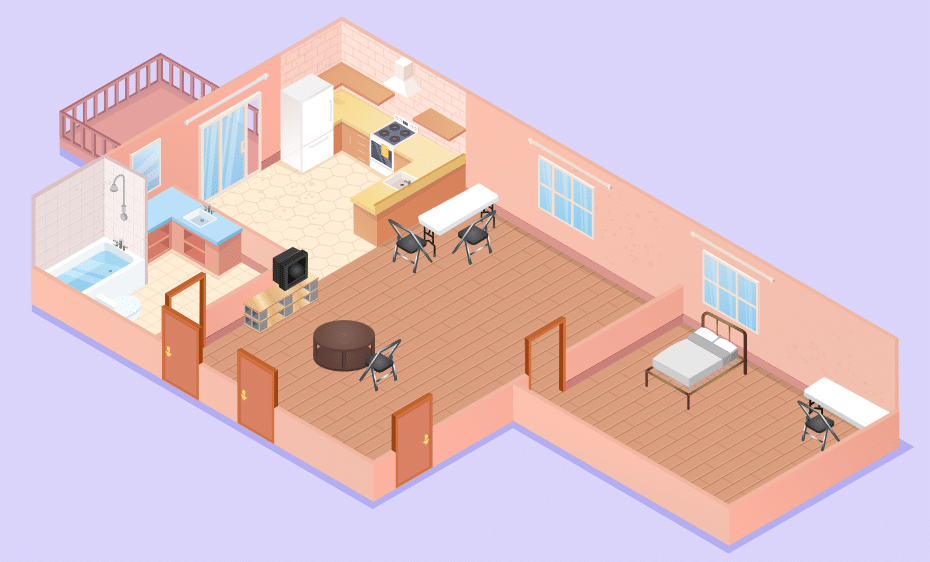

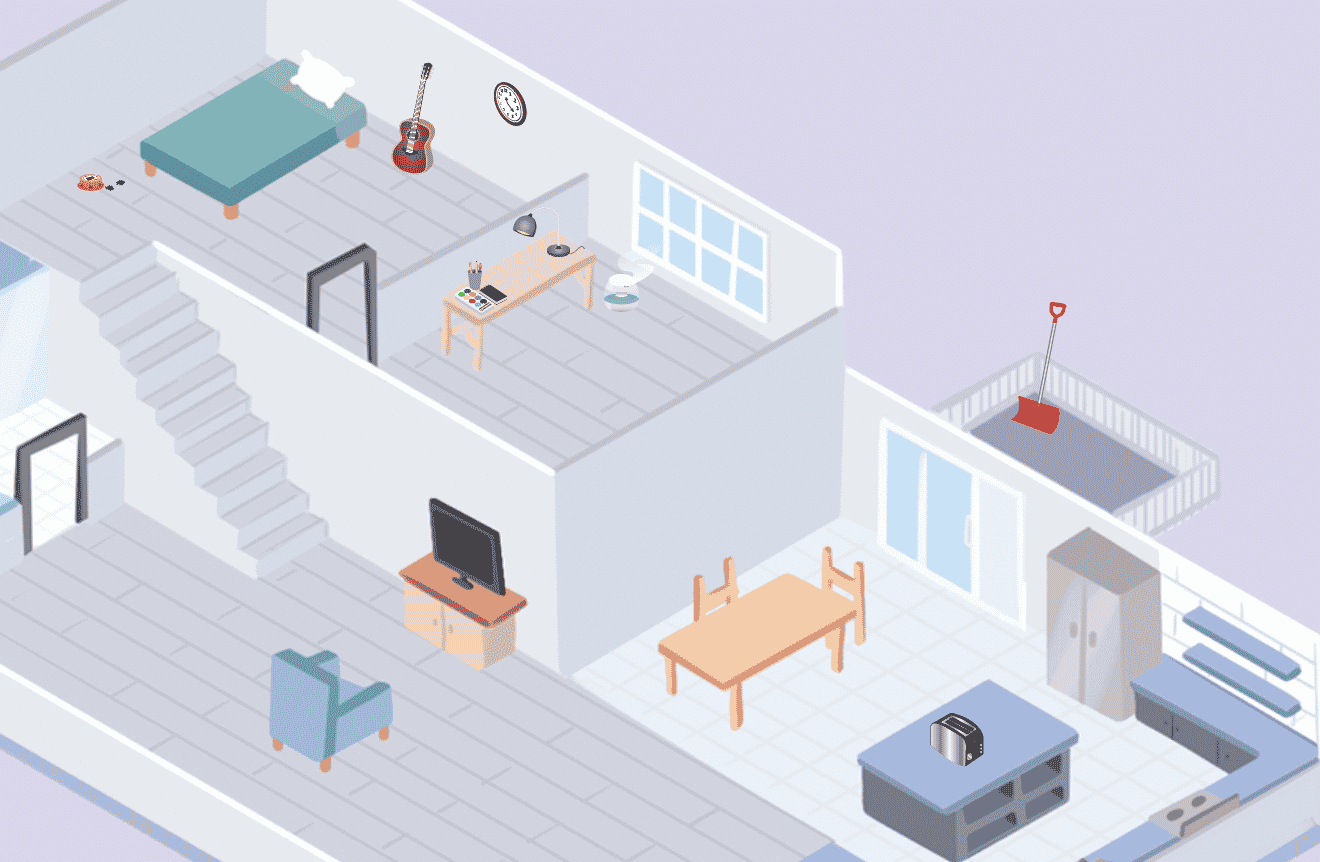

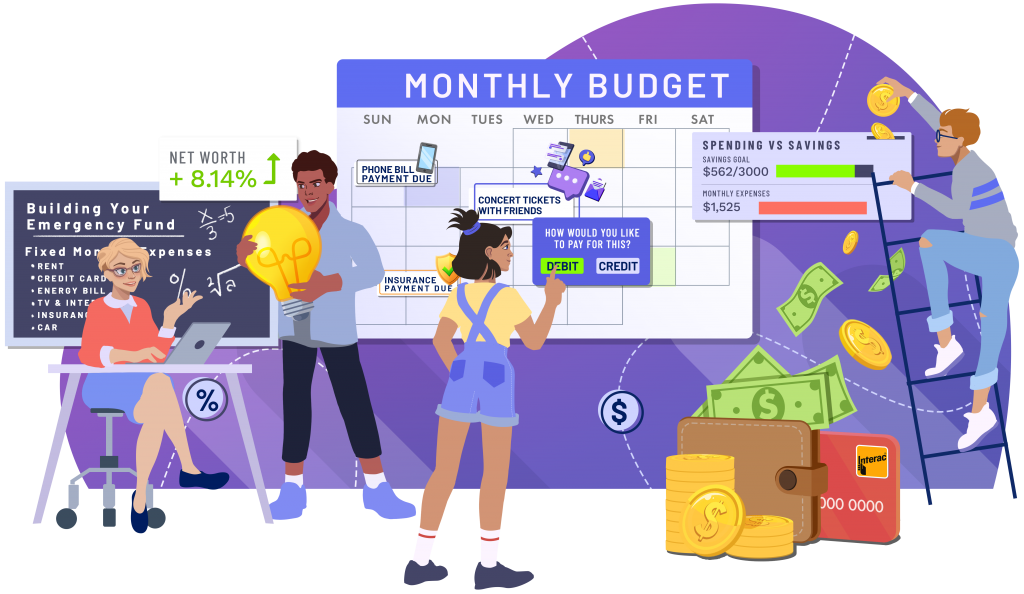

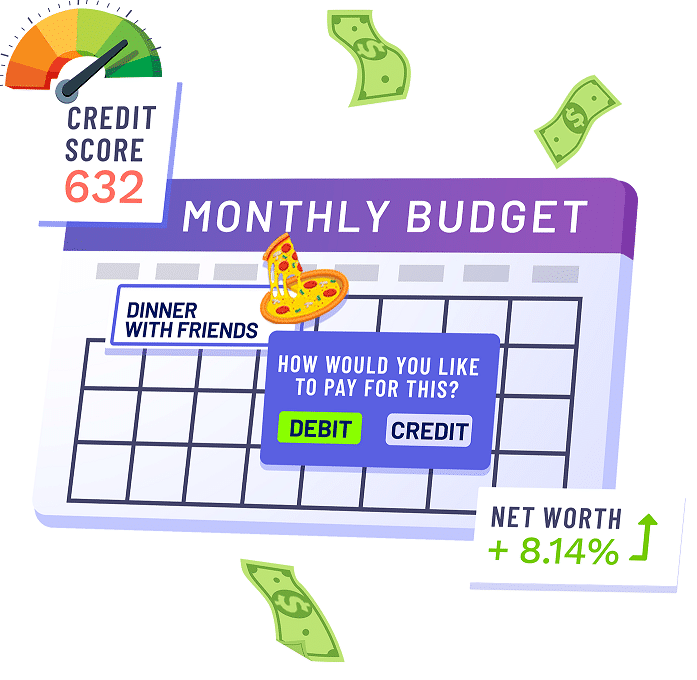

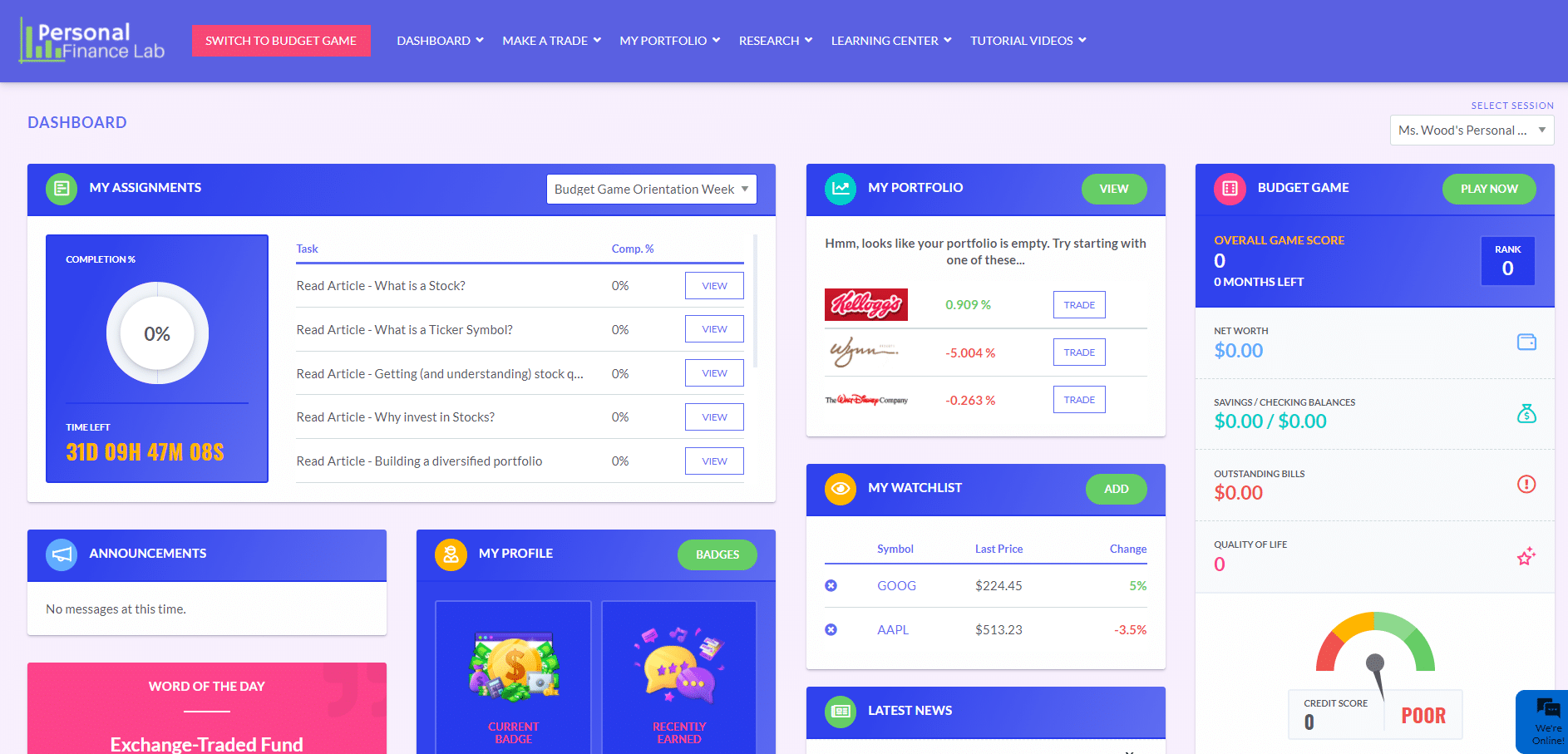

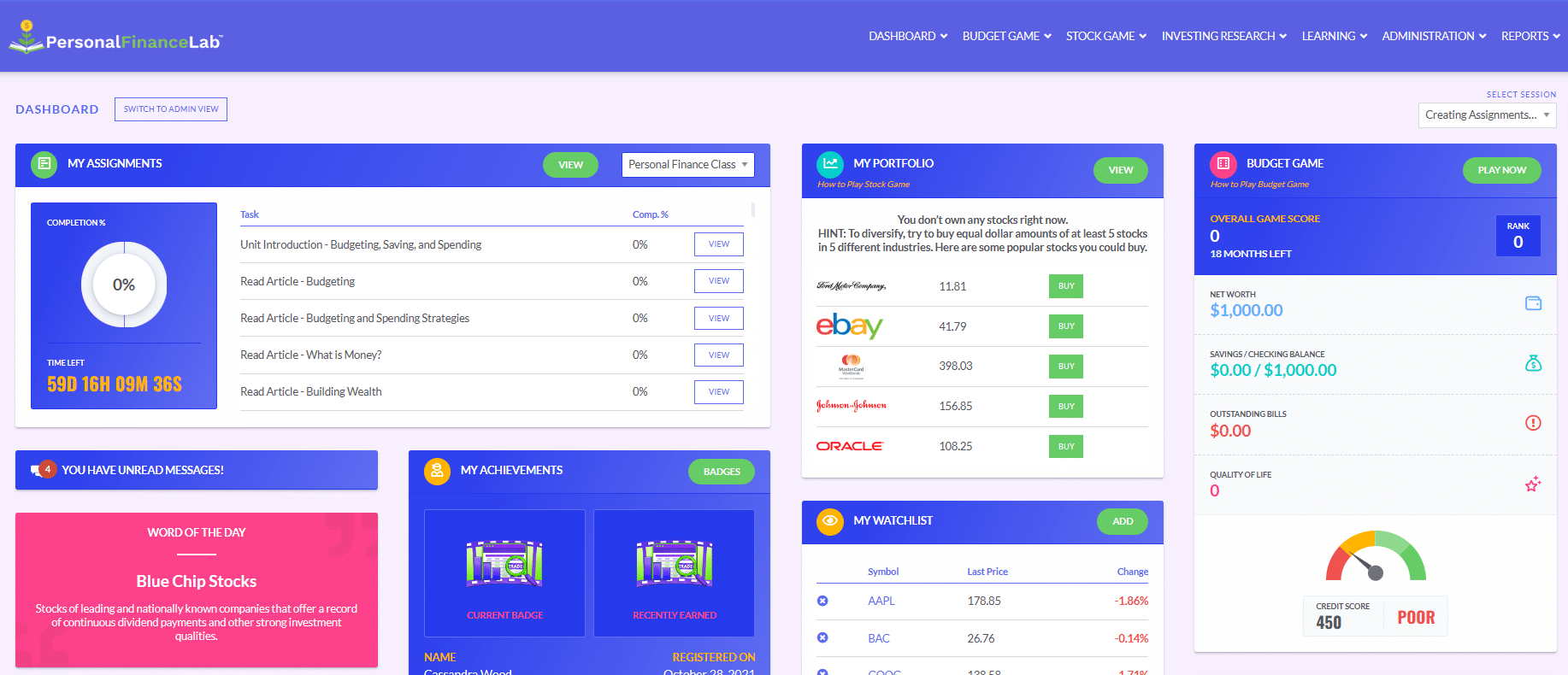

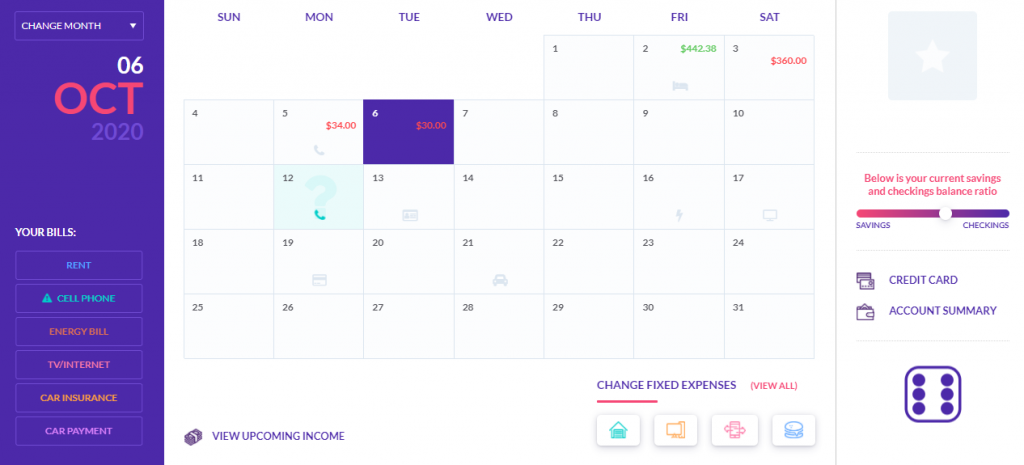

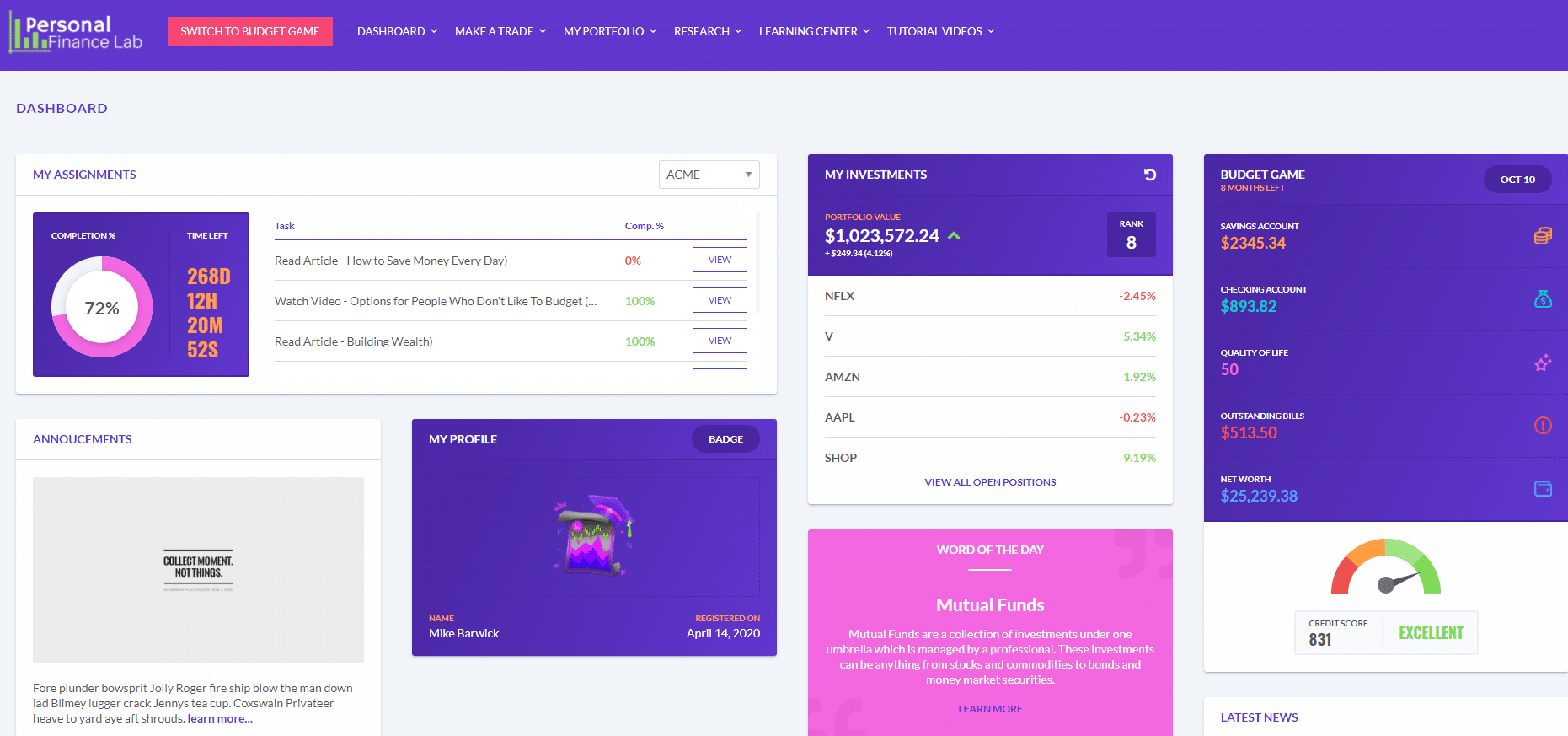

The Budget Game on PersonalFinanceLab is a long-term project where students will learn how to manage cash flow, savings goals, and credit over the course of your class. While the budget game is customizable for every class, for a 9-week course we recommend using a 12-month game (with each game taking 10-20 minutes to complete), with students “graduating” after 6 months.

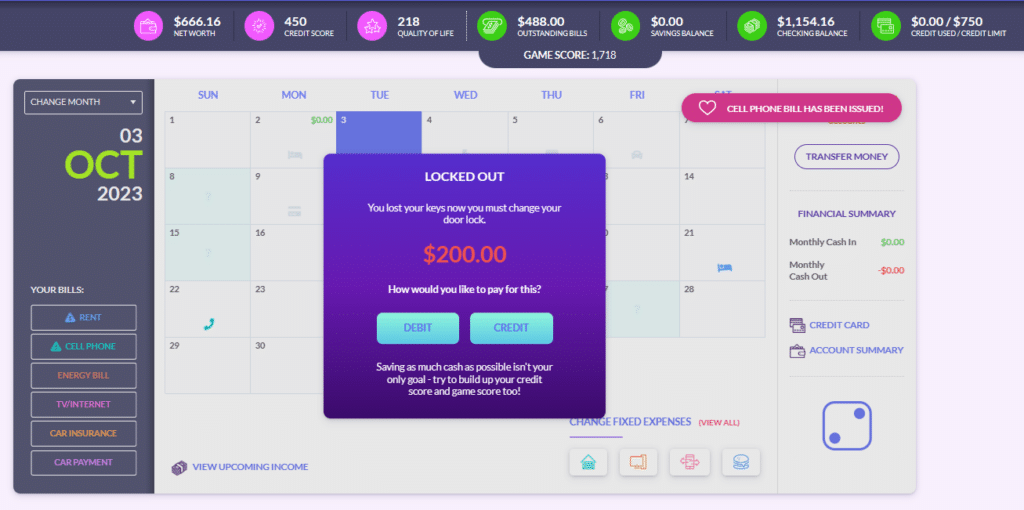

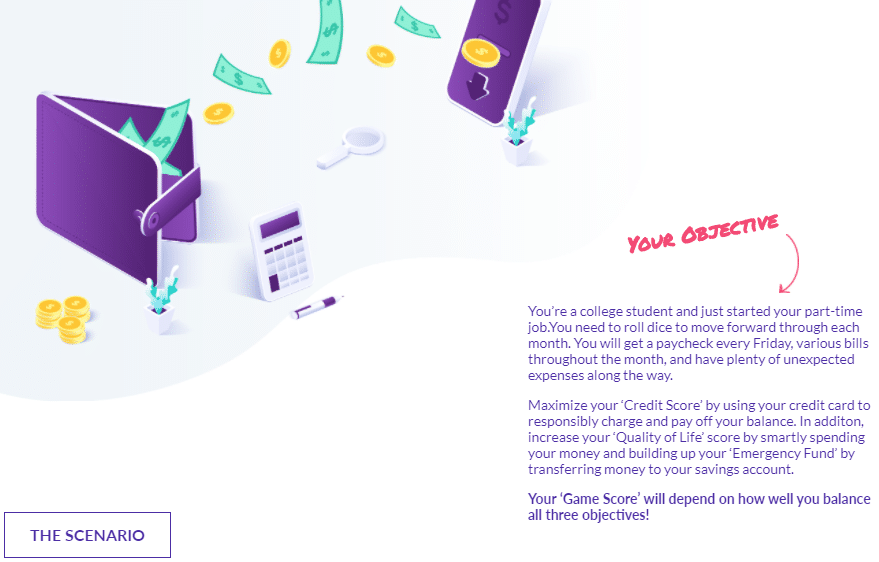

What this means is that your students will start the game taking on the role of a college student with a part-time job. They will have roommates (and so lower bills), but variable hours at work (and so their income each month will vary). After 6 months, students will “graduate” from school and start their first full-time job – right as the other topics in class transition to career planning. This will give them more consistent income, but their bills also increase (because they move into their own apartment) and new bills are added for student loan payments and health insurance.

Your students will need to complete “months” of the budget game a little more than once per week of your class. Approximately every three weeks, we also have recommended in-class activities to encourage students to reflect on what has happened so far in the game and encourage a class discussion of each student’s journey.

Besides setting aside time for students to play the game itself, we also have four other sub-projects relating to the game – a “Transaction Review” after the first three months, a “Midpoint Review” after students are halfway through the game, and a Final Report/Presentation that students can prepare individually or in groups. We also have a grading rubric for how students performed in the budget game itself.

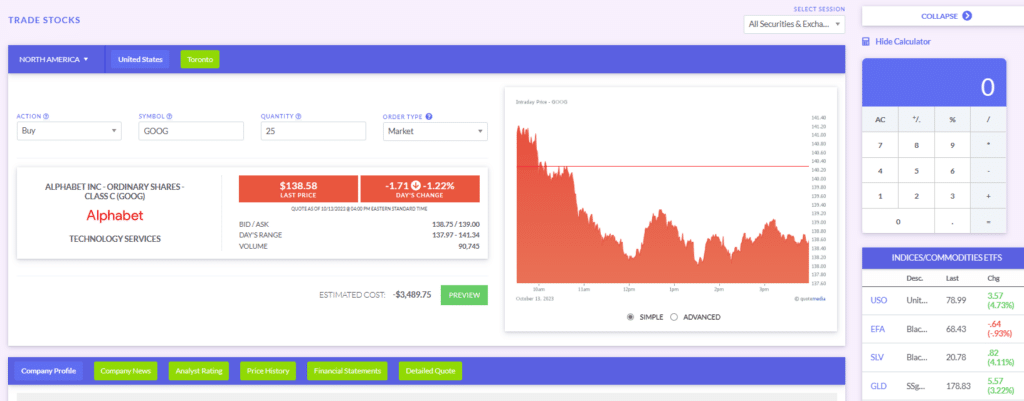

The final presentation/report combines both elements of the stock game and budget game. Students will be participating in the stock game in teams, and so the final report also has students compare their final budget game performance with their teammates.

Unit 1.6 – Budget Game – Transaction Review

If you are following wither the 9-Week or 18-Week Course Outline, this project is ear-marked for Unit 1.6. However, you can use this grading rubric at any time to accompany the Budget Game.

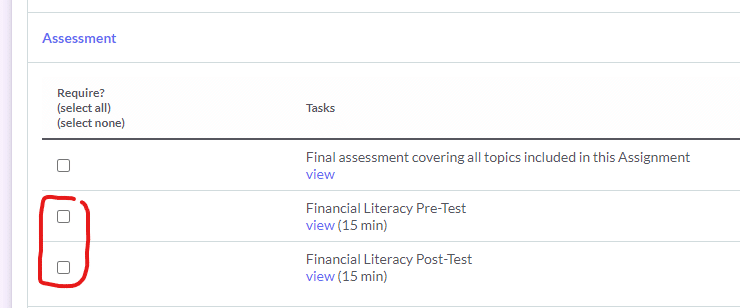

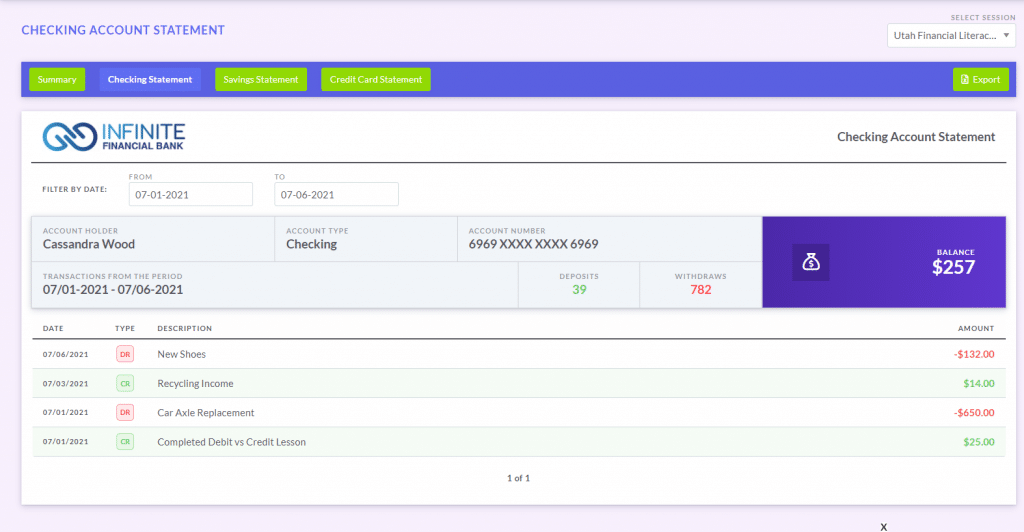

The first project leveraging the Budget Game comes at the end of the first unit (covering budgeting and spending plans). At this point, students will have completed their first 3 months of the game. The primary goal of the first project is to check students’ understanding of the core concepts of the game, and if they have a basic understanding of what’s happening in the game and how this translates to the real world so teachers can help clarify key learning takeaways before students dive too deep into the game itself.

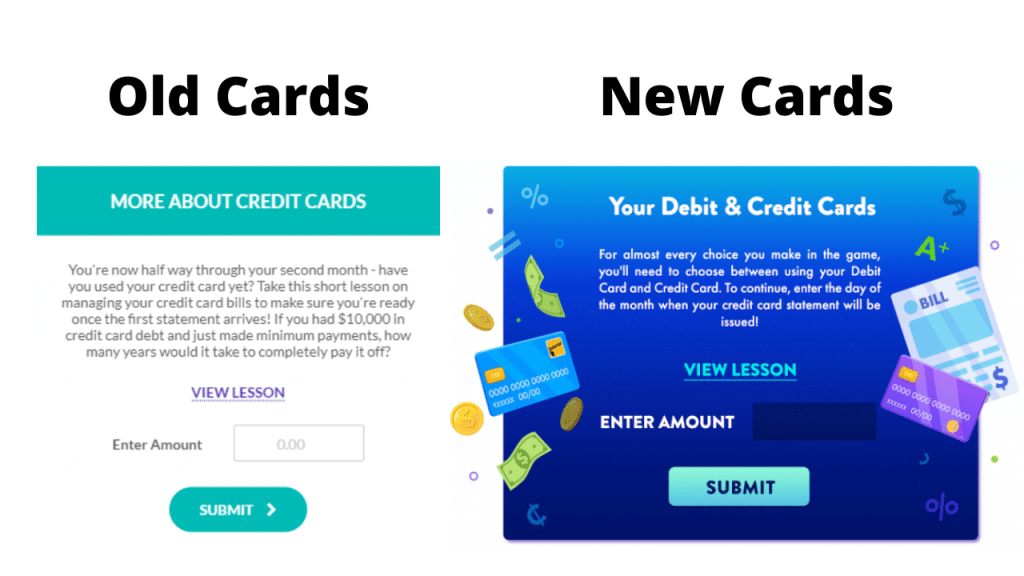

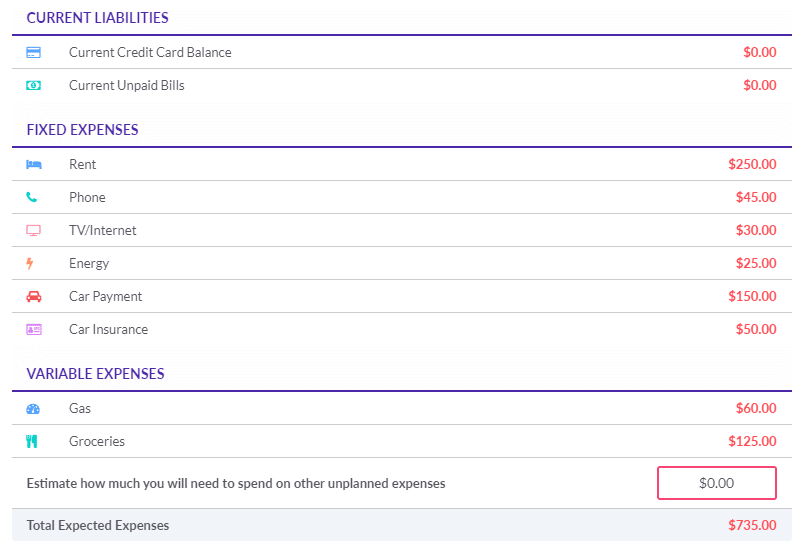

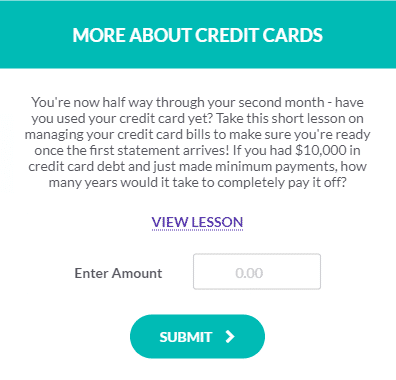

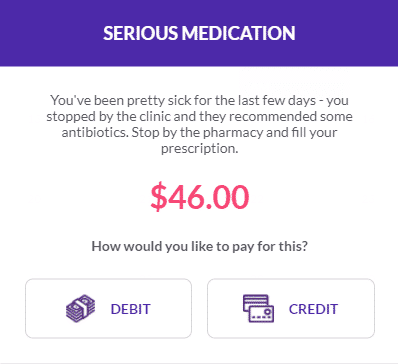

They will be asked to utilize their Debit Card Statement, Credit Card Statement, and Savings Account Statements to conduct a brief review of their spending so far in the game and will be asked basic questions about their status in the game. Evaluation at this stage is based mostly on how well the students organize their thoughts and answer a few basic math questions.

Specifically, they will need to:

- Identify if they currently have any outstanding bills, or if they were faced with unexpected challenges paying their bills on-time in the game.

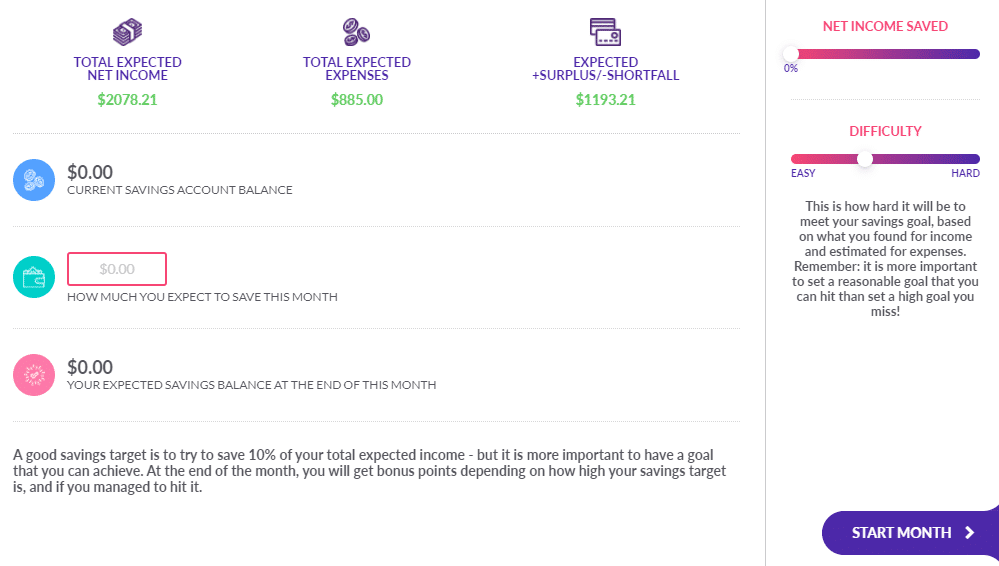

- What was their average savings goal each month? Were they able to consistently reach that goal?

- Identify their current credit score and give a summary of actions they have taken in the game that they believe improved or hurt their credit score.

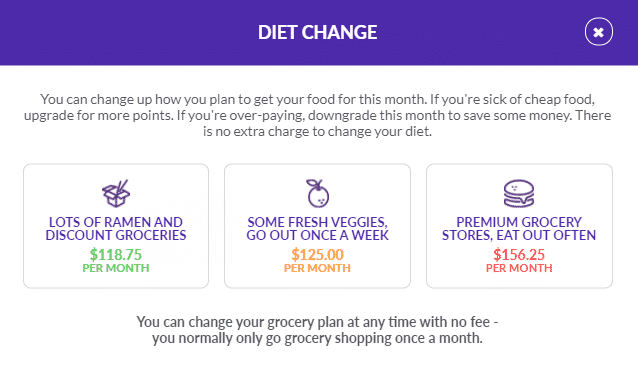

- How did they most frequently spend their weekends in the game? Do they think it is best to focus on one or two activities, or balance their time across different activities?

- Build a summary of their total spending, categorizing spending by:

- Money spent on bills (known expenses)

- Money spent on other events in the game (unknown events)

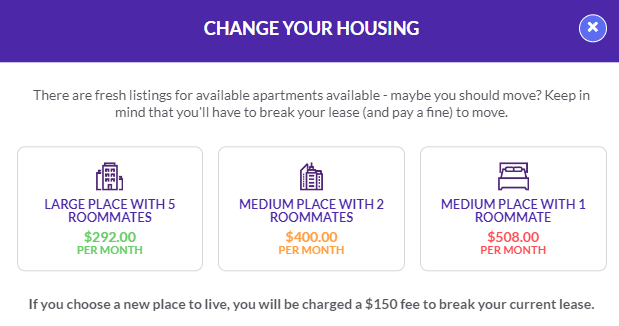

- Students in the game have the option to change some of their fixed expenses for a fee (for example, breaking their lease and moving to a cheaper/more expensive apartment). Do they believe that this will be necessary to maintain their budget in the long run?

- Based on how the game has gone for the first three months, and their current ranking on the budget game rankings page, what (if any) changes do they plan to make to how they play the game going forward?

Grading Rubric

| Needs Improvement (1) | Meets Expectations (2) | Exceeds Expectations (3) | Total Score | |

| Completeness | Not all questions have been answered. | All questions have answers, but some responses may lack full detail. | All questions are fully and completely answered. | |

| Style and Presentation | Answers are disorganized and difficult to follow. Numerous spelling/grammar errors. | Answers can be understood easily with minimal spelling/grammar errors. | Answers are creatively presented in an easy-to-understand format with no spelling or grammar errors |

Budget Game – Activity Rubric

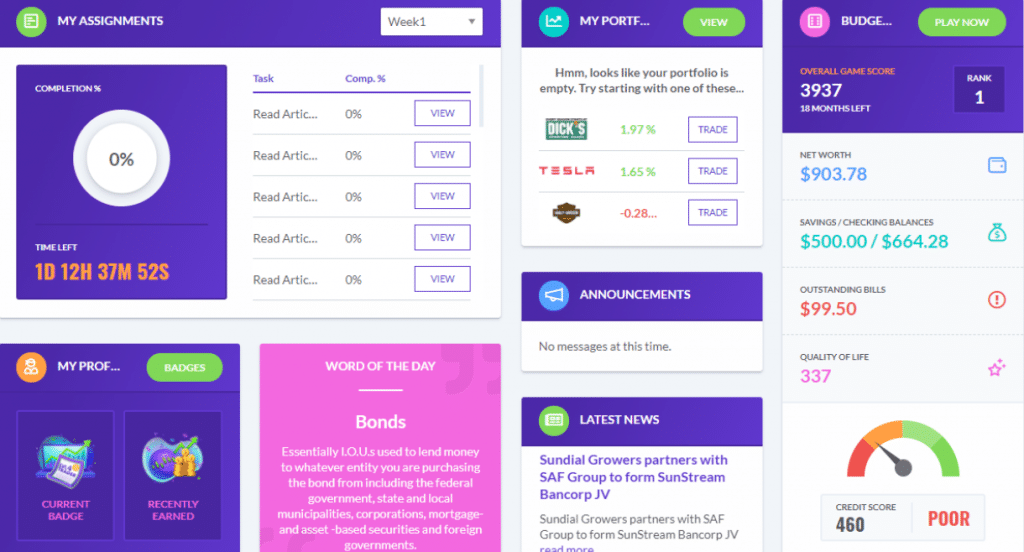

The budget game is balanced students playing a “perfect game” following all financial literacy best practices should be able to:

- Set and hit a savings goal of least 10% of their income every month

- This would earn 7,200 “bonus points” through the game

- Build a $1,000 emergency fund

- This would earn 2,000 “bonus points” through the game

- Earn a total credit score of at least 780

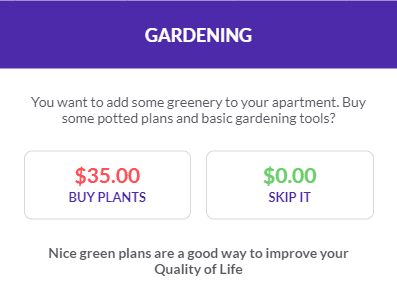

- And accumulate at least 9,000 “Quality of Life” points.

We do not recommend student evaluation based on their final Net Worth, and this does not factor into their overall score. We do, however, include this on the class rankings page so students can see their final standing.

This would give a student playing a “perfect game” an overall score of around 30,000 points. However, because there can be a learning curve (especially in the first three months) and these scores may be different depending on the individual settings teachers make for their class, our recommended student evaluation of the game is a bit more flexible.

Grading Rubric

| Needs Improvement (1) | Meets Expectations (2) | Exceeds Expectations (3) | Total Score | |

| Completeness | Student has completed fewer than 8 months of the game | Student has completed between 8 and 11 months of the game | Student has completed all 12 months of the game on time | |

| Emergency Fund | Student finishes the game with less than $500 in their savings account as an Emergency Fund | Student finishes the game with between $501 and $999 in their savings account as an emergency fund | Student finishes the game with over $1,000 in their savings account as an emergency fund | |

| Monthly Savings Goals | Student has accumulated fewer than 3,000 “bonus points” for hitting savings goals | Student has earned between 3,000 and 8,000 “bonus points” for hitting their savings goals | Student has earned over 8,000 points through the game by setting and hitting realistic savings goals | |

| Credit Score | Student has a final credit score of less than 500 points | Student has a final credit score between 500 and 650 | Student has a final credit score above 650 | |

| Quality of Life | Quality of Life Student has a Quality-of-Life score less than 3,000 points | Student has a Quality-of-Life score between 3,000 and 6,000 points | Student as a Quality-of-Life score above 6,000 points |

Student Packet

Download and distribute the student packet for this activity by clicking the button below!