The Reserve Requirement is how much of all deposits that a bank is required to keep “on hand”, meaning in its vaults, or on deposit at the Federal Reserve Bank (in the United States).

The stock market crash of 1929 was a massive crash in stock prices on the New York Stock Exchange, and marks the largest financial crash in the United States.

In the US, money is created as a form of debt. Banks create loans for people and businesses, which in turn deposit that money in their bank accounts. Banks can then use those deposits to loan money to other people – the total amount of money in circulation is one measure of the Money Supply.

Cottage Industry, or the “Putting Out System”, is a production system of producing goods that relies on producing goods, or parts of goods, by craftsmen at home, or small workshops, instead of large factories. Historically the cottage industry was the major production system for most of human history until the Industrial Revolution.

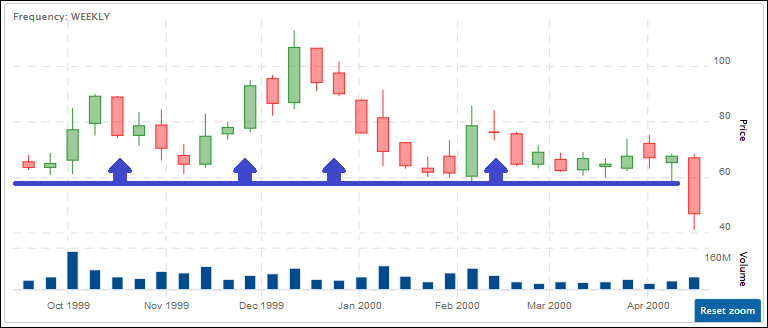

“OHLC” stands for “Open, High, Low, Close”, and this is a chart designed to help illustrate the movement of a stock’s price over time (typically a trading day, hour, or minute).

Spot and Futures contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the current date. The price is determined when the agreement is made.

Futures Contracts are a standardized, transferable legal agreement to make or take delivery of a specified amount of a certain commodity, currency, or an asset at the end of specified time frame.

An option allows you to pay a certain amount of money (the option price) to allow you to buy or sell a stock at the price (strike price) you decided on when buying the option.

Understanding what it means to build a diversified portfolio is one of the first concepts a new investor needs to understand. When talking about stocks, diversification means to make sure you don’t “put all of your eggs in one basket.”

A stock quote represents the last price at which a seller and a buyer of a stock agreed on a price to make the trade. Stock quotes also contain information about the volume, high and low prices of the day and year, and more.

A “Ticker Symbol” is a unique one to five letter code used by the stock exchanges to identify a company.

“Wall Street” is a street in New York City, near the southern end of Manhattan Island. It is the home of the New York Stock Exchange, and the biggest center of stock trading and finance in the world.

The New York Stock Exchange (or NYSE) is the largest stock exchange in the world, where buyers and sellers come to trade U.S. stocks!

Stocks are a share of ownership of a company. If you own a stock, you are involved in some of its management decisions, and you are entitled to some of the company’s profits.

Mutual Funds come in several different “flavors”, but the core concept is always the same: the fund is a pool of money contributed from many different investors that are used to purchase a bundle of securities. They are professionally managed, so you are basically buying a piece of a larger portfolio.

“ETF” stands for “Exchange Traded Fund”, which is exactly how it sounds; they are like mutual funds in many ways, but they trade on a normal stock exchange like a stock, with their value being determined both by the value of the underlying assets and the value of the ETF itself.

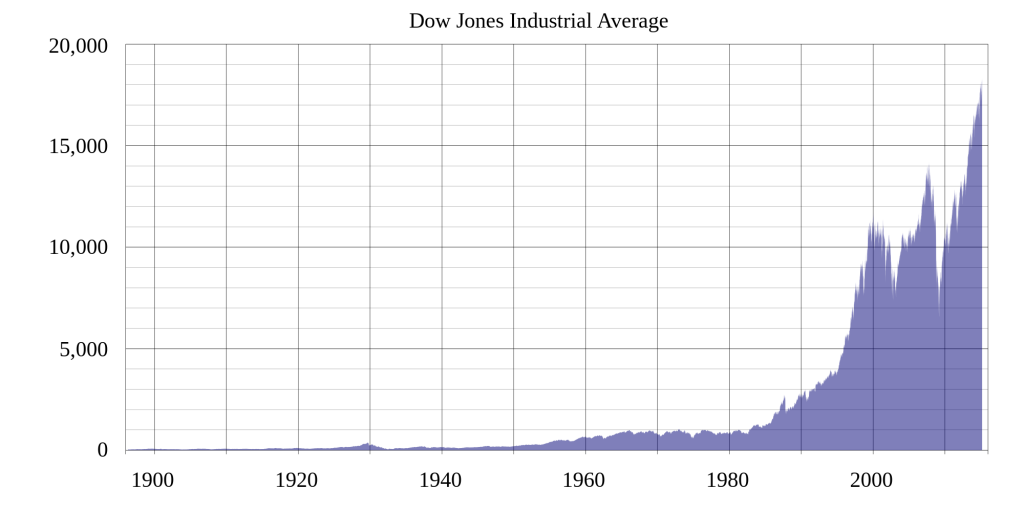

The Dow Jones Industrial Average, more frequently know simply as the Dow or the Dow Jones, is a stock market index made up of 30 of the largest publicly-owned companies based in the United States. It is a price weighted index meaning that the index’s price is an average of the price of the 30 stocks that make it up. Though it is price weighted, this does not mean that every time there is split the index is completely changed, as they have factors to keep the value of the index consistent.

The balance sheet is a financial snapshot of the firm on a specific date – specifically their assets, liabilities, and shareholder equity

The Income Statement is one of the financial statements that all publicly traded companies share with their investors, which shows the company’s sales, expenses, and net profit (or loss) over a period of time–usually 3 months, year-to-date, and twelve months.

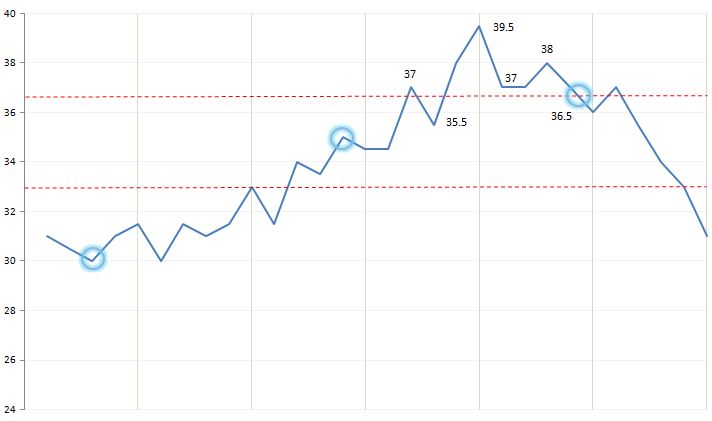

Fibonacci Arcs and retracements are used as a technical indicator to determine support and resistance. As with most indicators it can be used to see if a breakout has occurred or if a reversal is likely to happen.

Forex or (FX) is the term used for the world’s currency market. It comes from the words “Foreign Exchange”.

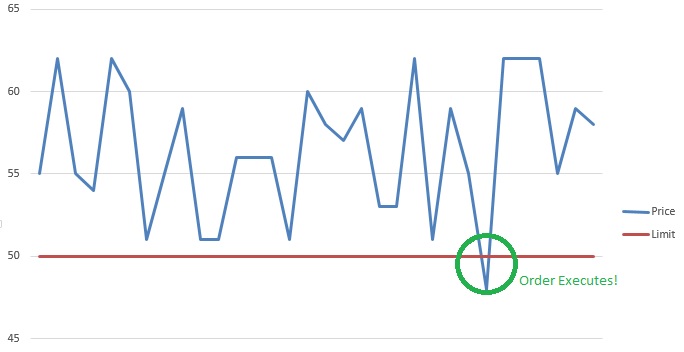

A Stop (or stop loss) order and Limit order are orders that try to execute when a certain price threshold is reached. These orders are mirrors of each other; they have the same mechanics, but have opposite triggers.

Trailing Orders are an order type that allows to set a moving stop or limit target price.

Bonds are essentially a much more formal I.O.U (I owe you) used to borrow money. You buy the bond in return to interest over a given period of time.

Your “Risk Level” is how much risk you are willing to accept to get a certain level of reward; riskier stocks are both the ones that can lose the most or gain the most over time.

An asset is anything that has monetary value and can be sold. Assets can be anything from a pencil (though it is not worth much) to a skyscraper to things like Stocks and ETFs.

“Asset Allocation” is how you have divided up your investments across different assets. You can have all your assets in one place, or you can use diversification to spread them around to reduce risk.

An investment strategy is the set of rules and behaviors that you can adopt to reach your financial and investing goals. Choosing an investing strategy can be a daunting task when you are starting to learn about investments and finance. H

In finance, Volume-Weighted Average Price (VWAP) is a ratio of the profit traded to complete volume traded over a distinct time horizon – normally one day. It’s a portion of the average price a stock traded at over the trading horizon.

Open Interest is the total number of options or futures contracts that are “open”, meaning currently owned by an investor and not yet expired.

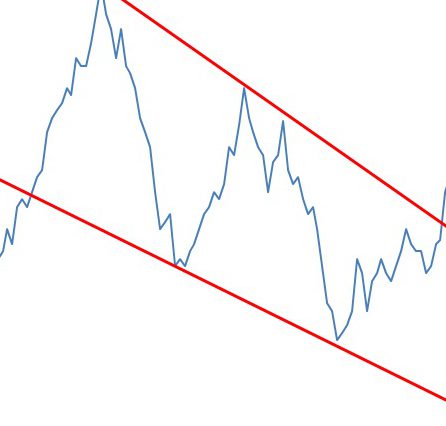

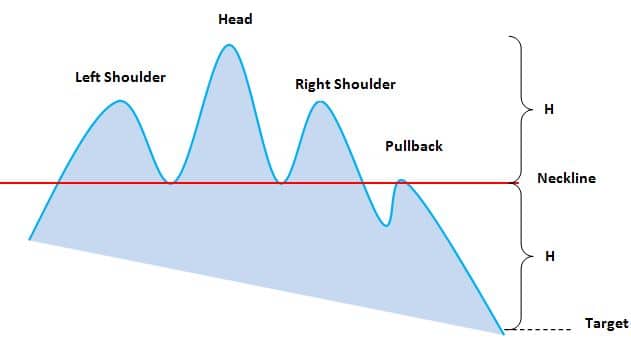

A pullback is a technical analysis term used frequently when a stock “pulls” back to a resistance and/or support line, usually after a breakout has occurred.

Variance is how far away from the average numbers are. The higher the variance, the farther away most numbers are from the group’s average.

A “Good-Till-Day” order is simply one that will cancel at the end of the trading day if it does not fill.

The Sharpe Ratio is an important tool for evaluating a stock, or a portfolio, based on how risky it is to get a higher return. You can use it to determine how consistent the returns of a stock or portfolio are, so you can determine if the returns are stemming more from wise investing, or “getting lucky”.

The head-and-shoulders pattern is one of the most popular chart patterns in technical analysis and indicates that a reversal is likely to happen after the pattern has been completed.

The Moving Average Convergence-Divergence (MACD) indicator is one of the easiest and most efficient momentum indicators you can get. The MACD moves two trend following indicators and moving averages into a momentum oscillator by subtracting the longer moving average from the shorter moving average. The result is that the MACD gives the best of both worlds: trend following and momentum.

Fixed Income represents a distinct asset class, typically of corporate and treasury bonds. This type of investment doesn’t usually have a high return, but gives a consistent “fixed” return over time

The Black-Scholes formula is the most popular ways to calculate the “true” price of an option.

Arbitrage is the simultaneous purchase of a security on one stock market and the sale of the same security on another stock market at prices which yield a profit.

There are also thousands of companies that want to sell shares to the general public, but are not able to sell on exchanges like NASDAQ, or the NYSE. Therefore, other exchanges exist to allow these companies to sell public shares. Stock traded on these “Over The Counter” exchanges are known as OTC stocks.

Gross National Product (GNP) is the value of all goods and services produced by a country’s residents.

Free Cash flow is the cash available to all the capital providers of a company. There are two types of free cash flows: 1) Cash flow available to pay out to all capital providers and 2) Free Cash Flow to Equity (FCFE).

The Form-8K is a SEC-mandated report filed by public companies to report unexpected events or transactions that are material in nature, and thus have an impact on the share prices of the company.

The earnings reports released by companies can be invaluable in providing relevant, timely, and high-quality information to help investors make the most informed decisions possible.

Discounted Cash Flow (DCF) is a valuation technique or model that discounts the future cash flows of a business, entity, or asset for the purposes of determining its value.

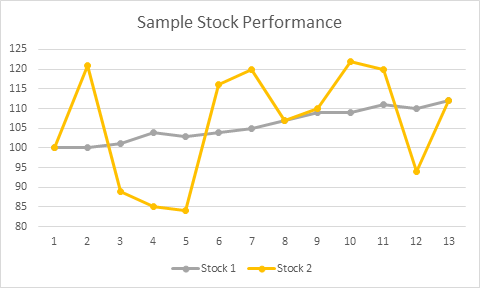

Covariance is a statistical measure of the extent that 2 variables move together relative to their respective mean (or average) values.

Correlation is a measure of the strength of linear association between two variables or more variables of interest. We can measure the degree and direction of their linear association using correlation analysis. Read this article to learn more!

Comprehensive insurance to a form of insurance policy which includes a broad range of coverage or protection. This article discuss the types, features, and advantages of comprehensive insurance.

The Chicago Mercantile Exchange (CME Group) is a publicly-traded derivatives-based exchange (NasdaqGS: CME), and is currently the largest futures exchange in the world in terms of number of contracts outstanding (or open interest).

The Chicago Board of Trade (CBOT) is a publicly-traded exchange (NYSE: BOT) that specializes in futures and options trading. It is highly active in markets such as agriculture, energy, equities, and US Treasuries, providing an important risk-management function for thousands of its CBOT members.