends are often far stronger than most other indicators.

The Arms Index is a technical analysis indicator that compares advancing and declining stock issues and trading volume as an indicator of overall market sentiment.

Absolute Breadth Index is a market indicator used to determine volatility levels in the market without factoring in price direction.

Advance/Decline Index is a technical analysis tool that represents the total difference between the number of advancing and declining security prices. This index is considered one of the best indicators of market movements as a whole.

By aggregating the value of a related group of stocks or other investment vehicles together and expressing their total values against a base value from a specific date. Market indexes help to represent an entire stock market and thus give investors a way to monitor the market’s changes over time.

A Sole Proprietorship is the simplest, oldest, and most common form of business ownership in which only one individual acquires all the benefits and risks of running an enterprise.

The maintenance margin is the minimum amount of equity that must be maintained in a margin account.

Margin calls happen when you are trading “on margin” and your account value drops to a value below that allowed by a broker – and they force you to sell stocks or add more cash

A corporation is an entity that abides by specific legal requirements that sets it apart as having a legal existence, as an entity separate and distinct from its stockholders (owners).

Retained Earnings is calculated by adding the net income to (or subtracting it from) the beginning retained earnings and then subtracting the dividends that were paid to shareholders.

A plan offered by a corporation that allows investors to reinvest their cash dividends by purchasing additional shares or fractional shares on the dividend payment date.

Technical Analysis is the use of technical indicator to predict which direction the stock price will move in the future. Technical indicators use past stock prices to calculate their value.

Blue Sky Laws are state regulations governing the sale of securities and mutual funds.

An investment service that allows individuals to purchase a stock directly from a company or through a transfer agent. Not all companies offer DSPPs and the plans often have restrictions on when an individual can purchase shares.

Falling Knife is a phrase used for a stock where the price has dropped significantly in a short period of time. A falling knife security can rebound, or it can lose all of its value where the shares become worthless. Trying to catch a “falling knife” right as it rebounds is dangerous!

The total amount that the federal government has borrowed including internal debt (borrowed from national creditors) and external debt (borrowed from foreign creditors).

A Stop Limit is an order that combines the features of stop order with the features of a limit order. A stop limit order executes at a specified price (or better) after a specified stop price is reached.

Horizontal Integration refers to the merger of companies at the same stage of production in the same or different industries.

US federal legislation of 1890 that prohibited the creation of monopolies by outlawing direct or indirect attempts to interfere with the free and competitive nature of the production and distribution of goods. Amended by the Clayton Act of 1914. Also called Sherman Act.

An order to buy or sell a stock at a fixed price. This order is active until 1) the trade is executed, 2) the investor decides to cancel it or 3) a specified time period elapses.

Decreasing the long-run average and marginal costs that come from an increase in the size of a factory or plant. Economics of scale can be from the inner workings of an organization. This would include the lower cost from adding technology and better organization.

A short call option position where the writer does not own the specified number of shares specified by the option nor has deposited cash equal to the exercise value of the call.

A high-risk bond with a low credit rating. Junk Bonds usually have a much higher yield than investment-grade bonds.

A 403(b) is an alternative retirement plan to a 401(k) plan offered by non-profit organizations, rather than corporations.

When a company offers to trade one security in return for another security.

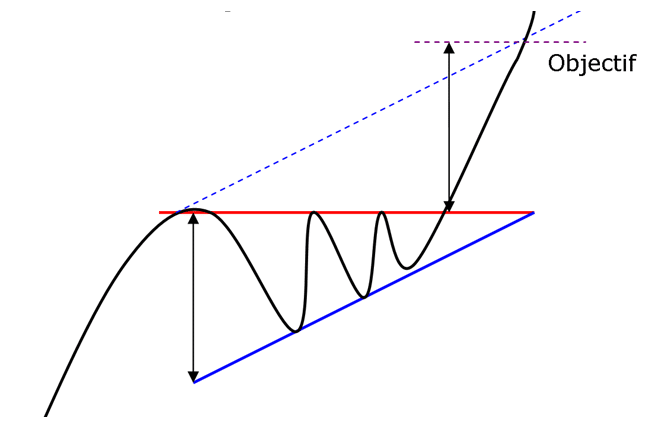

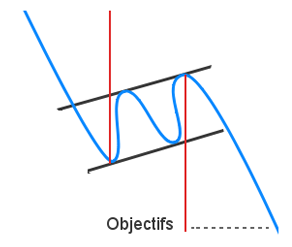

In technical analysis, “Support” is a price trend line that a stock usually won’t fall below (at least in the short term), while “Resistance” is a price trend line that it has trouble rising above

ADX is an indicator used in technical analysis as an objective value for the strength of trend.

If you perform four or more day trades in a 5 day period you may get flagged by the SEC as a “Pattern Day Trader.” This can cause you to lose your margin account status until you deposit enough cash to have $25,000 or more in your account. Many beginning traders have been bitten by this rule!

A trading term called a dead cat bounce is used to when a stock is in a severe decline and has a sharp bounce off the lows. It occurs due to the huge amount of short interest in the market. This bounce will be short lived and followed up by heavy selling which will break the prior price low.

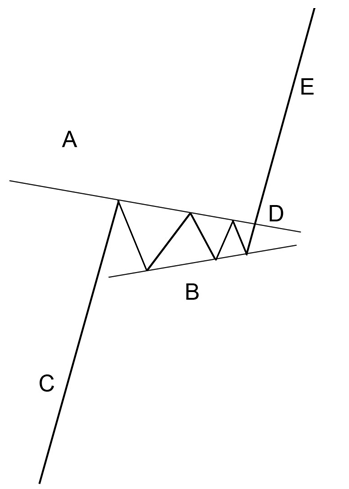

The ascending triangle is a bullish continuation pattern. This pattern is made by two converging lines. The first line is an upward slant which is the support and the other is a horizontal resistance line.

The pennant resembles the symmetrical triangle, but it’s characteristics are not the same. The pennants is shaped like a wedge of consolidation and normally appears after a sudden upward or downward movement.

An ascending flag is a continuation pattern formed by two straight upward parallel lines which are shaped like a rectangle. It is adjusted in the direction of the trend that it consolidates.

Charting Software is an analytical, computer-based tool used to help equity (stock) traders with trading analysis by charting the price stock price for various time periods along with various indicators. Equity charting software packages are used by many traders to determine the direction on any given stock price.

Bear ETFs short stocks to achieve their goals. Bear ETFs show gains when the underlying stocks loose value. Bull ETFs use long positions and show gains when the underlying stocks show gains.

A Trailing Stop Loss is calculated in a manner like the way we calculated our initial stop loss, the difference being that while we calculated our stop loss from the entry price, we’re calculating our trailing stop loss from the highest price since entry.

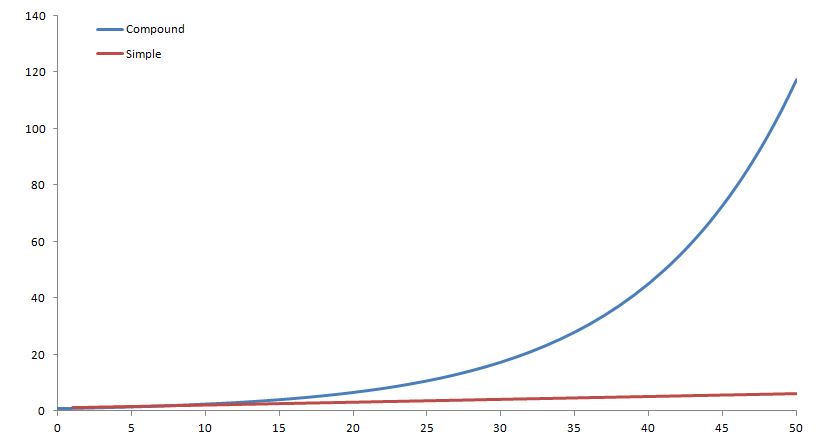

Compound Interest is an extremely important concept in any level of finance. Compound interest can make an enormous difference in the return you get from your investments. As we know, simple interest is the act of earning interest on an investment.

Expiration types determine how long an order will stay open without filling. Your order type is very important for limit orders, but understanding them can also remove a lot of confusion for market orders.

Market Orders, Limit Orders, Stop Market Orders, Stop Limit Orders and Trailing Stop Orders! Each one is used differently to balance a trading strategy – usually so you can place your orders and wait for prices to match your conditions

This term is generally used to refer to stocks with a price below $5. The name also comes from the fact that most penny stocks have either started or will end at $0.01 (a penny).

Asset Turnover Ratio is the amount of sales generated for every dollar’s worth of assets.

Day traders buy and sell the same stock (or other investment type) within a single trading day. Day trading has become a very popular way to make money, but it requires dedication and high volumes of cash.

A closed-end fund is a publicly traded investment company that raises a fixed amount of capital through an initial public offering (IPO). The fund is then structured, listed and traded like a stock on a stock exchange.

Screeners are a tool that investors and traders can use to filter ETFs based on user-defined metrics. ETF screeners are offered on many websites and trading platforms, and they allow users to select trading instruments that fit a certain profile set of criteria.

A load mutual fund comes with a sales charge or commission. To compensate a sales intermediary (ex: a broker, financial planner, investment advisor) for their knowledge and time in choosing a suitable fund for the investor, the fund investor will pay the load.

Covered calls are options strategies by which investors retain a long position in an asset and write or sell a call options on an identical in an effort to produce an increased income from the asset.

The Cash Flow Statement is one of the four financial statements required by the SEC based on the U.S. GAAP (Generally Accepted Accounting Principles). This statement presents where the cash and its equivalents are coming from and where they are being allocated.

Dollar Cost Averaging is the method of purchasing a fixed dollar amount of one particular investment at regular period of times, regardless of the share price.

Fundamental analysis is the process of looking at the basic or fundamental financial level of a business, especially sales, earnings, growth potential, assets, debt, management, products, and competition.

An IPO is the first sale of stock by a private company to the public. IPOs are often issued by smaller, younger companies seeking the capital to expand, but can also be done by large privately owned companies looking to become publicly traded.