Cash Conversion Cycle is defined as the length of time (in days) needed to transform inventory purchases into actual cash receipts. It takes into consideration the company’s time commitment towards collecting receivables and paying its suppliers, and is an important measure of a company’s internal liquidity.

Capital funding is the provision of monetary resources or capital for productive uses. Capital provided by investors or other parties is used by various entities such as governments, companies, organizations, and individuals in order to fund their functions and operations.

Account Receivables Management refers to the set of policies, procedures, and practices employed by a company with respect to managing sales offered on credit. If efficient, receivables management can lead to good sales growth, healthy cash flows, profitability, and stable operating cycles.

Account Payables Management refers to the set of policies, procedures, and practices employed by a company with respect to managing its trade credit purchases. It is an important working capital amount that can enhance a company’s short-term cash flow position.

The idea behind insurance is that there are random bad – and expensive – things that happen to just about anyone. Car crashes, medical emergencies, and other problems that can destroy your personal saving and investing plans if they happen. To protect against this, insurance companies work to pool the resources of many people together in one group.

A price ceiling is a government-mandated limit on the price that can be charged for a given product, such as a utility or electricity. The intended purpose of a price ceiling is to protect the consumers from conditions that would make a vital product from being financially unattainable for consumers.

A “Poison Pill” is a way to give shareholders more time to evaluate a hostile takeover bid and to give management the opportunity to make better informed business decisions. It was created in the 1980’s, a period rife with hostile takeovers and corporate raids.

A straddle is an investment strategy that involves the purchase or sale of an option allowing the investor to profit regardless of the direction of movement of the underlying asset, usually a stock. Read this article for details on the two straddle strategies: a long straddle and a short straddle.

An oligopoly is characterized by a small number of sellers who dominate an entire market. All of the firms who partake in an oligopoly are considered to be very large in terms of profit, size and client base.

Monopoly, in economic terms, is used to refer to a specific company or individual has a large enough control of a particular product or service that allows them to influence it’s price or certain characteristics.

Monopolistic Competition is characterized as a form of imperfect competition, which exist when there are many sellers of a good or service but the products do not contain noticeable differences. There are several forms of imperfect competition, of which Monopolistic Competition is one.

Money supply is the total amount of money available in an economy at any particular point in time. Money is required for both consumers and businesses to make purchases. Money is defined as currency in circulation and demand deposits (funds held in bank accounts.)

The Expected Return is a weighted-average outcome used by portfolio managers and investors to calculate the value of an individual stock, or an entire stock portfolio.

A Portfolio Manager is a professional investment adviser that manages a client’s assets. They should be registered with an investment authority and be certified to act as a manager. Read this post for details on how to evaluate a portfolio manager.

Economists define elasticity as the ratio of the percent change in one variable to the percent change in another valuable. Its purpose is to measure how one variable responds to changes in another variable.

Duration measures the percentage change in the price of a bond (or value of a bond portfolio) due to a change in market interest rates (also known as the yield).

Return on Equity (ROE) is one of the most important pieces of data that investors and creditors use to evaluate a company’s potential to grow and profitability. Dupont Analysis breaks the ROE into several different components in order to analyze where the returns are coming from.

Straight line depreciation is the most commonly used and simplest form of depreciation.

Depreciation refers to the gradual and permanent decrease in value of the assets (referred to as a depreciatable asset) of a firm, nation or individual over its lifetime.

A basic material used in manufacturing or commerce that is interchangeable with other the same commodities coming from a different source. The quality of a specific commodity may differ slightly, but it is essentially uniform across producers. When they are traded on an exchange, commodities must also meet specified minimum standards, also known as a basis grade. Typical types of commodities are corn, gold, silver, steel, etc.

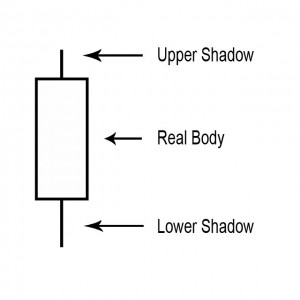

A point on a candle stick chart representing a specific time period (a day, an hour, a minute, etc) in which the underlying stock price has moved. Candlesticks will have a body and usually two wicks – one on each end.

A shadow is the small line (like a candle wick) found at the top or bottom of an individual candle in a candlestick chart.

An investment strategy that aims to capitalize on the continuance of existing trends in the market. The momentum investor believes that large increases in the price of a security will be followed by additional gains and vice versa for declining values.

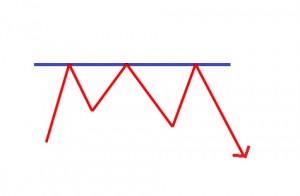

The Resistance Line is a point or range in a chart that caps an increase in the price of a stock or index over a period of time.

The price-to-sales ratios (Price/Sales or P/S) take the company’s market capitalization (the number of shares multiplied by the share price) and divide it by the company’s total sales over the past 12 months. The lower the ratio, the more attractive the investment.

Stagflation is high inflation and high unemployment are occurring simultaneously.

Inflation-Indexed Securities are securities with a guarantee of a return rate that is higher than the rate of inflation if it is held to maturity.

The fee charged by a broker or investment advisor in exchange for investment advice and/or handling the purchase or sale of a security. Commissions vary from brokerage to brokerage.

Earning estimates are an estimate of forecasted earnings and they provide one strong measure of potential future performance and are a mainstay of stock investing research!

This post describes, Return on Equity (ROE), which is used to measure how much profit a company is able to generate from the money invested by shareholders.

Price/Earnings To Growth, is a valuation metric for determining the relative trade-off between the price of a stock, the earnings generated per share (EPS), and the company’s expected future growth. It can be useful when looking at the future earning growth.

Stock volatility information can be used in many different ways but here is a quick and easy bit of stock volatility information that you can begin using today.

The typical hedge fund is designed to be a partnership arrangement with the fund manager acting as the general partner responsible for making investment decisions, and is one of the investment tools serious investors aspire towards.

Small cap stock investing is volatile. So, why risk your money by investing in what is typically considered risky business?

Hyperinflation refers to out of control or extremely rapid inflation, where prices increase so quickly that the concept of real inflation becomes meaningless. The classical definition of hyperinflation is inflation greater than 50% per month.

Inflation refers to the general rising of prices for goods and services in the economy, due to an increase in the amount of money and/or credit available. When it occurs, the purchasing power of your dollar falls.

A CD or Certificate of Deposit is one of the safest and liquid forms of investment available. Insured by the FDIC (Federal Deposit Insurance Corporation), CDs are a type of interest earning deposit account.

Market capitalization is calculated by multiplying the market price of stock by the number of issued shares of stock.

Market Risk, aka Systemic Risk, which is a measure of how much of a loss an investor is facing while trading.

Though investors often do not analyze it, most do realize there is risk inherent in investing. Never take on more risk than you are able to lose

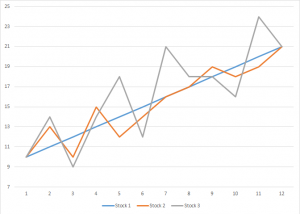

The buy and hold strategy is essentially just what it sounds like: Purchase stocks and then hold them for an extended period of time. The underlying assumption for the buy and hold strategy is that stocks tend to go up in price over extended periods of time.

Everywhere you turn there is another proprietary stock market timing system being sold. This is usually a computer program that tries to analyze real-time data for split-second trade decisions

The offer price, or the Bid price is what an investor is willing to pay for an investment. It is only an offer and will not be accepted if the seller is not willing to let go at the offer price.

The difference between the ask price and the sell price is called the “spread” and it is kept by the broker.

If you are brand new to investing then take time to understand what you are reading when viewing a Stock Exchange Symbol and learn Stock Market Investing Basics.

Most traders do not learn about stock trading Risk Management until it is too late, and they experiences losses of varying degrees. Insurance, options, and other tools exist – learn to use them!

An REITs or Real Estate Investment Trusts own, and often operate, real estate but are publicly traded like stock. Profit is paid as dividend to stock owners.

The U.S. Dollar has lost more than 30 percent of its value relative to other world currencies. Shorting the U.S. dollar and buying other world currency ETFs is one way to make money from this trend.

By measuring the compilation of similar stocks instead of just one or two stocks, a Stock Index provides information about that particular market or segment.

A non-bank organization that regularly trades large blocks of stocks. Because of the size of their investments, they qualify for preferential treatment and lower commissions. Institutional investors have less protective regulations as it is assumed that they have more experience with the market and are better able to protect themselves.