It happens to everyone: a monetary emergency happens, such as a car breakdown, draining your bank account. Bills are still coming in, and you know that you will not have enough money to pay for your debt obligations this month.

One of the first goals when developing a strong personal financial plan involves avoiding these scenarios by having a savings cushion, but this is not always possible. How can you get out of this situation with the least pain?

Example Scenario

For the examples in this article, we will assume that you have enough groceries for the month, you have $1000 in your checking account, and your next paycheck is a month away. You just received all of your bills today:

| Bill Amount | Late Fee | Late Interest (Monthly) | |

| Rent | $600.00 | $50.00 | 10% |

| Electricity/Gas | $80.00 | $10.00 | 5% |

| Internet | $80.00 | $10.00 | 5% |

| Cell Phone | $50.00 | $10.00 | 5% |

| Credit Card | $80.00 | $20.00 | 25% |

| Student Loan | $260.00 | $40.00 | 0% |

| Car Loan | $200.00 | $20.00 | 0% |

| Car Insurance | $30.00 | $5.00 | 0% |

| Health Insurance | $250.00 | $20.00 | 0% |

The total of all these bills is $1630 – way above what you can afford. Instead of getting worried or depressed, develop a plan of action.

Evaluate the Damage

The first step is to take a look at what will happen for each of these bills if they are not paid. This is a good way to prioritize which bills to tackle first.

- If your rent is unpaid for one month, you will get charged a late fee, but you probably won’t be evicted.

- Utilities usually cannot be turned off unless there are several months in a row of failed payments.

- Your internet connection probably will take a month or two of failed payments before your service provider shuts it off.

- If your cell phone bill is unpaid, your provider most likely will shut off your phone within a few days.

- Missing a credit card payment will not automatically put you in default, but you have a high interest rate and a late fee to deal with. Plus missing a credit card payment can really hurt your credit. This also applies to your car loan.

- Missing your student loan payment can put you in default fairly quickly. This is the stickiest kind of debt. Not even bankruptcy will remove it.

- Missing a payment on your car insurance might void your policy. And if you lose your insurance, you can no longer legally drive to work.

- Missing your health insurance payments might also void your policy, although there are some protections against this, and getting back on the plan might be expensive.

By knowing those facts about your different bills, now we can make a “ranking” of how important it is to keep each one of your creditors happy in the short term:

| High priority — must pay | Would like to pay | Can wait if needed |

| Cell phone Health insurance Car insurance | Credit card Car loan Student load | Rent Electricity/Gas Internet |

This priority will shift a lot if you are facing multiple months of being behind on your bills. For example, if you are under direct threat of eviction, rent might jump near the top of the list.

Explore Your Options

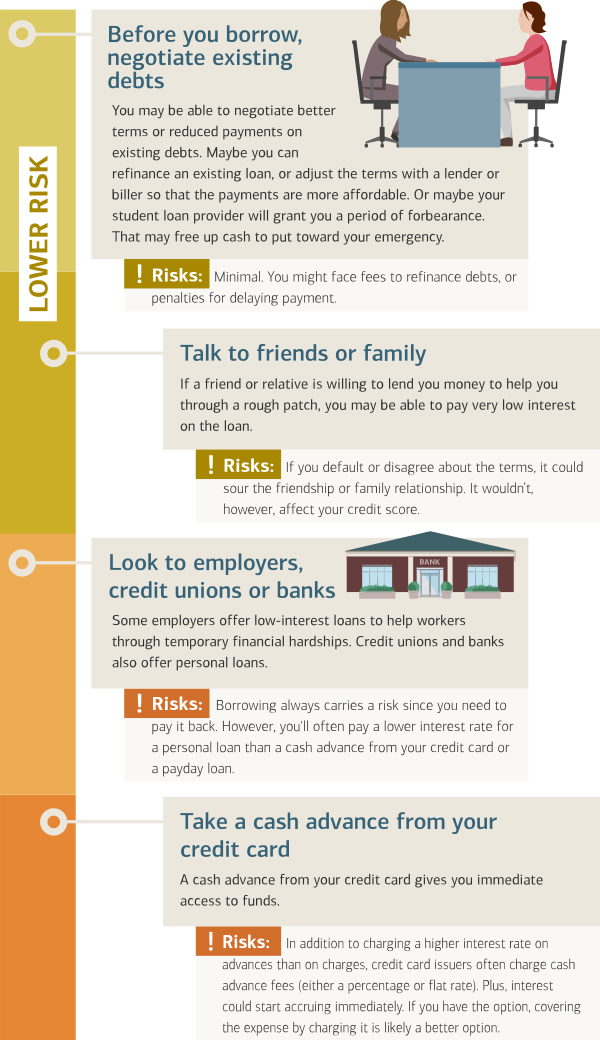

Next, spend a few minutes to think about any other ways you can scrounge up enough cash to make all your payments this month. We discuss this in detail in our article on Short-Term Financing.

Borrow from Friends or Family

Borrowing money from friends or family members might be able to help bridge the gap. This is usually the cheapest and easiest way to get money to pay your bills, but many people are uncomfortable or unable to borrow money from the people they know.

Credit Card Financing

One option is to pay off your credit card first and then use the line of credit available to pay off all your other debts. You could then pay off the credit card balance with your next paycheck. This is the second fastest and easiest method. This will keep all of your creditors happy, and you will not accumulate much interest before your next paycheck, making this the least expensive option available.

Short-Term Unsecured Loans

A short-term unsecured loan is the type of loan you can ask for at a bank. Whether it is granted or not depends on your credit history, the amount you need to borrow, and the policies of the bank itself. If your bank offers you a loan, this is another workable solution. (This is NOT a payday loan. See our article on Short-Term Financing to tell the difference.)

Divide Your Paycheck

In the real world, dividing your paycheck is the most common course of action if the first 3 options fail. Some of your bills are completely non-negotiable and will cause major problems if you cannot make the monthly payment. Pay those first. Then for the remaining bills, divide up your paycheck proportionally and hope your creditors do not complain too much until next month.

Pay Off What You Can

Paying off only what you can also happens in the real world, but is more rare. When using this method, instead of dividing up your paycheck proportionally, you pay off several of the bills in full, leaving others to be completely unpaid until next month. The creditors you do not pay off hate this. You may get angry phone calls or letters, and it could seriously hurt your credit.

Take Action

If you can borrow some cash, use your credit card, or get a line of credit from your bank, that will be the way to go. If not, you will need to determine which hurts less: dividing your paycheck or paying off what you can. Let’s take a look at how this works.

Step 1: Subtract the Non-Negotiables

The top 3 things on our list are non-negotiable. Any lapse in the bills will cause termination of your service entirely.

Non-Negotiable Bills = Health Insurance + Car Insurance + Cell Phone

= 250 + 30 + 50

= $330

We know that no matter what, we need to spend this $330, leaving us with $670 in cash for the remaining bills.

Step 2: Calculate Extra Costs Charged for Unpaid Bills

We want to decide if we are diving our $670 proportionally, or paying off a couple of bills entirely. To see which is best, we first need to know how much extra cost will be applied to the remaining bills if we wait until the next paycheck to make a payment

| Bill Amount | Late Fee | Late Interest (Monthly) | Bill Plus Late Fee | Interest Charge | Total Due In 30 Days | |

| Rent | $600.00 | $50.00 | 10% | $650.00 | $65.00 | $715.00 |

| Electricity/Gas | $80.00 | $10.00 | 5% | $90.00 | $4.50 | $94.50 |

| Internet | $80.00 | $10.00 | 5% | $90.00 | $4.50 | $94.50 |

| Credit Card | $80.00 | $20.00 | 25% | $100.00 | $25.00 | $125.00 |

| Student Loan | $260.00 | $40.00 | 0% | $300.00 | $- | $300.00 |

| Car Loan | $200.00 | $20.00 | 0% | $220.00 | $- | $220.00 |

$1,300 in bills today will grow to $1,549 next month if unpaid, or $249 more than it would be if we could pay everything today. We can see the biggest hits are coming from rent and credit cards.

We are not getting charged extra for missing payments for the student loan and the car loan, but missing a payment will damage our credit history, and we will accumulate more interest on the principal balance. We will estimate the damage to our credit history being $60 each for the credit card, student loan, and car loan payments.

There is also a chance that our landlord and utility companies will report the missed payments. We will assume there is about 1/6 chance, so we will estimate a “credit damage” amount of $10 for each of those bills.

This means the total damage done by missing every payment this month is $459.

| Late Fee | Interest Charge | Credit Damage | Total Cost | |

| Rent | $50.00 | $65.00 | $10.00 | $75.00 |

| Electricity/Gas | $10.00 | $4.50 | $10.00 | $14.50 |

| Internet | $10.00 | $4.50 | $10.00 | $14.50 |

| Credit Card | $20.00 | $25.00 | $60.00 | $85.00 |

| Student Loan | $40.00 | $- | $60.00 | $60.00 |

| Car Loan | $20.00 | $- | $60.00 | $60.00 |

| Total | $150.00 | $99.00 | $210.00 | $459.00 |

Step 3: Calculate Cost if Paycheck Is Divided

Next, we want to see what our cost will be if we divide our paycheck proportionally. This means we are not paying any bill in full. We are looking at the proportion each bill represents of the total amount we owe, and dividing our paycheck accordingly. We will still get charged late payments and some interest. However, we will assume that there will be 1/4 the amount of damage to our credit for a partial payment compared to making no payment at all.

| Bill Amount | Percent of Total | Amount We Pay ($670 x the %) | Amount Unpaid | Late Fee | Total Unpaid | |

| Rent | $600.00 | 46.1% | $308.87 | $291.13 | $50.00 | $341.13 |

| Electricity/Gas | $80.00 | 6.2% | $41.54 | $38.46 | $10.00 | $48.46 |

| Internet | $80.00 | 6.2% | $41.54 | $38.46 | $10.00 | $48.46 |

| Credit Card | $80.00 | 6.2% | $41.54 | $38.46 | $20.00 | $58.46 |

| Student Loan | $260.00 | 20.0% | $134.00 | $126.00 | $40.00 | $166.00 |

| Car Loan | $200.00 | 15.3% | $102.51 | $97.49 | $20.00 | $117.49 |

We are paying $150 in late fees alone. Now we factor in the interest charges and damage to our credit that goes with this payment:

| Total Unpaid | Late Interest (Monthly) | Interest Charge | Credit Damage | Total Due Next Month | |

| Rent | $341.13 | 10% | $34.11 | $2.50 | $377.74 |

| Electricity/Gas | $48.46 | 5% | $2.42 | $2.50 | $53.38 |

| Internet | $48.46 | 5% | $2.42 | $2.50 | $53.38 |

| Credit Card | $58.46 | 25% | $14.62 | $15.00 | $88.08 |

| Student Loan | $166.00 | 0% | $- | $15.00 | $181.00 |

| Car Loan | $117.49 | 0% | $- | $15.00 | $132.49 |

| Totals | $780.00 | $53.57 | $52.50 | $886.07 |

To calculate how much this is costing us, we can add together our total late fees, total interest charge, and total damage to our credit:

Total Cost = Late Fees + Interest Charges + Credit Damage

= $150 + $53.57 + $52.50

=$256.07

The total damage is $256.07, which is just $202.93 better than paying nothing at all, but still a big amount.

Step 4: Compare with Paying Off Big Credit Debts First

What if instead of dividing up our paycheck equally, we just pay off what we can afford, and leave the rest? To prioritize, we can take our $670 remaining, go down the list of priorities, and simply pay them off.

| Amount | Remaining Cash | |

| 1. Credit card | $80.00 | $590.00 |

| 2. Car loan | $200.00 | $390.00 |

| 3. Student loan | $260.00 | $130.00 |

| 4. Rent | $600.00 | Can’t pay – skip |

| 5. Electricity/Gas | $80.00 | $50.00 |

| 6. Internet | $80.00 | Can’t pay – skip |

Now we have an unhappy landlord and an unhappy internet service provider, but our other bills are paid. We can now compare this option to how much damage skipping these bills entirely would do:

| Bill Amount | Late Fee | Late Interest (Monthly) | Interest Charge | Credit Damage | Total Damage (Late fee + Interest + Credit damage) | |

| Rent | $600.00 | $50.00 | 10% | $65.00 | $10.00 | $125.00 |

| Internet | $80.00 | $10.00 | 5% | $4.50 | $10.00 | $24.50 |

This gives us a total damage of $149.50, saving over $100 compared to dividing up our paycheck equally. We even still have $50 remaining. Applying the $50 to the internet or rent bill would remove some of the credit damage and the interest charged, saving even more money.

Our calculations show that paying off most bills completely and leaving a few unpaid will be better dollar wise. You will save money on late fees, interest charged, and damage to your credit. However, the reason most people still divide up their paycheck and pay a little to each creditor when faced with a cash shortage is due to the human factor. Every creditor who is not paid will send you emails and make phone calls as soon as your payment is late, demanding payment as soon as possible. So people try to minimize the damage from each creditor instead of focusing on minimizing the damage from every creditor. By keeping the big picture in mind, you will do your spending plan a huge favor!

You can download a spreadsheet showing all of these calculations, and even change the values to match your own bills, by clicking here.

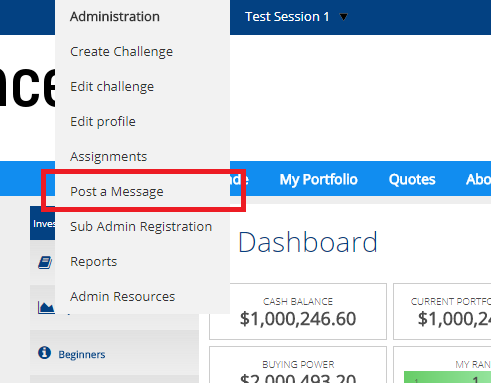

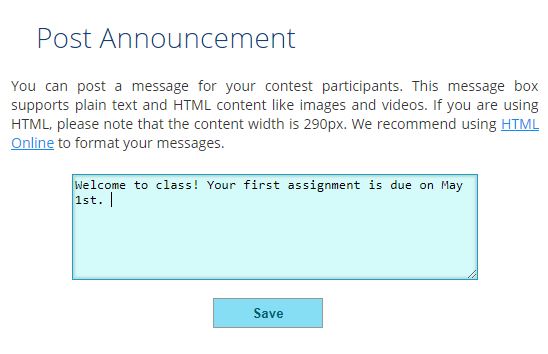

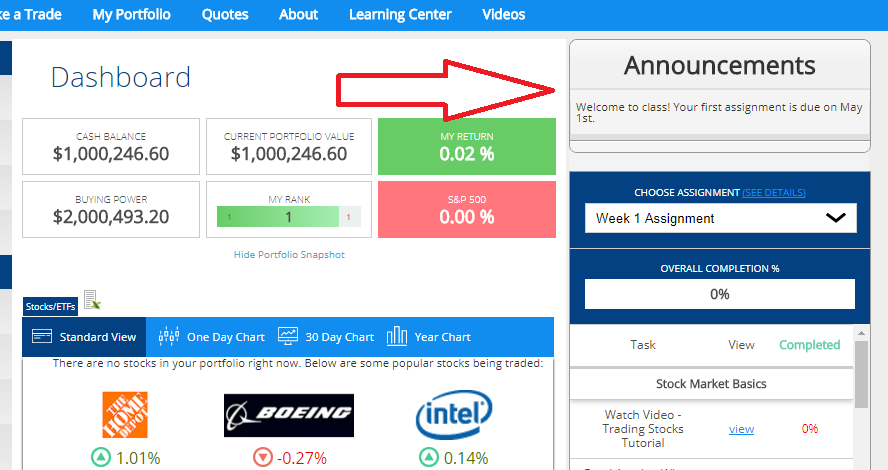

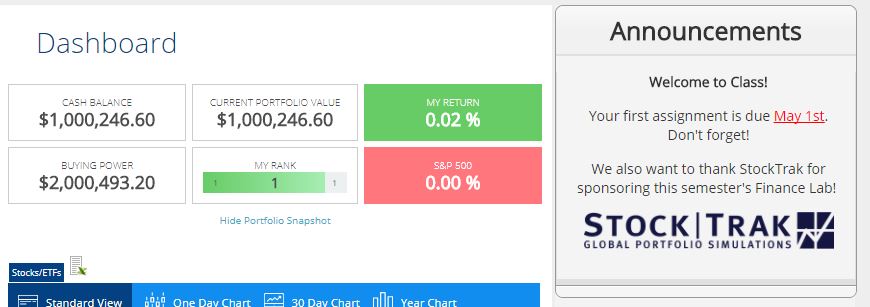

Get PersonalFinanceLab

This lesson is part of the PersonalFinanceLab curriculum library. Schools with a PersonalFinanceLab.com site license can get this lesson, plus our full library of 300 others, along with our budgeting game, stock game, and automatically-graded assessments for their classroom - complete with LMS integration and rostering support!

Learn More[qsm quiz=138]

Challenge Questions

- What reasons might there be that could cause someone to miss paying a bill?

- In your opinion, how important is it to have an emergency fund?

- After reading the text, would you pay a small amount to each creditor or prioritize and look to eliminate one bill at a time?

- What are some of the effects of paying your bills late?

From this point, we can interpret the value of a stock use this ratio to determine if it is a high growth or flawed stock. First we take a look at Nordstrom and how to interpret its P/E ratio. Their current P/E ratio is 23.61. Next we look at Macy’s, with a P/E ratio of 11.81. High P/E ratios correlated with higher growth stock due to investors finding more value in a companies share price. If this holds true, Nordstrom is seen as a better buy than Macy’s because investors expect more growth in the future.

From this point, we can interpret the value of a stock use this ratio to determine if it is a high growth or flawed stock. First we take a look at Nordstrom and how to interpret its P/E ratio. Their current P/E ratio is 23.61. Next we look at Macy’s, with a P/E ratio of 11.81. High P/E ratios correlated with higher growth stock due to investors finding more value in a companies share price. If this holds true, Nordstrom is seen as a better buy than Macy’s because investors expect more growth in the future. This specific financial ratio has been very useful over the past year with regards to the slump in retail stores due to online shopping. Nordstrom has a P/S ratio of 0.530 and Macy’s has a P/S ratio of 0.280. This is a great tool for valuing an asset in comparison to another in terms of sales. This ratio shows that Nordstrom’s current market cap is much lower than it could be in terms of their revenue compared to Macy’s – per dollar value of the company, Macy’s is making more sales.

This specific financial ratio has been very useful over the past year with regards to the slump in retail stores due to online shopping. Nordstrom has a P/S ratio of 0.530 and Macy’s has a P/S ratio of 0.280. This is a great tool for valuing an asset in comparison to another in terms of sales. This ratio shows that Nordstrom’s current market cap is much lower than it could be in terms of their revenue compared to Macy’s – per dollar value of the company, Macy’s is making more sales. To use this model, start by taking the risk-free rate of return, then adding in how you think many different variables will impact the price. Each “b” in the formula is another factor you think will have an impact, and you can have as many factors as you want. You could base the formula off of the inflation rate, exchange rates, production rates, etc. The possibilities are endless.

To use this model, start by taking the risk-free rate of return, then adding in how you think many different variables will impact the price. Each “b” in the formula is another factor you think will have an impact, and you can have as many factors as you want. You could base the formula off of the inflation rate, exchange rates, production rates, etc. The possibilities are endless.

When investing, an investor deposits money within an account with their broker. There is a choice of two types of accounts in which to deposit the money: a cash account or a margin account.

When investing, an investor deposits money within an account with their broker. There is a choice of two types of accounts in which to deposit the money: a cash account or a margin account.

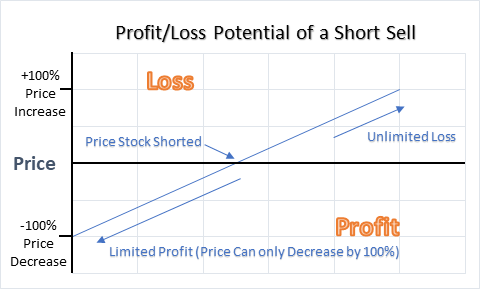

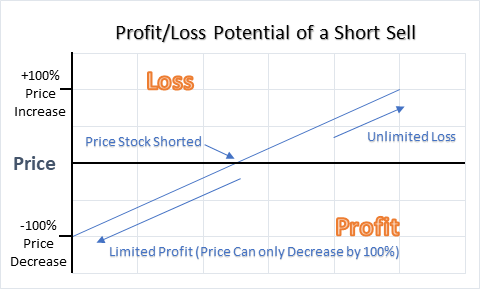

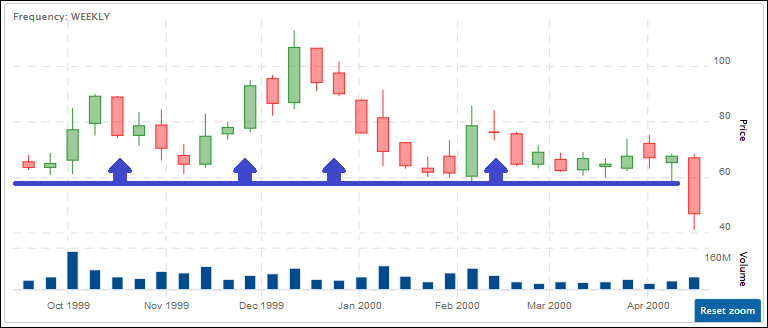

Market timing is an investment strategy where the investor buys or shorts stocks and financial instruments based on their expectations of what might happen in the market. This is the “Buy low, sell high” idea – trying to buy stocks just before the prices go up, and selling them at the peak.

Market timing is an investment strategy where the investor buys or shorts stocks and financial instruments based on their expectations of what might happen in the market. This is the “Buy low, sell high” idea – trying to buy stocks just before the prices go up, and selling them at the peak. A portfolio has an international investment strategy if it has investments in foreign markets. An international investment strategy offers the investor the opportunity to lower the risk of their portfolio and to take advantage of possible investment opportunities in foreign markets. It reduces risk through diversifying. Diversifying is where the investor invests in more than one market to reduce the risk to any specific market. Instead of being fully invested in domestic markets, the domestic market holds a smaller percentage of investments with investments in foreign markets making up the rest of the portfolio. If the investor was to only focus on American markets and if the markets took a dive, it would be very difficult to protect the portfolio from taking a hit. Therefore, if they had investments in many markets internationally, the investments in other markets would be safe. The investor’s portfolio of investments would not be as exposed.

A portfolio has an international investment strategy if it has investments in foreign markets. An international investment strategy offers the investor the opportunity to lower the risk of their portfolio and to take advantage of possible investment opportunities in foreign markets. It reduces risk through diversifying. Diversifying is where the investor invests in more than one market to reduce the risk to any specific market. Instead of being fully invested in domestic markets, the domestic market holds a smaller percentage of investments with investments in foreign markets making up the rest of the portfolio. If the investor was to only focus on American markets and if the markets took a dive, it would be very difficult to protect the portfolio from taking a hit. Therefore, if they had investments in many markets internationally, the investments in other markets would be safe. The investor’s portfolio of investments would not be as exposed.

Upper managements such as the chief executive officers (CEO), the chief financial officer (CFO), the chief operating officer (COO), the chief technology officer (CTO), the chief marketing officer (CMO), the directors, the presidents, the senior vice presidents, the vice presidents, the sales managers, and many others are charged with being the role models, supporters, the enforcers, the implementers, and the delegators of social responsibility. In other words, social responsibility usually comes from the top, with the highest-level managers encouraging their subordinates to act with social responsibility. This is usually done through the company’s mission and vision statements, implementations of internal controls, and specific goals laid out in the business plan.

Upper managements such as the chief executive officers (CEO), the chief financial officer (CFO), the chief operating officer (COO), the chief technology officer (CTO), the chief marketing officer (CMO), the directors, the presidents, the senior vice presidents, the vice presidents, the sales managers, and many others are charged with being the role models, supporters, the enforcers, the implementers, and the delegators of social responsibility. In other words, social responsibility usually comes from the top, with the highest-level managers encouraging their subordinates to act with social responsibility. This is usually done through the company’s mission and vision statements, implementations of internal controls, and specific goals laid out in the business plan. Being and becoming socially responsible is about working with people who are able to identify when something is socially responsible or irresponsible. Social responsibility is about listening and learning about the people and the environment from which it will apply. Being constructive means listening to complaints, coming from both inside and outside of the organization, and being willing to act on those complaints.

Being and becoming socially responsible is about working with people who are able to identify when something is socially responsible or irresponsible. Social responsibility is about listening and learning about the people and the environment from which it will apply. Being constructive means listening to complaints, coming from both inside and outside of the organization, and being willing to act on those complaints. Companies get the best press if they are proactive and address social issues before they are forced to do so by government regulation. For example, the Heinz brand became nationally beloved after it became the first major

Companies get the best press if they are proactive and address social issues before they are forced to do so by government regulation. For example, the Heinz brand became nationally beloved after it became the first major  Inviting the public (current, future, and potential customers) to share their thoughts and ideas of how the company can improve their products and services and reaching out to the public to help solve problems. Whenever you take a survey or write a review, all that data is used by the company to make a change.

Inviting the public (current, future, and potential customers) to share their thoughts and ideas of how the company can improve their products and services and reaching out to the public to help solve problems. Whenever you take a survey or write a review, all that data is used by the company to make a change. The federal government had to respond to this one because people were getting tricked into buying things over the phone by people pretending to sell them something they needed. In return, people gave these fraudsters their personal and financial information. Investigators reported that each year there were $40 billion of losses because of these indirect phishing schemes and Congress responded. This act makes it illegal for telemarketers to deceive and coerce customers and requires them to disclose their information and only make calls at certain times of the day.

The federal government had to respond to this one because people were getting tricked into buying things over the phone by people pretending to sell them something they needed. In return, people gave these fraudsters their personal and financial information. Investigators reported that each year there were $40 billion of losses because of these indirect phishing schemes and Congress responded. This act makes it illegal for telemarketers to deceive and coerce customers and requires them to disclose their information and only make calls at certain times of the day.

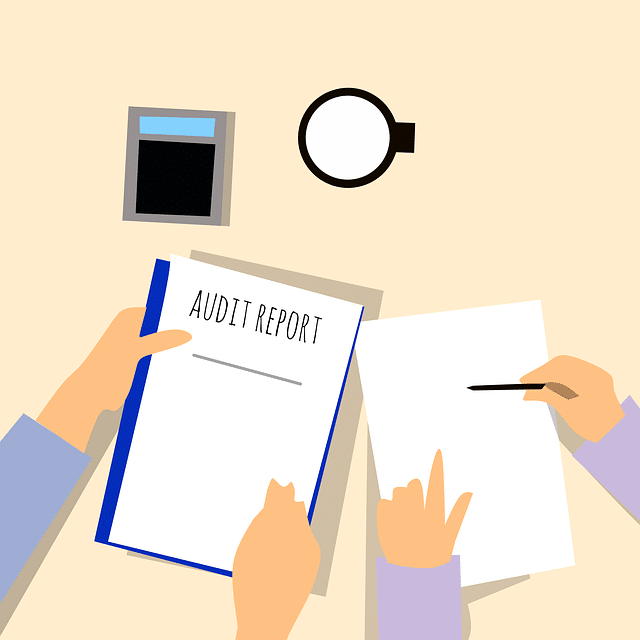

Internal Controls are the procedures and processes in place at an organization to make sure everything operates smoothly and mistakes stay rare. This includes things like building Standard Operating Procedures (SOPs), Quality Assurance (QA), and Auditing. It also includes checks and investigations to make sure those SOPs and QA processes are being followed properly, not just unused documents. Most of the examples in this article will focus on internal risk management.

Internal Controls are the procedures and processes in place at an organization to make sure everything operates smoothly and mistakes stay rare. This includes things like building Standard Operating Procedures (SOPs), Quality Assurance (QA), and Auditing. It also includes checks and investigations to make sure those SOPs and QA processes are being followed properly, not just unused documents. Most of the examples in this article will focus on internal risk management. Internal Risk Control is what a manager and organization put in place to minimize risks coming from inside the organization. These controls fall into 4 broad categories:

Internal Risk Control is what a manager and organization put in place to minimize risks coming from inside the organization. These controls fall into 4 broad categories: Before a risk can be assessed, the first step is identifying what exactly that risk is. The goal of Step 1 is to have a clear and concise definition of what exactly the potential problems are and what kinds of damage might be caused. For example, dangerous machines in a workplace have a defined risk of harming workers, which both loses productivity and results in lawsuits.

Before a risk can be assessed, the first step is identifying what exactly that risk is. The goal of Step 1 is to have a clear and concise definition of what exactly the potential problems are and what kinds of damage might be caused. For example, dangerous machines in a workplace have a defined risk of harming workers, which both loses productivity and results in lawsuits. Effective controls are implemented on a trial basis. This means the team has a training session to outline what the hazards are and the new controls being implemented to address them. While the trial progresses, the entire team (from rank-and-file workers through the management involved) record how the implementation impacts their work, both in terms of actually addressing the risks the controls are addressing and the realized cost of implementing them.

Effective controls are implemented on a trial basis. This means the team has a training session to outline what the hazards are and the new controls being implemented to address them. While the trial progresses, the entire team (from rank-and-file workers through the management involved) record how the implementation impacts their work, both in terms of actually addressing the risks the controls are addressing and the realized cost of implementing them. Audits are larger reviews of the internal risk controls that a company has implemented. Audits are separate from the normal risk assessment procedures, but do follow a similar road map for how they are conducted.

Audits are larger reviews of the internal risk controls that a company has implemented. Audits are separate from the normal risk assessment procedures, but do follow a similar road map for how they are conducted.

Planning is a combination of analysis and outlining a plan of action. Planning is what you want to do to achieve some goal or objective to help better manage a business. The purpose of planning is to plan what direction the business is headed, what decisions need to be made, how to be better than competitors in the same industry and business, and how to eliminate wastefulness and optimize current operations. Since plans address a huge variety of business objectives, they tend to be very diverse themselves, but all good plans have a few core components:

Planning is a combination of analysis and outlining a plan of action. Planning is what you want to do to achieve some goal or objective to help better manage a business. The purpose of planning is to plan what direction the business is headed, what decisions need to be made, how to be better than competitors in the same industry and business, and how to eliminate wastefulness and optimize current operations. Since plans address a huge variety of business objectives, they tend to be very diverse themselves, but all good plans have a few core components: A “Business Plan” in this context is the core document of a small business – it merges many elements of both Strategic Planning and Business Planning together to present one clear vision of what a company is, what its goals are, and how it seeks to achieve them. A good business plan serves three functions: it provides direction to all levels of management as to where the company is heading (like a Strategic Plan), it provides guidance for what a company’s goals and missions are to the rank-and-file workers at a business, and it serves as a document to present to banks and other investors to show why a company will be profitable.

A “Business Plan” in this context is the core document of a small business – it merges many elements of both Strategic Planning and Business Planning together to present one clear vision of what a company is, what its goals are, and how it seeks to achieve them. A good business plan serves three functions: it provides direction to all levels of management as to where the company is heading (like a Strategic Plan), it provides guidance for what a company’s goals and missions are to the rank-and-file workers at a business, and it serves as a document to present to banks and other investors to show why a company will be profitable. Reveals the possible strengths, weaknesses, opportunities, and threats that your company will encounter in internal and external business environment.

Reveals the possible strengths, weaknesses, opportunities, and threats that your company will encounter in internal and external business environment. Planning and locating the procurement, distribution, and exchange of supplies and materials to reduce shipping time and decrease shipping costs.

Planning and locating the procurement, distribution, and exchange of supplies and materials to reduce shipping time and decrease shipping costs. Crowdsourced plans farm out most of the “heavy lifting” to a large number of people. Companies with strong cohesion of their low-level managers and workers can find great success when crowdsourcing business plans, because it gives all of the people involved a greater “stake” in helping define what company goals are attainable.

Crowdsourced plans farm out most of the “heavy lifting” to a large number of people. Companies with strong cohesion of their low-level managers and workers can find great success when crowdsourcing business plans, because it gives all of the people involved a greater “stake” in helping define what company goals are attainable. For instance, when it comes to organizing in the logistics department, the manager plans the structure of when shipments will be made, at what times, how long the shipments should be, at what facilities they should be distributed to reduce shipping costs. The manager also needs to plan how much supplies will be allocated to each factory, how much each factory will produce, how much of that product will be shipped to facilities, and where should they be distributed. The manager leads in the structure and allocation of what happens in the logistics department by planning how to get workers to do what is asked and expected of them so that the work process and item production are operating at the highest level. However, when problems arise the manager must control the situation by planning how to solve the problem and how to prevent it from happening again. Planning is in everywhere and everything the manager does.

For instance, when it comes to organizing in the logistics department, the manager plans the structure of when shipments will be made, at what times, how long the shipments should be, at what facilities they should be distributed to reduce shipping costs. The manager also needs to plan how much supplies will be allocated to each factory, how much each factory will produce, how much of that product will be shipped to facilities, and where should they be distributed. The manager leads in the structure and allocation of what happens in the logistics department by planning how to get workers to do what is asked and expected of them so that the work process and item production are operating at the highest level. However, when problems arise the manager must control the situation by planning how to solve the problem and how to prevent it from happening again. Planning is in everywhere and everything the manager does.

Here, sellers gather as much relevant information as possible prior to the appointment with the customer. This focuses on new customers where information is collected in such a way that it has enough applicability and usefulness for effective use. This can be looking up a customer on their social media accounts and finding their likes, dislikes, and needs to present this information in relation to the product.

Here, sellers gather as much relevant information as possible prior to the appointment with the customer. This focuses on new customers where information is collected in such a way that it has enough applicability and usefulness for effective use. This can be looking up a customer on their social media accounts and finding their likes, dislikes, and needs to present this information in relation to the product. The last part of the presentation and the most fearful for the seller. But have no fear! Closing the sale is only confirming and understanding, the fear will disappear if the seller TRULY believes that the customer will enjoy the benefits after they made the purchase.

The last part of the presentation and the most fearful for the seller. But have no fear! Closing the sale is only confirming and understanding, the fear will disappear if the seller TRULY believes that the customer will enjoy the benefits after they made the purchase. Improvements in technology are drastically changing the communication between buyers and sellers. This phenomenon is referred to as a revolution in sales. Technology is an amazing factor in the personal selling process, and allows for products and services to be sold in a variety of different ways. Social Media and the Internet contributed a great deal to this revolution. Customers still want relationships, but look for it in different ways. With more and more people buying online, relationships and repeating customers have to be brought in – in a completely different way. Sellers are no longer meeting face to face with each customer, and need another way to build trust. You might have already seen one way companies address this – many websites have an online chat feature that allows a potential customer to communicate with a seller and then partake in the 8-step process above.

Improvements in technology are drastically changing the communication between buyers and sellers. This phenomenon is referred to as a revolution in sales. Technology is an amazing factor in the personal selling process, and allows for products and services to be sold in a variety of different ways. Social Media and the Internet contributed a great deal to this revolution. Customers still want relationships, but look for it in different ways. With more and more people buying online, relationships and repeating customers have to be brought in – in a completely different way. Sellers are no longer meeting face to face with each customer, and need another way to build trust. You might have already seen one way companies address this – many websites have an online chat feature that allows a potential customer to communicate with a seller and then partake in the 8-step process above. Be careful of the small talk, some cultures believe that it makes someone appear untrustworthy. In America, although tedious to some, small talk is normal. However, in some other cultures, talking about personal life before talking about a business deal can cause the customer to feel uneasy about the seller and may view them as mischievous.

Be careful of the small talk, some cultures believe that it makes someone appear untrustworthy. In America, although tedious to some, small talk is normal. However, in some other cultures, talking about personal life before talking about a business deal can cause the customer to feel uneasy about the seller and may view them as mischievous.

Executive role – The HR department are specialists in areas that encompass the management of employees.

Executive role – The HR department are specialists in areas that encompass the management of employees. Choosing and hiring employees – The HR department oversees setting job qualifications and sifting through résumés and choosing the most qualified candidate for the interview.

Choosing and hiring employees – The HR department oversees setting job qualifications and sifting through résumés and choosing the most qualified candidate for the interview.

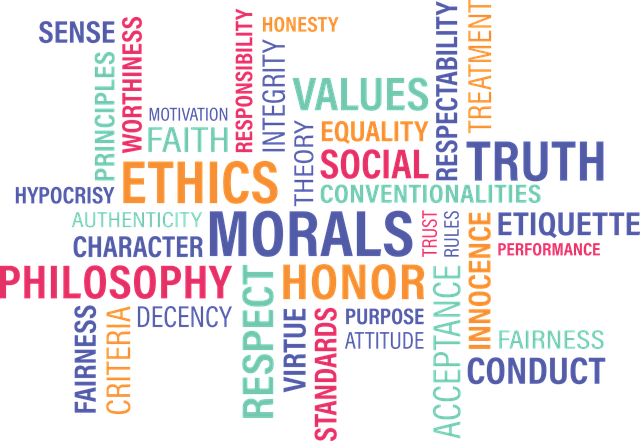

What is and is not “Ethical” is often very subjective. Over time, several different ways of defining ethical behavior have arisen.

What is and is not “Ethical” is often very subjective. Over time, several different ways of defining ethical behavior have arisen. All businesses are based on a foundation of trust. Customers expect to get their money’s worth from a product they buy (that it will do what is advertised, is free from defect, and is safe to use). Investors expect to know how their money is being used to run the business (though accurate financial statements, truthful statements from the management, and adherence to core principles). Nothing destroys a business faster than losing the public trust, which is why maintaining strong business ethics is essential in the business world today.

All businesses are based on a foundation of trust. Customers expect to get their money’s worth from a product they buy (that it will do what is advertised, is free from defect, and is safe to use). Investors expect to know how their money is being used to run the business (though accurate financial statements, truthful statements from the management, and adherence to core principles). Nothing destroys a business faster than losing the public trust, which is why maintaining strong business ethics is essential in the business world today. The government actively monitors companies throughout the country, through quality control tests on products, audits of tax forms and financial statements, and other avenues. If unethical behavior is discovered by the government, a company will usually face extremely stiff penalties, and the management may be criminally liable. The company will also likely be forced to engage in lengthy and expensive legal battles, and may have its reputation irreparably damaged.

The government actively monitors companies throughout the country, through quality control tests on products, audits of tax forms and financial statements, and other avenues. If unethical behavior is discovered by the government, a company will usually face extremely stiff penalties, and the management may be criminally liable. The company will also likely be forced to engage in lengthy and expensive legal battles, and may have its reputation irreparably damaged. You probably will not see a business’s Code of Ethics until after you start. For most employees, they usually do not even take a good look until a major ethical issue has already come up, but your life will be made much easier by evaluating the Code of Ethics early, and bringing up any concerns with your managers before issues arise.

You probably will not see a business’s Code of Ethics until after you start. For most employees, they usually do not even take a good look until a major ethical issue has already come up, but your life will be made much easier by evaluating the Code of Ethics early, and bringing up any concerns with your managers before issues arise. This act was created in the wake of the Enron Collapse. Enron was a company that primarily dealt with energy. Throughout the late 2000’s, the corporate culture of Enron was obsessed with driving Growth At Any Cost – the company’s daily stock price was posted in the elevators, and associate bonuses were based almost entirely on short-term gains. At lower levels of management, managers were found to have been artificially manipulating energy levels in several states, causing artificial shortages to drive up energy prices. At higher levels, senior managers were found to be manipulating the “book value” of many assets to make failing assets seem profitable. Eventually the entire company collapsed when journalists began investigating their seemingly impossible winning streak, bringing down both one of the biggest energy companies in the world, and one of the most (formally) trusted accounting firms.

This act was created in the wake of the Enron Collapse. Enron was a company that primarily dealt with energy. Throughout the late 2000’s, the corporate culture of Enron was obsessed with driving Growth At Any Cost – the company’s daily stock price was posted in the elevators, and associate bonuses were based almost entirely on short-term gains. At lower levels of management, managers were found to have been artificially manipulating energy levels in several states, causing artificial shortages to drive up energy prices. At higher levels, senior managers were found to be manipulating the “book value” of many assets to make failing assets seem profitable. Eventually the entire company collapsed when journalists began investigating their seemingly impossible winning streak, bringing down both one of the biggest energy companies in the world, and one of the most (formally) trusted accounting firms. Ahead of the Great Recession, many banks were issuing record numbers of sub-prime loans, or loans issued to lenders with poor credit history or low earnings. Sub-prime loans in and of themselves are not bad – they can be an important way to help uplift people from poverty. What was new was the introduction of wide-spread derivatives trading involving investment banks using something called derivatives and interest-rate swaps, which created a potential for abuse.

Ahead of the Great Recession, many banks were issuing record numbers of sub-prime loans, or loans issued to lenders with poor credit history or low earnings. Sub-prime loans in and of themselves are not bad – they can be an important way to help uplift people from poverty. What was new was the introduction of wide-spread derivatives trading involving investment banks using something called derivatives and interest-rate swaps, which created a potential for abuse.

Dog Bites. If you have a dog that bites someone, your premiums will immediately increase. This is the single most common reason why homeowners file insurance claims – their dog bites someone, who then sues for damages.

Dog Bites. If you have a dog that bites someone, your premiums will immediately increase. This is the single most common reason why homeowners file insurance claims – their dog bites someone, who then sues for damages.

Because convenience goods carry a relatively low price, consumers usually don’t bother price-checking—they simply stick with the brand they have always bought. For that reason, pricing isn’t overly important as long as the company doesn’t raise prices to the point of being significantly different from competitors. If someone always purchased Crest toothpaste for their entire life, they will not bother checking Colgate’s price to see if they can save a few cents; it’s a habitual purchase. Wide-scale promotion is very important in order to build brand recognition. Typically for a quick, impulsive purchase consumers will choose a brand that they have heard of and are familiar with (Heinz ketchup, for example, holds over 60% market share in the US largely because of its iconic brand). Strategic placement is also frequently used in an attempt to sell convenience goods. A common example is when stores will place candy and other small items right next to the checkout line in hopes of stirring up impulse purchases.

Because convenience goods carry a relatively low price, consumers usually don’t bother price-checking—they simply stick with the brand they have always bought. For that reason, pricing isn’t overly important as long as the company doesn’t raise prices to the point of being significantly different from competitors. If someone always purchased Crest toothpaste for their entire life, they will not bother checking Colgate’s price to see if they can save a few cents; it’s a habitual purchase. Wide-scale promotion is very important in order to build brand recognition. Typically for a quick, impulsive purchase consumers will choose a brand that they have heard of and are familiar with (Heinz ketchup, for example, holds over 60% market share in the US largely because of its iconic brand). Strategic placement is also frequently used in an attempt to sell convenience goods. A common example is when stores will place candy and other small items right next to the checkout line in hopes of stirring up impulse purchases. Strategically, product quality and pricing are much more important for shopping goods than for convenience goods. With customers actively weighing their options, it is vital for a company to provide an offering with attractive value. This can mean selling a product that is better quality than competitors for the same price or selling a product that is similar in quality but at a lower price. The larger the purchase, the more important marketing the good becomes because customers will more actively consider the product’s price-value relationship. Promotion is also important for shopping goods in order to differentiate a product from its competitors and to communicate the value proposition to customers. Whereas promoting convenience goods simply focused on awareness, promoting shopping goods must focus on separating a product from its competition in the minds of customers.

Strategically, product quality and pricing are much more important for shopping goods than for convenience goods. With customers actively weighing their options, it is vital for a company to provide an offering with attractive value. This can mean selling a product that is better quality than competitors for the same price or selling a product that is similar in quality but at a lower price. The larger the purchase, the more important marketing the good becomes because customers will more actively consider the product’s price-value relationship. Promotion is also important for shopping goods in order to differentiate a product from its competitors and to communicate the value proposition to customers. Whereas promoting convenience goods simply focused on awareness, promoting shopping goods must focus on separating a product from its competition in the minds of customers. Typically, consumers of specialty goods do not have much price sensitivity—they are willing to pay whatever price is necessary for the product or brand that they prefer. Someone purchasing a Ferrari likely doesn’t care if a similar car is a few thousand dollars cheaper; they are paying for the brand name and the social status that comes with owning a Ferrari. Therefore, more of the company’s strategic focus needs to be centered on developing outstanding and innovational products that will retain the loyalty of their following. Promotion focuses on demonstrating the company’s latest great product and when/where people can buy it. It is also important to promote status that comes with the brand.

Typically, consumers of specialty goods do not have much price sensitivity—they are willing to pay whatever price is necessary for the product or brand that they prefer. Someone purchasing a Ferrari likely doesn’t care if a similar car is a few thousand dollars cheaper; they are paying for the brand name and the social status that comes with owning a Ferrari. Therefore, more of the company’s strategic focus needs to be centered on developing outstanding and innovational products that will retain the loyalty of their following. Promotion focuses on demonstrating the company’s latest great product and when/where people can buy it. It is also important to promote status that comes with the brand. The key to marketing unsought goods is to remind consumers that the product exists and to convince them that they need to purchase the product to avoid future hardships. For example, a company might run an emotional campaign focusing on how the potential customer’s loved ones will suffer financially if the customer dies unexpectedly. If successful, this would convince the buyer that purchasing a policy is a payment toward protecting their family and they would be compelled to go through with it in order to not have to worry about the potential danger. A lot of promotion is necessary, because consumers rarely think about buying such products unless they are prompted to.

The key to marketing unsought goods is to remind consumers that the product exists and to convince them that they need to purchase the product to avoid future hardships. For example, a company might run an emotional campaign focusing on how the potential customer’s loved ones will suffer financially if the customer dies unexpectedly. If successful, this would convince the buyer that purchasing a policy is a payment toward protecting their family and they would be compelled to go through with it in order to not have to worry about the potential danger. A lot of promotion is necessary, because consumers rarely think about buying such products unless they are prompted to. There are certain issues or uncertainties within the product classification model that need to be taken into consideration. One problem is that certain goods can potentially fall under multiple categories. For example, certain customers may see diamonds as a shopping good and compare prices extensively between brands before making a purchase. Other consumers may have chosen one brand as the best (ie Tiffany & Co.) and they buy that brand for the quality and status it brings. Sometimes product classification can vary depending on the individual customer that is buying the good.

There are certain issues or uncertainties within the product classification model that need to be taken into consideration. One problem is that certain goods can potentially fall under multiple categories. For example, certain customers may see diamonds as a shopping good and compare prices extensively between brands before making a purchase. Other consumers may have chosen one brand as the best (ie Tiffany & Co.) and they buy that brand for the quality and status it brings. Sometimes product classification can vary depending on the individual customer that is buying the good.

There are two ways to reduce your tax bill – a “Deduction” and a “Tax Credit”.

There are two ways to reduce your tax bill – a “Deduction” and a “Tax Credit”. To make it easier to file taxes, everyone has the option to choose between “Itemized Deductions” or “Standard Deduction”. If you file an “Itemized Deduction”, you need to provide evidence of each item you’re deducting (like receipts and proof it is eligible), which can be very time consuming for small deductions.

To make it easier to file taxes, everyone has the option to choose between “Itemized Deductions” or “Standard Deduction”. If you file an “Itemized Deduction”, you need to provide evidence of each item you’re deducting (like receipts and proof it is eligible), which can be very time consuming for small deductions.

The Federal Child Tax Credit gives a simple tax credit for $1000 per child, up to a certain income threshold (between $55,000 and $110,000, depending on your marital status). If you earn more than this threshold, you will have $50 less tax credit for every $1000 over the threshold (so a married couple earning $120,000 would have a $950 tax credit). This tax credit is non-refundable.

The Federal Child Tax Credit gives a simple tax credit for $1000 per child, up to a certain income threshold (between $55,000 and $110,000, depending on your marital status). If you earn more than this threshold, you will have $50 less tax credit for every $1000 over the threshold (so a married couple earning $120,000 would have a $950 tax credit). This tax credit is non-refundable.  While you cannot write off any costs incurred in a job search, if you need to move between cities when you get a job, you can usually write off part of the moving expense. This is a deduction, subtracted from your taxable income.

While you cannot write off any costs incurred in a job search, if you need to move between cities when you get a job, you can usually write off part of the moving expense. This is a deduction, subtracted from your taxable income.  If you have a mortgage, some or all of your interest will be tax-deductible. Not all mortgage interest is tax-deductible – you need to provide evidence that your mortgage was taken out to buy your primary residence, or used for extensive renovations, and only applies to interest paid on loans up to $1 million. If your mortgage does not qualify, you can still write off the interest on the first $100,000 of your loan.

If you have a mortgage, some or all of your interest will be tax-deductible. Not all mortgage interest is tax-deductible – you need to provide evidence that your mortgage was taken out to buy your primary residence, or used for extensive renovations, and only applies to interest paid on loans up to $1 million. If your mortgage does not qualify, you can still write off the interest on the first $100,000 of your loan.  The “Saver’s Credit” is another word for the Retirement Savings Contribution Credit – the purpose of this credit is to encourage saving in retirement accounts and IRAs. This credit is for up to $2000, and is calculated as a percentage of your contributions (either 50%, 20%, or 10%, depending on your income).

The “Saver’s Credit” is another word for the Retirement Savings Contribution Credit – the purpose of this credit is to encourage saving in retirement accounts and IRAs. This credit is for up to $2000, and is calculated as a percentage of your contributions (either 50%, 20%, or 10%, depending on your income).

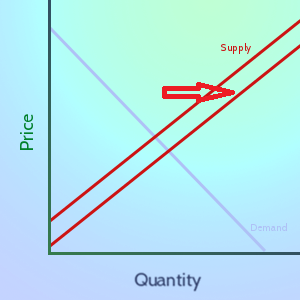

Supply and demand are among the most basic factors on market price for goods, and often an individual firm has little control over them. When there is an oversupply of a product in the market, assuming constant demand, the price of the good will decrease as firms attempt to unload their excess of inventory. Companies that refuse to lower price during a period of oversupply can be punished with huge drops in sales and a buildup of inventory they can’t get rid of. Oil is a prime example of an industry that is currently in oversupply—increased production has led to prices falling from well over $100/barrel down to around $50/barrel today.

Supply and demand are among the most basic factors on market price for goods, and often an individual firm has little control over them. When there is an oversupply of a product in the market, assuming constant demand, the price of the good will decrease as firms attempt to unload their excess of inventory. Companies that refuse to lower price during a period of oversupply can be punished with huge drops in sales and a buildup of inventory they can’t get rid of. Oil is a prime example of an industry that is currently in oversupply—increased production has led to prices falling from well over $100/barrel down to around $50/barrel today. Line pricing is when a company offers products at several different levels of quality (typically low, medium, and high). Pricing is set to reflect the relative quality of each offering, so the low-quality product would be at a discount price, the medium product would be at an average price, and the high-quality product would be at a premium price. The iPad is an example of this strategy—customers have the choice of buying a very basic model or they can pay several hundred dollars more to get one with higher quality and better features. As its name indicates, the line strategy is effective when a firm has a product line with several items that have a distinct difference in quality level. Segmented pricing can help clarify to consumers the added value that buying a better model entails and it provides customers some flexibility on deciding how much they want to spend.

Line pricing is when a company offers products at several different levels of quality (typically low, medium, and high). Pricing is set to reflect the relative quality of each offering, so the low-quality product would be at a discount price, the medium product would be at an average price, and the high-quality product would be at a premium price. The iPad is an example of this strategy—customers have the choice of buying a very basic model or they can pay several hundred dollars more to get one with higher quality and better features. As its name indicates, the line strategy is effective when a firm has a product line with several items that have a distinct difference in quality level. Segmented pricing can help clarify to consumers the added value that buying a better model entails and it provides customers some flexibility on deciding how much they want to spend. The loss leader strategy involves a company selling certain items at a loss in order to bring customers into the store. The assumption is that once customers are tempted into the store, they will have a tendency to buy other things as well that will generate the profit for the company. One very basic example of this are restaurants that sell kids’ meals for very cheap (even for free sometimes). The restaurant loses money on the kids’ meal, but makes their profit when the adults accompanying the children have to order full-price meals. This can be an effective strategy to generate store traffic, but firms must be careful to make sure that customers actually are buying products besides just the loss leaders.

The loss leader strategy involves a company selling certain items at a loss in order to bring customers into the store. The assumption is that once customers are tempted into the store, they will have a tendency to buy other things as well that will generate the profit for the company. One very basic example of this are restaurants that sell kids’ meals for very cheap (even for free sometimes). The restaurant loses money on the kids’ meal, but makes their profit when the adults accompanying the children have to order full-price meals. This can be an effective strategy to generate store traffic, but firms must be careful to make sure that customers actually are buying products besides just the loss leaders. Psychological pricing is an approach where prices are set based upon a psychological reaction that they will cause consumers. The ultimate goal of this tactic is to increase sales without significantly reducing prices. The most common example of this is when retailers price items one penny below an even dollar amount, $9.99 instead of $10 for example. Customers associate the $9.99 with the lower dollar amount of $9 rather than actively realizing that it is just one cent below $10. The massive usage of that tactic alone illustrates the success psychological pricing can have. It can be effective both for relatively low cost goods like gasoline or for big purchases like cars– $19,999.99 for some reason just seems a lot cheaper than $20,000.

Psychological pricing is an approach where prices are set based upon a psychological reaction that they will cause consumers. The ultimate goal of this tactic is to increase sales without significantly reducing prices. The most common example of this is when retailers price items one penny below an even dollar amount, $9.99 instead of $10 for example. Customers associate the $9.99 with the lower dollar amount of $9 rather than actively realizing that it is just one cent below $10. The massive usage of that tactic alone illustrates the success psychological pricing can have. It can be effective both for relatively low cost goods like gasoline or for big purchases like cars– $19,999.99 for some reason just seems a lot cheaper than $20,000. Technology has led to a very different environment for pricing than has been the norm in the past. With an increased ability to quickly “price-check” online, customers have become more sensitive to prices and it is more important to either be priced below competitors or to clearly communicate the brand’s superiority to consumers. It is also easier for customers to switch brands in that they can shop online and avoid having to travel to multiple stores to find the best deal. In these ways, additional power has shifted to the consumer in determining the way prices are set.

Technology has led to a very different environment for pricing than has been the norm in the past. With an increased ability to quickly “price-check” online, customers have become more sensitive to prices and it is more important to either be priced below competitors or to clearly communicate the brand’s superiority to consumers. It is also easier for customers to switch brands in that they can shop online and avoid having to travel to multiple stores to find the best deal. In these ways, additional power has shifted to the consumer in determining the way prices are set.

Revenue represents income earned by the firm through the primary goods and/or services provided. It is the income earned from the firm’s operating activities. For example, Mike’s Computers specializes in selling computers to small businesses. During the year, he sells 10,000 computers at $800, and nothing else. The total sales from the computers sold during the year, $8,000,000, would be Mike’s revenue.

Revenue represents income earned by the firm through the primary goods and/or services provided. It is the income earned from the firm’s operating activities. For example, Mike’s Computers specializes in selling computers to small businesses. During the year, he sells 10,000 computers at $800, and nothing else. The total sales from the computers sold during the year, $8,000,000, would be Mike’s revenue. Expenses can either be capitalized or expensed. Capitalization effectively means the cost of an assets can spread out over the life of an asset. A machine, for example, may be capitalized rather than expensed because the asset has a long useful life.

Expenses can either be capitalized or expensed. Capitalization effectively means the cost of an assets can spread out over the life of an asset. A machine, for example, may be capitalized rather than expensed because the asset has a long useful life. Losses are similar to gains in that both are recognized on the income statement only when an asset is sold and a loss is taken. Like gains, there can also be unrealized losses.

Losses are similar to gains in that both are recognized on the income statement only when an asset is sold and a loss is taken. Like gains, there can also be unrealized losses.

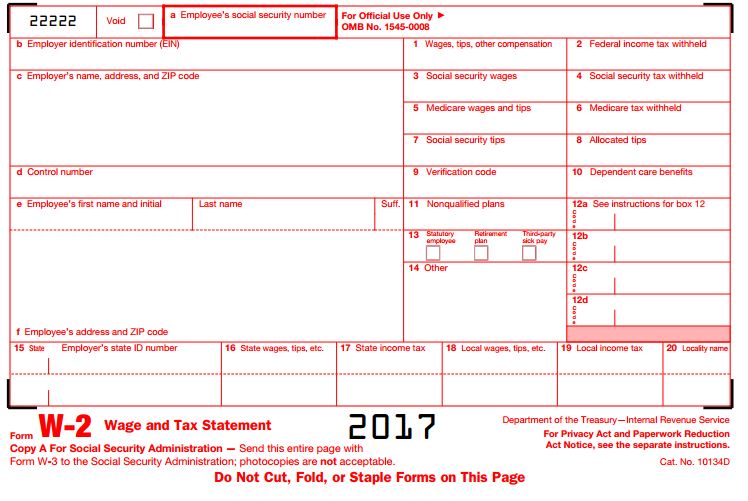

Income tax is the tax you pay on your income, usually directly taken out of your paycheck. Everyone who works in the United States should be paying income tax on their earnings.

Income tax is the tax you pay on your income, usually directly taken out of your paycheck. Everyone who works in the United States should be paying income tax on their earnings. The

The  The basic income tax return form in the United States is known as the

The basic income tax return form in the United States is known as the  The IRS may also apply corrections directly based on their own calculations of your taxes owed. If this is the case, they will generally mail you a letter explaining how their calculation differs from theirs, along with a method to dispute their calculation.

The IRS may also apply corrections directly based on their own calculations of your taxes owed. If this is the case, they will generally mail you a letter explaining how their calculation differs from theirs, along with a method to dispute their calculation.

The purpose of the Financial Accounting Standards Board (FASB) is to establish and improve US GAAP. There are also auditing standards, enforced by the Public Company Accounting Oversight Board (PCAOB), and required by the SEC. The purpose of the PCAOB is to protect the public interest in the preparation of audit reports. The FASB and PCAOB are responsible for the oversight of all United States accounting. Internationally, the IFRS Foundation and the International Accounting Standards Board (IASB) oversee international accounting.

The purpose of the Financial Accounting Standards Board (FASB) is to establish and improve US GAAP. There are also auditing standards, enforced by the Public Company Accounting Oversight Board (PCAOB), and required by the SEC. The purpose of the PCAOB is to protect the public interest in the preparation of audit reports. The FASB and PCAOB are responsible for the oversight of all United States accounting. Internationally, the IFRS Foundation and the International Accounting Standards Board (IASB) oversee international accounting. To remedy this, the Sarbanes-Oxley Act of 2002 (SOX) was passed by U.S. Congress in 2002. The SOX Act is a United States federal law that introduced major change to the regulation of financial disclosures and corporate governance. The SOX Act has closed loopholes in accounting practices and increased the consequences for fraudulent activity. The accounting profession is constantly changing and must adapt effectively and efficiently to meet the demands of the economy and society. Developments in the accounting profession, economy, and society affect the profession and how it performs its role. The SOX Act is one example of how a new regulation forced the profession to adapt to change.

To remedy this, the Sarbanes-Oxley Act of 2002 (SOX) was passed by U.S. Congress in 2002. The SOX Act is a United States federal law that introduced major change to the regulation of financial disclosures and corporate governance. The SOX Act has closed loopholes in accounting practices and increased the consequences for fraudulent activity. The accounting profession is constantly changing and must adapt effectively and efficiently to meet the demands of the economy and society. Developments in the accounting profession, economy, and society affect the profession and how it performs its role. The SOX Act is one example of how a new regulation forced the profession to adapt to change. Accountants regularly face ethical dilemmas. Accountants seek to add value by reducing costs and increasing revenue. An accountant wants to produce favorable results for their company or client. Accountants must also have the public best interest in mind. Therefore, information must be represented fairly and accurately to be ethical.

Accountants regularly face ethical dilemmas. Accountants seek to add value by reducing costs and increasing revenue. An accountant wants to produce favorable results for their company or client. Accountants must also have the public best interest in mind. Therefore, information must be represented fairly and accurately to be ethical.

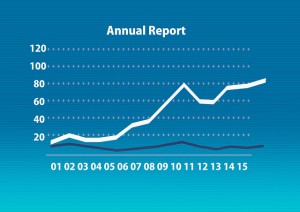

The introduction stage marks the very first time a company brings a product to market. The main objective for companies at the beginning is not profit (often new products will generate losses because of high advertising costs and low sales) but rather developing a market for the product and building awareness among consumers. If successful, the company can then enjoy a better ROI in future stages as sales grow and relative costs lessen. An example of a product in the introduction stage could be when Amazon first rolled out their

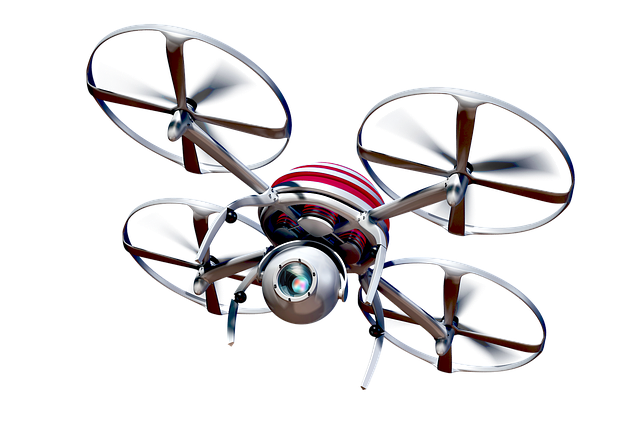

The introduction stage marks the very first time a company brings a product to market. The main objective for companies at the beginning is not profit (often new products will generate losses because of high advertising costs and low sales) but rather developing a market for the product and building awareness among consumers. If successful, the company can then enjoy a better ROI in future stages as sales grow and relative costs lessen. An example of a product in the introduction stage could be when Amazon first rolled out their  If products make it through the introduction stage, they next advance to the growth period. This is when demand starts to take off for a product as companies promote to a wider audience in an attempt to build consumer preference over other brands and win market share. Because of increasing demand, companies are often able to start to make sizable profits in this stage. An example of a growth-stage product in today’s market could be drones; though they are a fairly new product, the market has been established and demand is rapidly growing.

If products make it through the introduction stage, they next advance to the growth period. This is when demand starts to take off for a product as companies promote to a wider audience in an attempt to build consumer preference over other brands and win market share. Because of increasing demand, companies are often able to start to make sizable profits in this stage. An example of a growth-stage product in today’s market could be drones; though they are a fairly new product, the market has been established and demand is rapidly growing. At some point, growth inevitably slows down and products reach the maturity stage. The top focus for managers at this point is protecting the market share they have earned, because the maturity stage is often the phase of the product life cycle with the most competition. Another key objective is to maximize profits—products in this phase of their life often turn into “cash cows” for companies that generate the funds necessary for developing new products. Apple’s (

At some point, growth inevitably slows down and products reach the maturity stage. The top focus for managers at this point is protecting the market share they have earned, because the maturity stage is often the phase of the product life cycle with the most competition. Another key objective is to maximize profits—products in this phase of their life often turn into “cash cows” for companies that generate the funds necessary for developing new products. Apple’s ( In the final stage of a product’s life, demand starts to decline as consumers move on to newer and more appealing products. Traditional telephones are an example of a product in this stage—with the emergence of cell phones, fewer and fewer people are using landlines and the market seems to be on its last legs.

In the final stage of a product’s life, demand starts to decline as consumers move on to newer and more appealing products. Traditional telephones are an example of a product in this stage—with the emergence of cell phones, fewer and fewer people are using landlines and the market seems to be on its last legs. While the product life cycle model is useful in many ways, it does have some issues. For one, there are products that do not seem to fit into the model. Brands like Coke (

While the product life cycle model is useful in many ways, it does have some issues. For one, there are products that do not seem to fit into the model. Brands like Coke (

What exactly is management? Is there only one way to manage? Management is the organization and coordination of the activities within a business to meet specific goals. Management creates policy and organizes, plans, controls, and directs a company’s resources to complete the objectives of that policy. Do all managers manage the same way? Do they all follow the same guidelines to meet their goals? As a matter of fact, management can be done in a number of different ways to achieve different goals within a business. The different ways managers define guidelines, set goals, and organize the company is collectively known as “Management Theories“, while the ideas behind ways managers interact with associates and lower-level managers are known as “Motivational Theories“. Some of the most prevalent management theories were first formulated by by Frederick Taylor, Max Weber and Henri Fayol, while some of the most potent motivational theories were formulated by Abraham Maslow, and Frederick Herzberg.

What exactly is management? Is there only one way to manage? Management is the organization and coordination of the activities within a business to meet specific goals. Management creates policy and organizes, plans, controls, and directs a company’s resources to complete the objectives of that policy. Do all managers manage the same way? Do they all follow the same guidelines to meet their goals? As a matter of fact, management can be done in a number of different ways to achieve different goals within a business. The different ways managers define guidelines, set goals, and organize the company is collectively known as “Management Theories“, while the ideas behind ways managers interact with associates and lower-level managers are known as “Motivational Theories“. Some of the most prevalent management theories were first formulated by by Frederick Taylor, Max Weber and Henri Fayol, while some of the most potent motivational theories were formulated by Abraham Maslow, and Frederick Herzberg. Max Weber had a bureaucratic management theory built on principles of Frederick Taylor Weber focused on making a system based on standardized procedures and a clear chain of command. The chain of command is top-down management where employees answer to their department managers, who answer to their managers who then answer to the CEO in a pyramid structure. Weber stressed efficiency and while he focused on a bureaucratic way of doing things, he stressed the dangers that a true bureaucracy could face. Max Weber feared that a company would hire someone who will not be qualified for the job, so he stressed that employees only be hired if they possess the skill set of the job. While this may seem obvious, the reason this is important is because Weber’s management theory puts in place to make sure the employees being hired are competent, or can be weeded out of the company. Through this management theory, there had been development for current management theories: Job roles, authority hierarchy, strict record keeping, standardized procedures and hiring employees if their skills match those that are needed in the job.

Max Weber had a bureaucratic management theory built on principles of Frederick Taylor Weber focused on making a system based on standardized procedures and a clear chain of command. The chain of command is top-down management where employees answer to their department managers, who answer to their managers who then answer to the CEO in a pyramid structure. Weber stressed efficiency and while he focused on a bureaucratic way of doing things, he stressed the dangers that a true bureaucracy could face. Max Weber feared that a company would hire someone who will not be qualified for the job, so he stressed that employees only be hired if they possess the skill set of the job. While this may seem obvious, the reason this is important is because Weber’s management theory puts in place to make sure the employees being hired are competent, or can be weeded out of the company. Through this management theory, there had been development for current management theories: Job roles, authority hierarchy, strict record keeping, standardized procedures and hiring employees if their skills match those that are needed in the job. A democratic style of management allows management and its staff to have significant responsibility. This is also sometimes called “Lateral Management”, or “Flat” organizations, since it is defined by fewer levels of middle management between associates and the top management. It gives employees a chance to have a voice and it is often combined with participatory leadership by collaborating between leaders and the people they guide. The democratic style splits responsibility between staff.

A democratic style of management allows management and its staff to have significant responsibility. This is also sometimes called “Lateral Management”, or “Flat” organizations, since it is defined by fewer levels of middle management between associates and the top management. It gives employees a chance to have a voice and it is often combined with participatory leadership by collaborating between leaders and the people they guide. The democratic style splits responsibility between staff. Company policies – Company policies that seem arbitrary or “in the way” are a major cause of dissatisfaction

Company policies – Company policies that seem arbitrary or “in the way” are a major cause of dissatisfaction

Every firm needs capital to purchase assets like inventory, land, and equipment. They also need cash to help manage expenses such as paying employees. How do companies raise the money they need to run their businesses? The answer is through a mix of liabilities (borrowing money) and equity (selling shares of ownership of the company). Liabilities and equity make up the right-hand side of the fundamental accounting equation:

Every firm needs capital to purchase assets like inventory, land, and equipment. They also need cash to help manage expenses such as paying employees. How do companies raise the money they need to run their businesses? The answer is through a mix of liabilities (borrowing money) and equity (selling shares of ownership of the company). Liabilities and equity make up the right-hand side of the fundamental accounting equation:

The purpose of a marketing plan is to create an outline for a company’s marketing efforts, usually over the span of a year. The marketing plan should outline a series of short-term marketing targets, aligned with a long-term marketing strategy. Ultimately, the purpose of marketing plans is making progress towards reaching and capturing the desired customer base and improving both the top and bottom line of financial statements. These plans should not be static – it is meant to be revised on an annual basis so as to remain flexible and avoid becoming irrelevant.

The purpose of a marketing plan is to create an outline for a company’s marketing efforts, usually over the span of a year. The marketing plan should outline a series of short-term marketing targets, aligned with a long-term marketing strategy. Ultimately, the purpose of marketing plans is making progress towards reaching and capturing the desired customer base and improving both the top and bottom line of financial statements. These plans should not be static – it is meant to be revised on an annual basis so as to remain flexible and avoid becoming irrelevant. 1. Market Research: Research helps to identify the current situation in the marketplace that ultimately points towards opportunities and threats organizations should be aware of as they strive to move forward.

1. Market Research: Research helps to identify the current situation in the marketplace that ultimately points towards opportunities and threats organizations should be aware of as they strive to move forward. 1. Situational Analysis: In this section of a marketing plan, the market research is discussed at length to get an in depth understanding of the marketplace. Reviews of the external environment, internal operations, product category and competition are all discussed in this section.