Texas A&M University-Kingsville

College of Business Administration

Fall 2016 Course Syllabus

Investments

FIN 4331

COURSE INFORMATION

Credit hours: 3

Prerequisites: Business Finance (FINC 2331)

Web-Orientation (and explanation): Face-to-face course, with grade book and various resources online

Location/Times: BUSA 104 / 12:00 – 12:50 p.m. M/W/F

COURSE INSTRUCTOR

Thomas (Tom) Krueger

Professor of Finance, Chair of Accounting and Finance Department, and

J.R. Manning Endowed Professor of Innovation in Business Education

Office room: BUSA #200

Campus Office Hours: Monday, Wednesday 9:00 a.m. – 11:30 p.m. 1-4 p.m.

Online Office Hours: Monday 4:00 p.m. – 6:00 p.m.

Office phone #: 361-593-3787

Cell phone #: 361-230-9117 (preferred)

E-mail address: Thomas.krueger@tamuk.edu

CBA MISSION STATEMENT

The College of Business Administration is a school of opportunity providing an accessible, quality business education that empowers both working and full-time students of all ages and diverse backgrounds, transforming their lives. To accomplish this mission, we provide a comprehensive business education to emerging leaders of the region, the state of Texas, national, and international communities.

CBA VISION STATEMENT

The Texas A&M University-Kingsville College of Business Administration will be recognized for:

- High quality teaching programs that produce graduates who are valued by employers and citizens who positively impact society.

- Engagement of stakeholders through professional and community service.

- Excellence in business and pedagogical research advancing academics, extending business knowledge, and contributing to practice.

BBA LEARNING GOALS

- Goal 1: CBA Graduates will communicate effectively in a business context.

Objective 1: Students will write professional business materials.

Objective 2: Students will deliver professional oral presentations.

Objective 3: Students will demonstrate interpersonal and communication skills in a team setting.

- Goal 2: CBA Graduates will possess critical thinking and problem solving skills.

Objective 1: Students will use appropriate analytical techniques to identify a business problem.

Objective 2: Students will formulate alternative solutions.

Objective 3: Students will evaluate options and their implications.

- Goal 3: CBA Graduates will demonstrate ethical, sustainable, cultural, and global consciousness.

Objective 1: Students will recognize, analyze, and defend a solution to ethical problems.

Objective 2: Students will define key components of sustainable, cultural, and global issues in a business context.

- Goal 4: CBA Graduates will competently utilize business technologies.

Objective 1: Students will identify appropriate technology to apply in a business context.

Objective 2: Students will utilize electronic spreadsheets to analyze and present business data.

- Goal 5: CBA Graduates will exhibit knowledge of fundamental business concepts.

Objective 1: Students will demonstrate business specific skills and competencies in Accounting, Economics, Management, Quantitative Analysis, Finance, Marketing, Legal and Social Environments, Sustainability, Information Systems and Global Issues.

COURSE DESCRIPTION

Analysis and evaluation of the decision-making process in investments. Asset valuation, portfolio management and performance evaluation. Theoretical and analytical developments in security selection and portfolio management. Risk measurement and risk reduction through portfolio construction. Analysis of derivative securities, including options and future contracts. Student-directed simulated portfolio management.

This class deals primarily with BBA program goal #1, #2, #5.

Effective portfolio management does not guarantee positive returns or even a minimal level in return. From 1975 through 2014, the Dow Jones Industrial Average grew at a 8.8% effective annual rate, from 616 to 17,823. However, during the 40 year period, there were 10 years in which the DJIA declined including the 33.84 percent drop in 2008. As we go forward into fall of 2016, the U.S. presidential election, impact of BREXIT, chance of continued interest rate adjustments by the Federal Reserve, and prospect for additional instances of terrorism will be weighing heavily on the market. In this environment, students in this course will discover the logic and potential of modern portfolio management. Though containing some mathematics, the course attempts to be “user friendly,” through an applications orientation.

TEXTBOOK INFORMATION

NEW TEXTBOOK à Fundamentals of Investing, 13th Edition, By Smart, Gitman and Joehnk (978-0-13-408330-8). The instructor will supplement this text with current examples from the financial press.

Wall Street Journal, USA Today, Business Week, Fortune, or any other financial press publication will provide you with additional information of value when forming portfolios and bring more realism into the classroom. These publications are available at greatly reduced rates.

STUDENT LEARNING OBJECTIVES (for the course)

Upon successful completion of this course, students should be able to:

- Set portfolio objectives (Initial Stock-Trak simulation report)

- Compute returns from a variety of investments (Exam 1)

- Price equities with varying growth rates (Exam 2)

- Price bonds and compute returns from them (Exam 3)

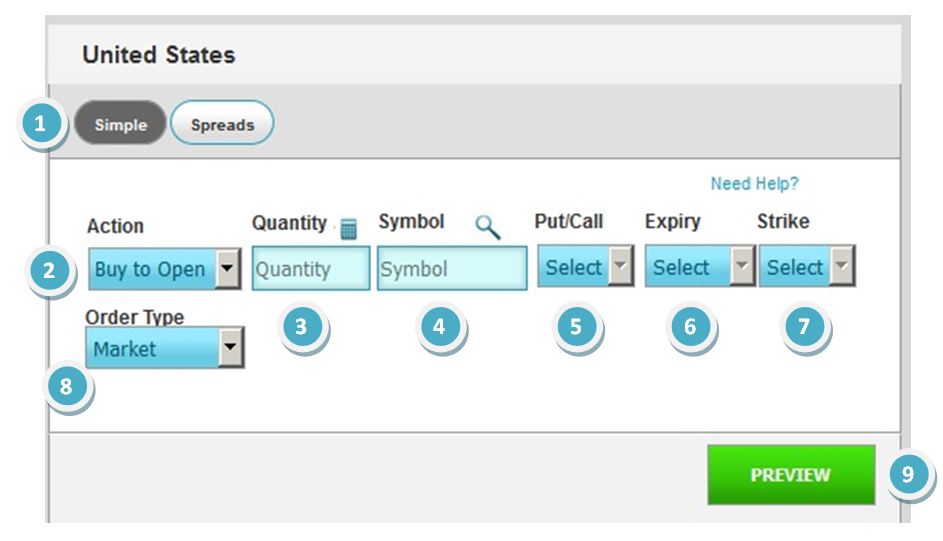

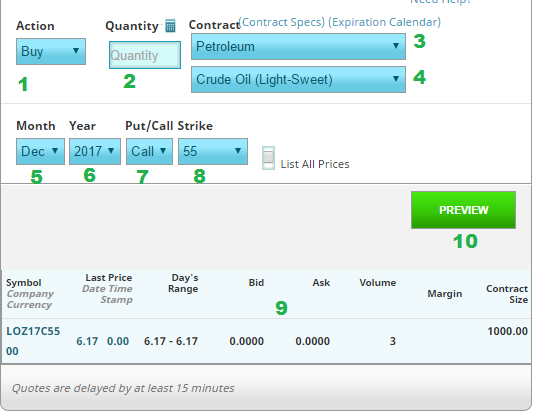

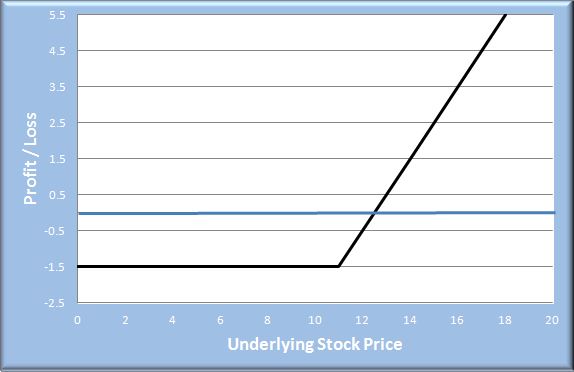

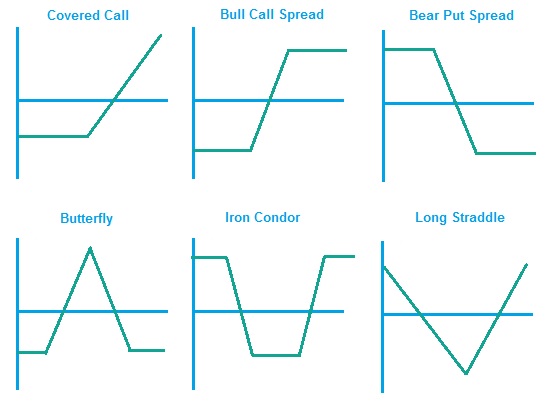

- Describe the use of options and futures contracts (Exam 4)

- Present accurate verbal & written reports regarding key current financial conditions (Market conditions reports)

- Accurately describe the performance of their portfolio of securities (Final report)

More than any other CBA course, FINANCE 380 is designed with the individual in mind and helps them learn how to manage their personal portfolio in a dynamic world. In this course we analyze a variety of investments individually and study how they can be utilized in unison to reach investor’s goals of security and wealth. This course may not enable you to make a million, but it will help you make the most of your available financial resources.

Every semester brings in new faces and challenges. Investing is difficult in normal times, as you forego consumption today for an unknown future benefit. However, this fall maybe anything but normal. Undoubtedly, the biggest macro event is the Presidential election. The November choice will impact investments over at least the next four years and have implications for health care reform, immigration, and taxation. In addition, we have continued fighting in the Middle East and terrorism around the world. Markets dropped significantly with the unexpected BREXIT vote in June. Nonetheless, by July, the U.S. stock market indexes were hitting new highs.

On a more micro level, on a daily basis, investors vote with their dollars. Do they currently have more confidence in the computer, energy, or housing industry? Perhaps they will trade stocks for more secure bonds or give up these investments all together for the security of the money market. It is a gamble; and unlike Texas Hold’em, there are no definite odds of a given position being a winner

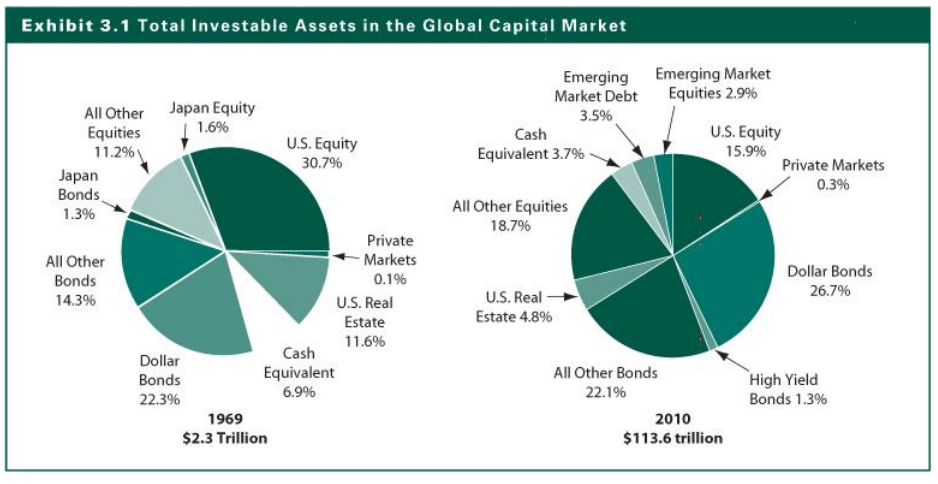

Investment principles will be presented in three stages. First, we will discuss market operations, investment information, and the measurement of return and risk. As soon as it is feasible we will begin the STOCK-TRAK simulation. Second, fundamental security analysis methods, including several valuation models, will be presented in relationship to stocks and bonds. Third, we will investigate a variety of other popular investments, including mutual funds, options, and futures.

Primary Course Goal:

Upon completion of this course, students will be able to approach the investment process from an informed, objective, and hopefully financially rewarding standpoint. To reach this goal, students will be exposed to investment-related lectures, a variety of projects, and management of a simulated portfolio. This course is designed to meet four of the CBA Learning Goals

Goal 1) effective communication skills,

Goal 2) problem solving ability, and

Goal 5) understand fundamental business concepts.

Related Course Objectives:

Upon passing this course the student will be able to:

- Understand the investment environment–risk, return, taxes, brokers.

- Analyze a variety of investments–stocks, bonds, mutual funds, options, and futures contracts

- Manage a portfolio of investments, which may include stocks, bonds, mutual funds, options, and

futures contracts.

- Access data from a variety of financial databanks

- Be able to obtain, synthesis, and report information about the investment environment.

COURSE STRUCTURE

Reading Assignments:

Students are expected to have read the chapter to be discussed in class beforehand. The attached calendar contains a tentative schedule of lectures, projects, and examinations.

Examinations:

Four examinations will be given during the semester. Questions will be of the true‑false, multiple choice, problem, and case solution variety. Tests cover lecture and text materials. Review questions, listed on the schedule, will assist in preparation. Exams will be worth an average of 50 points. The best exam will be up-weighted to a point total of 75 points in determination of the final grade, while your worst exam will be down-weighted to 25 points or one-third your best exam. For instance, if your scores are 48, 44, 41, and 26, instead of earning 159 points, you will earn 172.5 points as shown below, a gain of 5.825%!

Best exam 48 * 1.5 = 72.0 points

Middle exams: 44 + 39 = 85.0 points

Worst exam: 26 * 0.5 = 13.0 points

Total = 170.0 points

FORMULA Card: Because I am much more interested in your ability to apply appropriate problem solving methods and interpret results than I am in your ability to memorize formulas, you can prepare a formula sheet for each exam. Specifically:

- You may use one side of one-half of a 8 ½” x 11” sheet of paper.

- The formula card can only contain formulas. Problems or other narrative is forbidden.

Violation of this rule constitutes academic dishonesty and

will automatically result in a grade of F for the course.

Course Projects:

In order to give you some “hands‑on” experience the three following projects are being assigned.

Market Conditions Presentations:

Every week will include a discussion of activity in the capital markets during the prior week. Everyone is expected to monitor the markets by reading The Wall Street Journal. There will also formal monitors each week. Monitors will be expected to present a 10-minute report on Wednesday covering the prior week. Financial statistics will be as of Friday’s closing bell. A two or three page report is to be typewritten and stapled, with sufficient copies for all classmates. The reporters are to underline the three most important pieces of information included on their report. Items, identified by the presenters are valid questions for subsequent exams.

In this way we will be developing a “Market Conditions Weekly.” A sign-up sheet will be distributed early in the semester. You are to sign up once. The report will be worth up to five points (1 for each of the following sections). A report earning full credit will include:

- Current Financial Statistics

- Primary Events/Conditions to Watch

This segment covers macroeconomic conditions and markets, not specific issues

- Domestic story at large

- Foreign story at large

- Portfolio Strategies in the News (“Hot” investments – not specific companies)

- Our Choice

Identify one of your investments (or, early in the course, your intended investments), why it was chosen, and its recent performance. This portion of the market conditions report facilities student sharing about investment options.

Internet Sites Investment Research Project:

There has been an explosion in the number of sources from which one can access financial information. Predominant in this group are the Internet sites, with their ability to update information instantaneously and continually. Access to some sites is free, while other sites charge a membership fee. This project is designed to help you become more aware of the broad array of information that is now available to you. There will be a 15-point, take-home quiz requiring access to a variety of web sites. The Internet Sites project is due September 23.

Securities Markets Simulation:

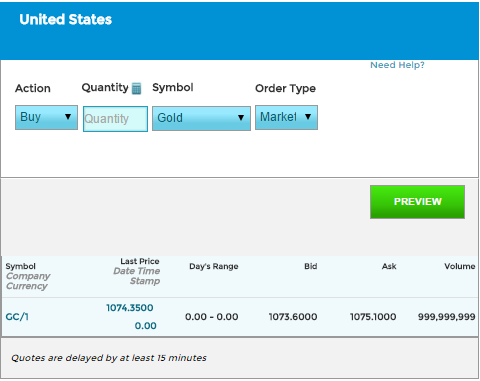

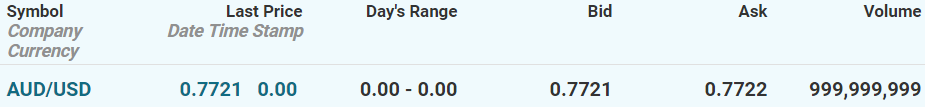

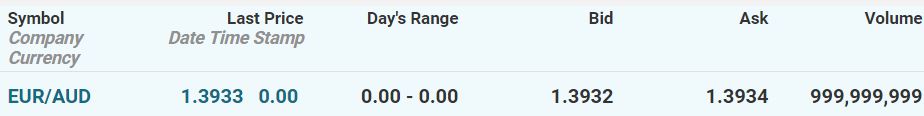

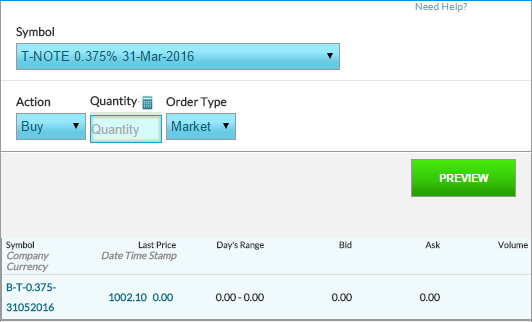

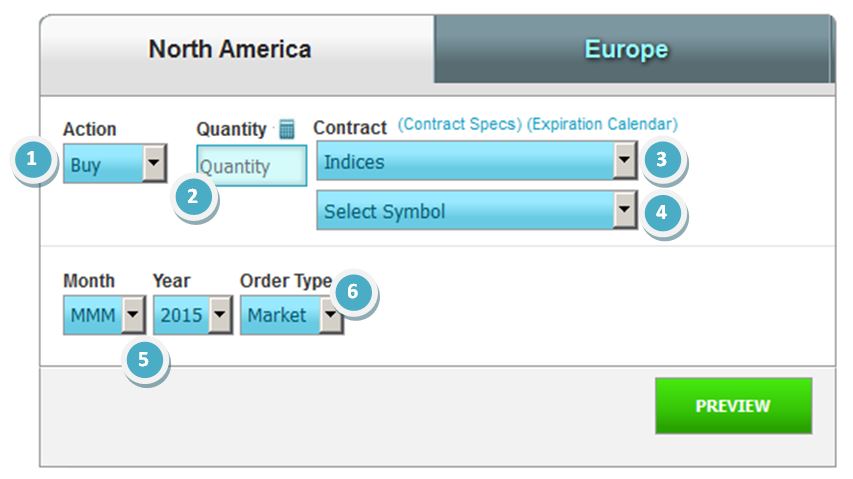

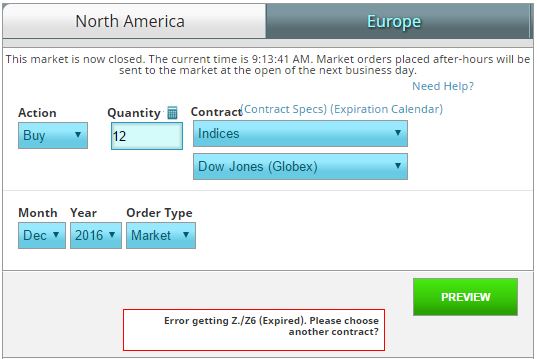

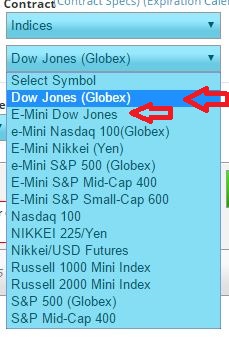

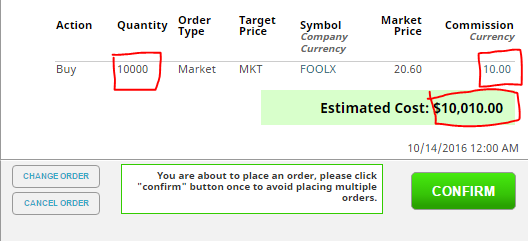

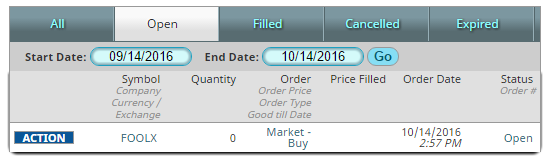

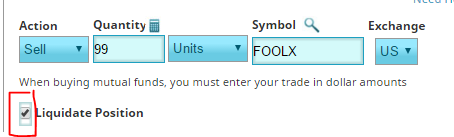

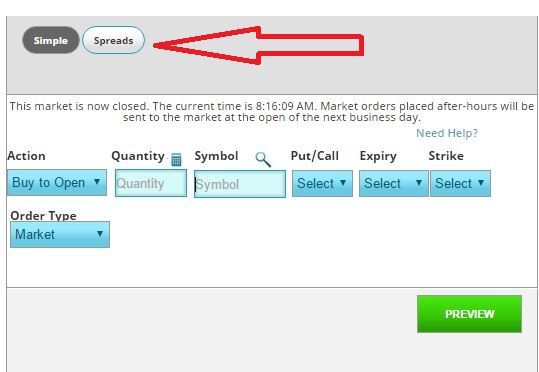

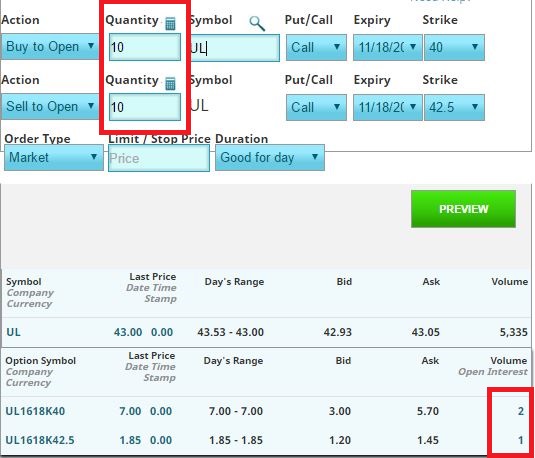

Students will be assigned to groups of two during the second week of class. Each team will participate in a portfolio simulation managed by STOCK-TRAK, INC. The basic objective of this exercise is to provide you with an introduction to the realities of our capital market system and how they behave (or misbehave); at the same time, it’s hoped that you will learn something about the trading side of several key financial instruments.

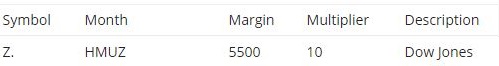

The simulation will run over a ten-week interval. There is a $24.95 dollar charge per account, or about eight dollars per student on a three-person team. In return, STOCK-TRAK participants can access their account 24 hours a day at http:/www.stocktrak.com. On this page you can review account activity, enter trades, and view the Professor Summary (a listing of investor positions), and a link to a wide range of financial information found on the Internet. Each team will be given an opening position of $500,000, which they are to use in the purchasing of a wide variety of investments. Other important characteristics of the simulation include:

Start of Simulation: September 12 (Near completion of the “Preparing to Invest” Section)

End of Simulation: November 18 (a 10-week experience)

Number of Transactions: 100

Transactions options: Long (purchase before sale) & Short (sale before purchase) if price > 25¢

Cash & Margin (buying shares with borrowed $)

Position limit 25% in any one asset

Day Trading Permitted

Quote timing: Real time quotes

Teams will be required to deliver three reports during the semester. The first report, the Preliminary Report, will be turned in near the time that you make your first market order. This report requires an explanation of your investment strategy. The preliminary report will include information on the team’s investment scheme (i.e., active/passive, bond/stock, high/low risk, special sectors, and special economic/political conditions). The process of completing the preliminary report assists team members in planning their strategy. The Preliminary report is due in September 23.

Next, there will be a Mid-term report, consisting of fundamental, technical, and comparative analysis. The follow-up report will give you an opportunity to re-evaluate your performance relative to your goals and the markets’ performance to that point in time. The Mid-term report is due October 21.

After the simulation concludes, you are required to present a final report, including suggestions for future investments. The final report, turned in on the last day of class (November 30), should include:

- discussion of the portfolio’s success or lack thereof, including market‑excess and risk-adjusted returns;

- perceived timing and selection strengths or weaknesses, and

- proposed short-term (6 months) and long-term strategy (5 years).

The Preliminary and Mid-term reports are to be up to four pages in length, with one page consisting of a form which will be distributed by the instructor. The Final report is to be up to five pages in length. A grading sheet will be distributed; giving you a clear understanding of what is required in the final report, which you are to bring to the final class. You will gather more information about your investments and have more information about your portfolio as the simulation progresses, hence the points you can earn on these three reports increases from 30 to 25 to 40 points, from Report 1 through Report 3.

Investment!: In order to reward performance, everyone is expected to contribute $2.00 to a “kitty.” At the close of the simulation, this money will be distributed as follows:

Top Quintile ‑ $ 4.00 a 100% return!!!!

Second Quintile ‑ $ 3.00

Third Quintile ‑ $ 2.00

Fourth Quintile ‑ $ 1.00

Stock Portfolio Project

After you leave TAMUK, you will be on your own in the investment world. Normally, investors limit themselves to stocks and bonds, with most of the volatility and unexpected performance coming from the stock end of the portfolio. Hence, this project is an opportunity to use resources outside Stock-Trak to invest.

In the stock portfolio project, you will be examining the performance of ten stocks. These may, or may not be in your Stock-Trak portfolio. This is purely a buy-and-hold investment of $100,000 in aggregate. On November 11, you will examine how this portfolio performed in terms of both return, risk, and risk-adjusted return. You can earn 50 points for completion of this project.

Class Participation:

In order to earn participation points students must:

a.) be in class at the beginning of each session

b.) have their textbook, calculator, notebook

c.) have worked through assigned problems ahead of class periods in which problems are covered.

For each absence above three, there will be a one-point deduction per class period. Those with three or fewer unexcused absences will earn 10 bonus points for class participation. In order to participate, you must have your learning aids (textbook calculator) and be prepared. If you do not have your textbook and calculator after the second week (with limited exceptions) or have not made an attempt to solve relevant problems, you will not earn class participation points.

GRADING

Course points may be earned through the following activities, which are described below:

Points Possible % of Final Grade

Class Participation 10 3%

Examinations Score x weight x number

Best exam (1) 50 x 1.5 x 1 75

Middle exams (2) 50 x 1 x 2 100

Worst exam (1) 50 x 0.5 x 1 25 200 50%

Internet Sites Report 15 4%

Market Conditions Reports (2 at 10 points each) 20 5%

Stock-Trak Simulation

Initial Report 30

Mid-simulation Report 25

Final Report 40

Stock Portfolio Project 50 155 39%

Total 400 100%

Minimum final grades will be awarded according to the following schedule:

Total Course Points Course Grade

Equal or greater than 360 (90%) A

Equal or greater than 320 (80%) B

Equal or greater than 280 (70%) C

Equal or greater than 240 (60%) D

Less than 240 F

COURSE POLICIES

Cell phone Use: Texting during class will not be tolerated and will result in the loss of class participation points.

Late Assignments: Assignments not turned in on the day of the assignment will lose 50% of their possible point value per day late.

Original work and re-use of work: All work must be original. You cannot use assignments completed for other courses.

Food: All food is expected to be eaten prior to class and impinges on class participation (including points).

Avoid and Prevent Plagiarism: Plagiarism is strictly prohibited.

COLLEGE OF BUSINESS ADMINISTRATION POLICIES

Textbook Policy: Students are REQUIRED to obtain the course textbook, or textbooks, within two weeks of the first class meeting. Students receive free access to an electronic version of the book for two weeks at www.coursesmart.com). Beginning in the third week, students may not attend class without the required textbook.

If there are financial reasons that prevent a student from having the textbook, they are to contact either Cynthia Longoria or Carlos Alvarado in the CBA Student Development Office (BUSA 112) before the third week of the semester.

Writing Standards Policy: Written assignments in the College of Business Administration are expected and required to meet minimal* standards in the following areas:

(1) Spelling & Capitalization

(2) Punctuation

(3) Grammar

(4) Agreement error

(5) Word choice error

(6) Formatting

Students are encouraged to receive writing assistance from the Undergraduate Writing Center (located on the second floor of the Jernigan Library; http://www.tamuk.edu/writingcenter/) before submitting a writing assignment. CBA faculty may require students use the writing center and provide verification of its usage.

If any single page of any outside writing assignment (as opposed to in-class tests) contains more than five writing errors, the paper is returned, ungraded, to the student, who will have no more than one calendar week to revise the paper, correct the errors, and return it to the instructor for grading. Any writing assignment returned for correction receives a one-letter grade penalty.

No more than two (2) different assignments per course will be eligible for resubmission. Faculty will inform students which assignments are eligible. Additional assignments are graded based on the initial submission and will not be allowed to be resubmitted. Each returned writing assignment may be corrected and resubmitted only once. A returned paper resubmitted with uncorrected errors receives a maximum grade of “D.”

*These are the minimal standards required by the College of Business Administration. At their discretion, faculty may impose stricter standards, such as fewer acceptable errors or less time to correct and resubmit. Faculty will note in the course syllabi which assignments are eligible for resubmission.

Software Policy

All assignments to be submitted electronically must be done using Windows software (Word, Excel, etc.). Students have free access to Microsoft Office 365 through the following link on JNET: https://jnet.tamuk.edu/web/home-community/service-catalog

Concealed Carry Policy

Effective August 1, 2016, Texas law permits the concealed carry of handguns on the Texas A&M University-Kingsville University campus by some students, faculty, staff, and visitors. Other than qualified law enforcement officers, only those persons who have been lawfully issued and are in possession of a License to Carry a Handgun (LTC) are permitted to do so. These firearms must remain concealed at all times. If a firearm becomes visible, notify University Police (call 361-593-2611) or the Kingsville Police Department (361-592-4311). Use of firearms is prohibited on campus. For additional information, please visit http://www.tamuk.edu/campuscarrylaw.

TENTATIVE COURSE SCHEDULE &AGENDA

| Topic: |

Key Dates: |

Chapter/Title: |

Key Problems

|

|

Unit 1. Preparing to Invest & Conceptual Finance Tools |

August 22 |

Introduction |

|

| August 24

September 12

September 16

September 19

September 21

September 23 |

Begin Unit

2. Securities Markets and Transactions

3. Investment Information

4. Risk & Return

Extra: Portfolio Planning (Chapter 5, pages 170-181)

Beginning of Stock-Trak Simulation

Exam 1

Stock-Trak Simulation Report Work Day

Internet Sites Project Work Day

Initial Stock-Trak Report Due, Internet Sites Project Due |

2:3,4,8,12-15,20,21

3:1,2,6,7

4:2,4,5,9,15,16,18,21-23

5:5

|

| Unit 2. Common Stock Analysis and Management |

September 23

October 12

October 14 |

Begin Unit

6. Common Stocks

7: Analyzing Common Stocks

8: Stock Valuation

Extra: CAPM and MPT (Chapter 5, pages 181-197)

Exam 2

Review of Exam 2 |

6:1,3,5,7,10,11,14,15

7:4,10,17,Case 7.2

8:1,8,9,13,15,16,21,23,24

5:18,19,24,26,29,30,31

|

| Unit 3. Bonds and Mutual Funds |

October 17

October 21

November 4

November 7 |

Begin Unit

10. Fixed Income Securities

11. Bond Valuation

12. Mutual Funds and Exchange-Traded Funds

Extra: Market Efficiency (Chapter 9, pages 335-347)

Mid-term Stock-Trak Report Due

Exam

Review of Exam 3 |

10:1,4,5,6,9,14,16,17,18,21

11:2,11,16-19,21,27

12:1-3,7,11,12

Q9:1,2 |

| Unit 4. Derivative Securities and Assessing Performance |

November 9

November 28

December 5 |

Begin Unit

13. Managing Your Own Portfolio

14. Options: Puts and Calls

15. Futures Markets and Securities

Bonus: Behavioral Finance (Chapter 9, pages 348-375)

Final Stock-Trak Report Due

Exam 4 (8:00 a.m.) |

13:4,7,8,11,13,15,16

14:1,3,5,11,12,14,16

15:1,5,7,8,11-14

9:2,4,6,7,9 |

Retained earnings is one of the most useful numbers taken off the balance sheet. It shows how much money the firm keeps after all other payments and expenses have been accounted for. “Retained earnings” is basically net income minus any cash dividends the company pays out to shareholders. On the balance sheet, retained earnings is added to an account known as “accumulated retained earnings”. These earnings are “retained” by the company to invest in growth projects, pay off debt, etc.

Retained earnings is one of the most useful numbers taken off the balance sheet. It shows how much money the firm keeps after all other payments and expenses have been accounted for. “Retained earnings” is basically net income minus any cash dividends the company pays out to shareholders. On the balance sheet, retained earnings is added to an account known as “accumulated retained earnings”. These earnings are “retained” by the company to invest in growth projects, pay off debt, etc. Preferred stock is a less common form of equity. Preferred stock acts somewhat like debt because it has no voting rights and typically earns a fixed dividend. Unlike debt, owners of preferred stock get these dividends forever. Preferred stockholders also have a claim on a firm’s assets before common stock holders do. This means preferred stockholders always get paid dividends first. If the company goes bankrupt, preferred stockholders also get “first claim” on any remaining assets after all debts are paid.

Preferred stock is a less common form of equity. Preferred stock acts somewhat like debt because it has no voting rights and typically earns a fixed dividend. Unlike debt, owners of preferred stock get these dividends forever. Preferred stockholders also have a claim on a firm’s assets before common stock holders do. This means preferred stockholders always get paid dividends first. If the company goes bankrupt, preferred stockholders also get “first claim” on any remaining assets after all debts are paid. Other Comprehensive Income (OCI) is all the income a company makes that is not on the Income Statement as part of “Net Income”. “Net Income” is a company’s revenue minus expenses, interest, and taxes. However, a firm may have other sources of income, like as buying stock in another company and earning a dividend. If this company sells that stock or earns a dividend, it does not normally appear on the income statement. That is because these earnings are not relevant to the main operations, just like individuals do not count investment gains as salary. Basically, any income a firm gets that is not counted as part of the Income Statement is counted as “Other Comprehensive Income”.

Other Comprehensive Income (OCI) is all the income a company makes that is not on the Income Statement as part of “Net Income”. “Net Income” is a company’s revenue minus expenses, interest, and taxes. However, a firm may have other sources of income, like as buying stock in another company and earning a dividend. If this company sells that stock or earns a dividend, it does not normally appear on the income statement. That is because these earnings are not relevant to the main operations, just like individuals do not count investment gains as salary. Basically, any income a firm gets that is not counted as part of the Income Statement is counted as “Other Comprehensive Income”.

Gross margin compares the first two lines on the income statement: sales and cost of goods sold. Cost of goods sold is the amount a company spends to obtain the goods they are selling. Let’s say I own a hat company. My cost of goods sold would be the money I spend either buying the hats from a supplier or on the materials and direct labor necessary to produce them myself. For many companies, cost of goods sold is the largest expense.

Gross margin compares the first two lines on the income statement: sales and cost of goods sold. Cost of goods sold is the amount a company spends to obtain the goods they are selling. Let’s say I own a hat company. My cost of goods sold would be the money I spend either buying the hats from a supplier or on the materials and direct labor necessary to produce them myself. For many companies, cost of goods sold is the largest expense. Whereas those profitability ratios focused on income statement items, liquidity and solvency are mainly concerned with the strength of a company’s balance sheet. The concept of liquidity centers upon a business’s ability to handle short-term obligations like accounts payable, accruals, and debt that is due within one year.

Whereas those profitability ratios focused on income statement items, liquidity and solvency are mainly concerned with the strength of a company’s balance sheet. The concept of liquidity centers upon a business’s ability to handle short-term obligations like accounts payable, accruals, and debt that is due within one year.

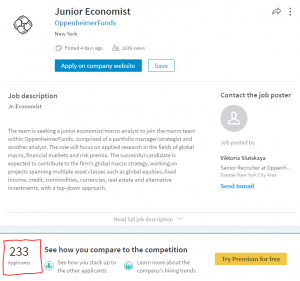

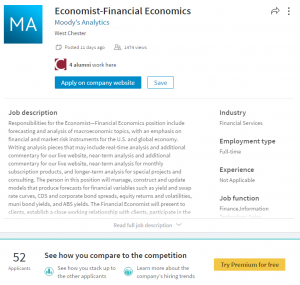

Each person starts off as an Unskilled Worker, meaning they do not have any specific training or professional skill sets that set them apart from any other worker. If a person goes to school or gains enough experience to become a Specialist or Expert, they become a Skilled Worker (

Each person starts off as an Unskilled Worker, meaning they do not have any specific training or professional skill sets that set them apart from any other worker. If a person goes to school or gains enough experience to become a Specialist or Expert, they become a Skilled Worker (

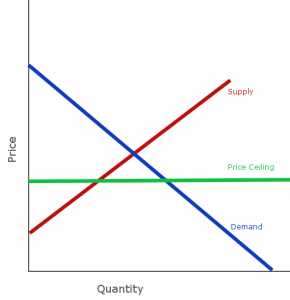

Price Ceilings are controls put in place to prevent the price of some good or service from getting too high. This type of control is most common with food, where there might be a maximum price that businesses can charge for things like flour or electricity.

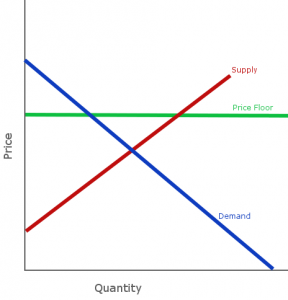

Price Ceilings are controls put in place to prevent the price of some good or service from getting too high. This type of control is most common with food, where there might be a maximum price that businesses can charge for things like flour or electricity. Price Floors are the opposite – a control put in place to ensure that a certain amount of something is produced by making sure producers are guaranteed at least a certain price for what they supply. These types of control are common for milk.

Price Floors are the opposite – a control put in place to ensure that a certain amount of something is produced by making sure producers are guaranteed at least a certain price for what they supply. These types of control are common for milk.

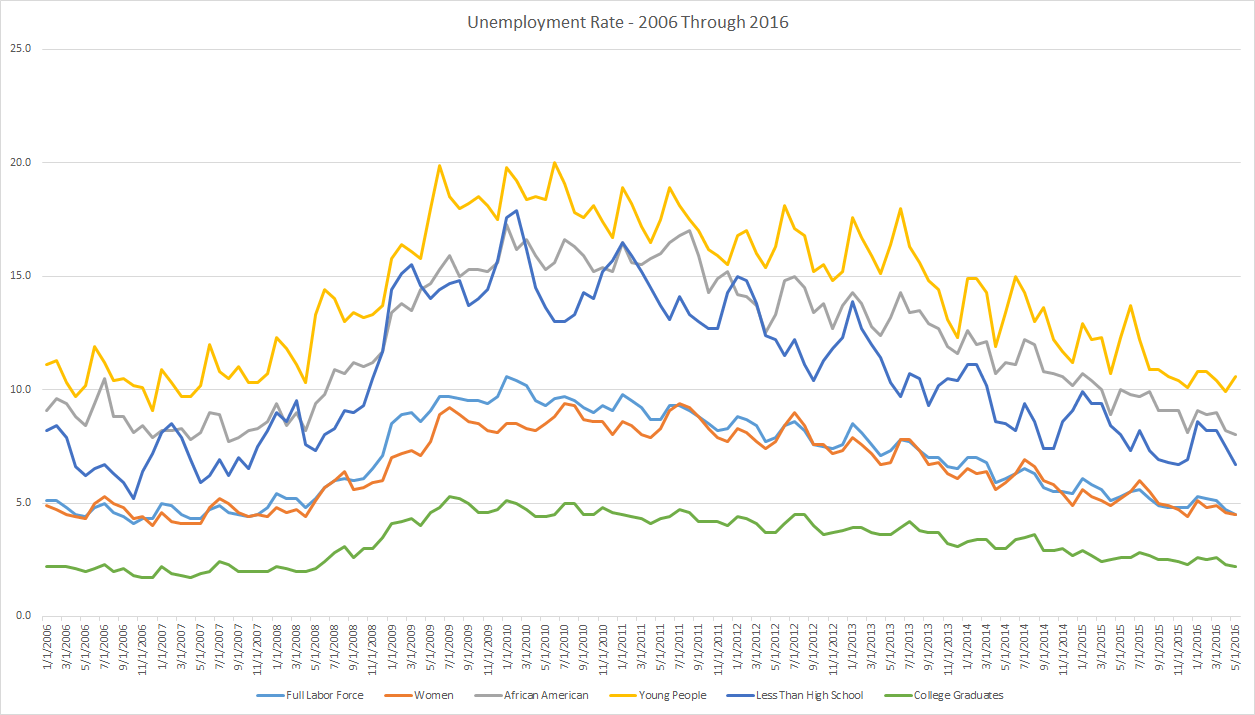

Interest rates are growth rates – it is a percentage that is used to calculate how much a loan or investment grows over time.

Interest rates are growth rates – it is a percentage that is used to calculate how much a loan or investment grows over time. If a loan is risky, the lender will charge a higher interest rate to compensate for the fact that they might not get paid back at all. On the other hand, very reliable borrowers usually have much lower interest rates.

If a loan is risky, the lender will charge a higher interest rate to compensate for the fact that they might not get paid back at all. On the other hand, very reliable borrowers usually have much lower interest rates.

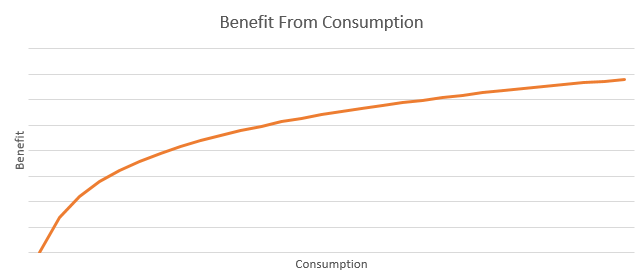

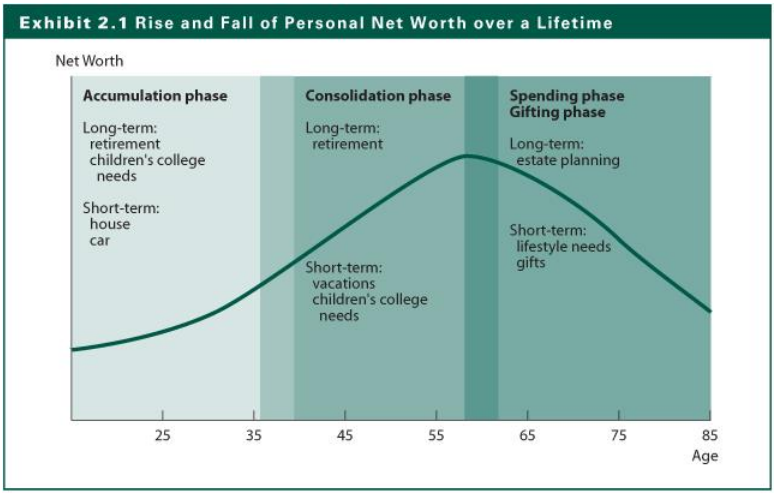

You can use more of your income for consumption and less for saving, but this might mean that you will have less consumption later when you lose your job or retire. You can save and invest more of your income, but that means you will have less available to consume today.

You can use more of your income for consumption and less for saving, but this might mean that you will have less consumption later when you lose your job or retire. You can save and invest more of your income, but that means you will have less available to consume today.