New Career as a Finance Teacher

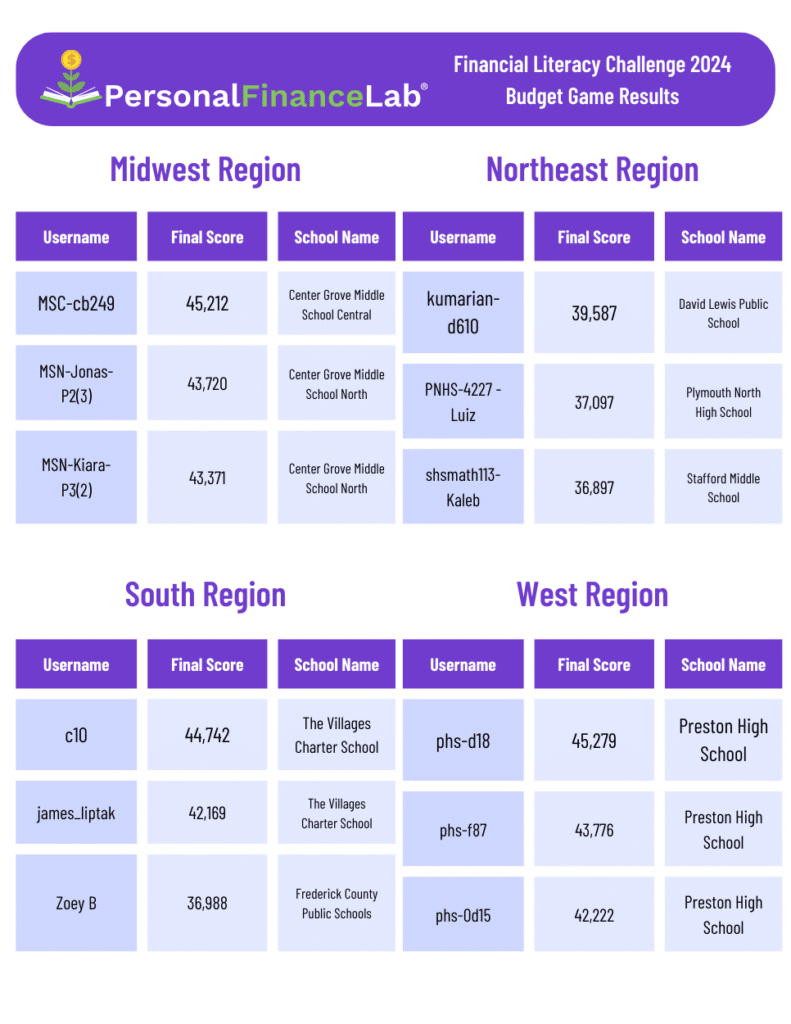

“I’ve been passionate about finance my entire life; I’ve been working in it in some fashion for 27 years,” Mason Renfer said at the beginning of our interview. He was nominated by his students and won the “Nominate Your Teacher” Award in the Fall 2024 Financial Literacy Challenge on PersonalFinanceLab.

During Covid, Mason made a major career change and took his background in banking and finance and moved into education. For the last year he’s been in his current position as the finance teacher at a Scottsdale District high school in Arizona.

“I loved working in education, and was working in the elementary school library when I started looking for something more in my area of expertise here at SUSD… It was the first job that popped up… and I thought you couldn’t ask for something more perfect.”

The classes he teaches at Scottsdale Unified fall under the career and technical education department. “They’re really big on group learning, hands-on learning, and giving students opportunities to learn through doing. I do a little bit of direct instruction for the units we’re covering, but I try to lead with probing questions to get them talking. Then, I pair them up or put them into groups to tackle some sort of project.”

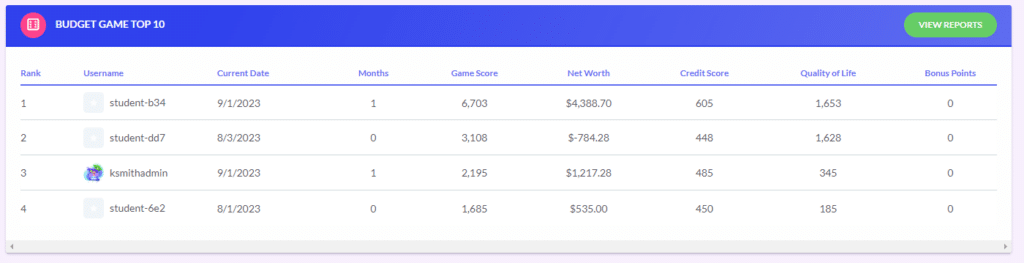

He explained an example of when his class was learning about budgeting, each group tackled a different method. The more they learned, the more they became experts, and in the end the class launched into a debate as they argued which was the best method.

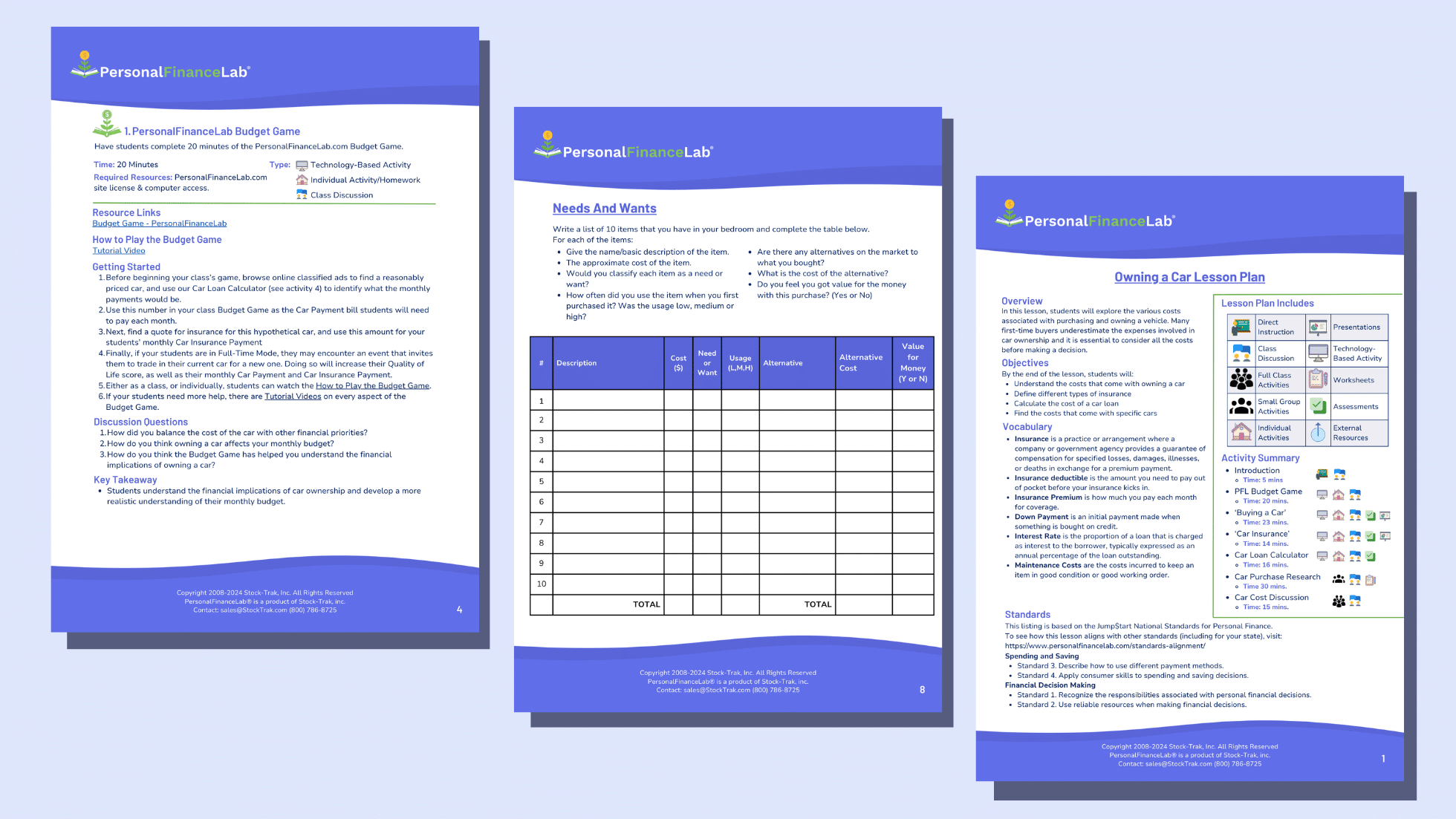

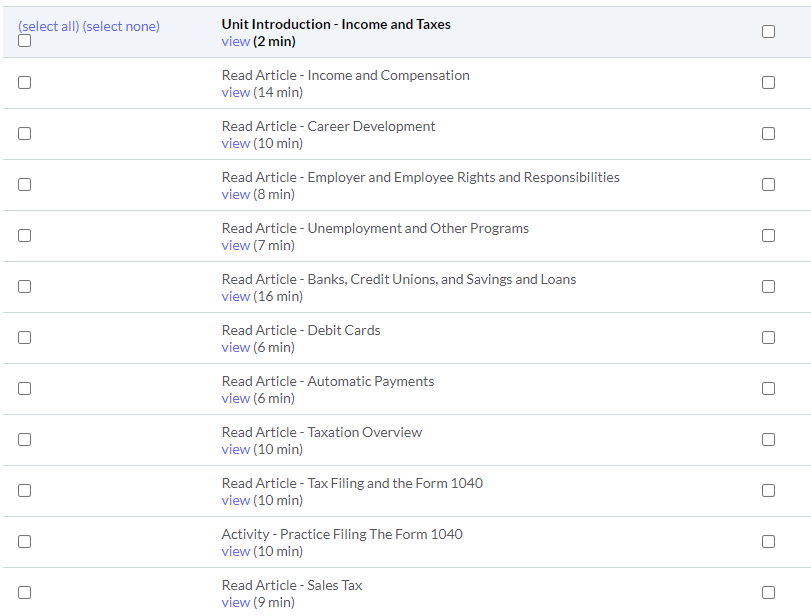

When Mason arrived at Scottsdale Unified, they already had a license for PersonalFinanceLab. He also has access to Everfi and uses Next Gen Personal Finance (NGPF) for their starters, bell ringers and videos. He teaches two classes, a year-long personal finance course and another year-long business course. Ideally, students would start with the year-long personal finance course where they cover topics like:

- Setting up their resume

- Interviewing and getting a job and then,

- Saving money

- Investing money

- Loans and Mortgages

- Retirement

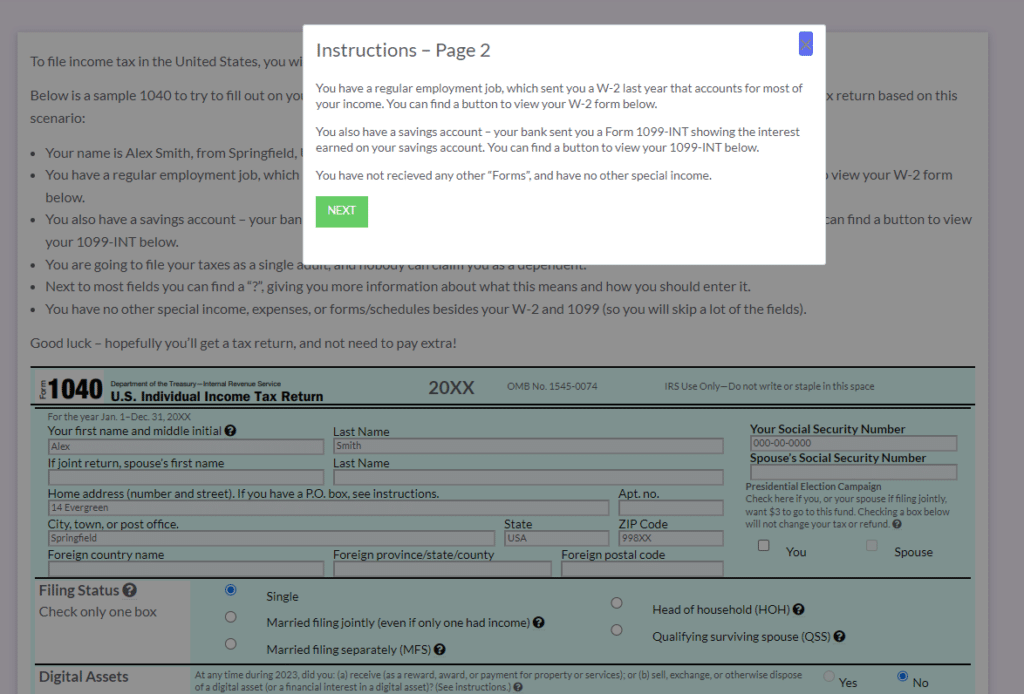

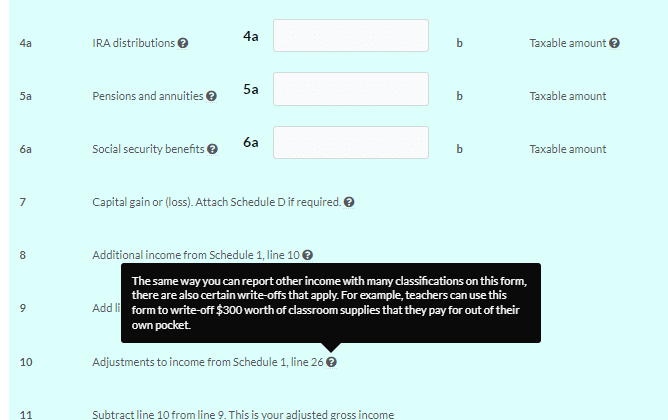

- Taxes

“The first year (personal finance course), I think, benefits every single student. They’re going to need to know how to buy a house, how to budget, they’re going to need to know how to invest… The second year (business course) is a must for any student considering business school… They’re going to have first-hand experience when they get to some advanced fourth-year stuff. It’s not going to be new. They’re going to have a leg up over anyone that hasn’t done the simulations who hasn’t understood how to do it.”

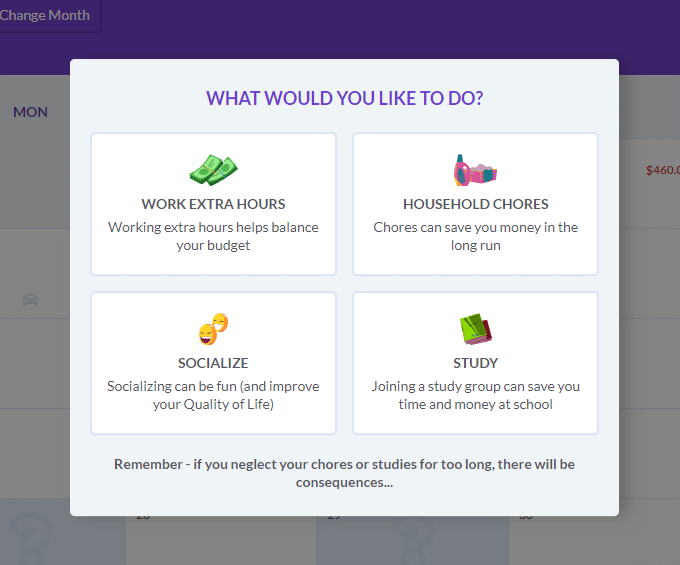

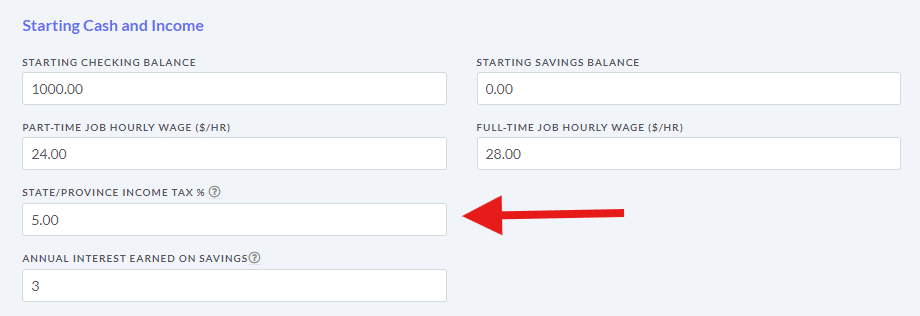

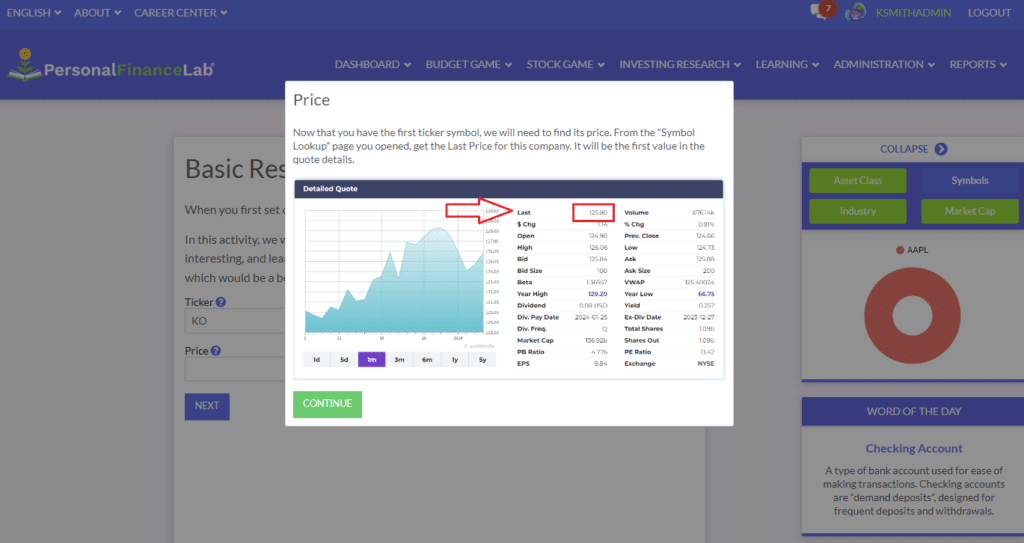

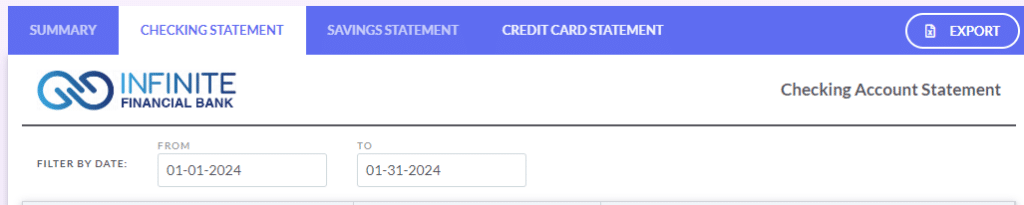

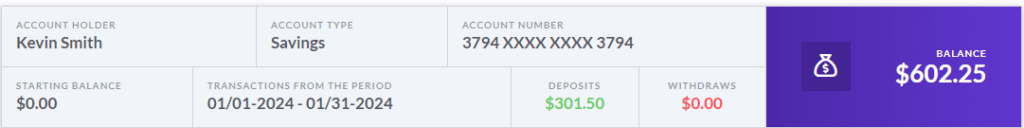

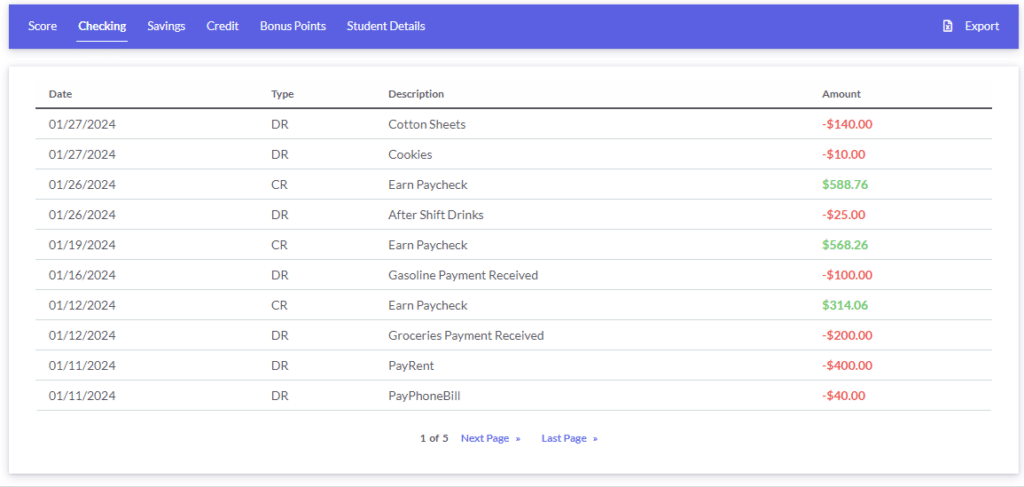

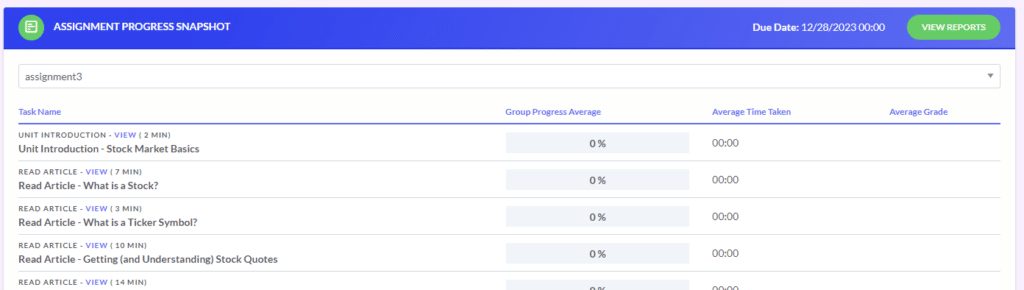

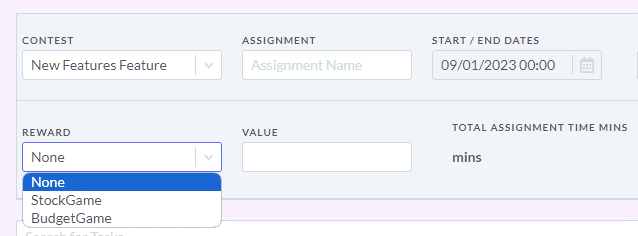

Turning Settings on As They Go

“For my first-year students, I’m turning things on as we go. So, we set-up the Budget Game and we start with budgeting, and then when we get to investing, I’m going to do stocks, mutual funds, and bonds first. They will be able to trade just on the US exchange. Then, as we learn about some of the other things, I’ll unlock those. But I don’t want them getting in there too soon. They’re young and they’re excited, and I love that part of it, but I don’t want them to go and buy some crypto nobody’s heard of because they read about it on TikTok.”

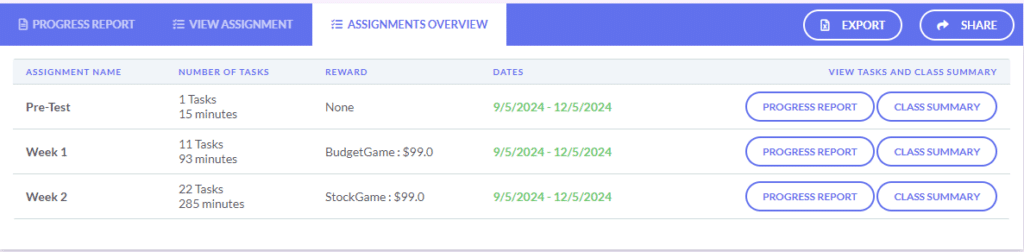

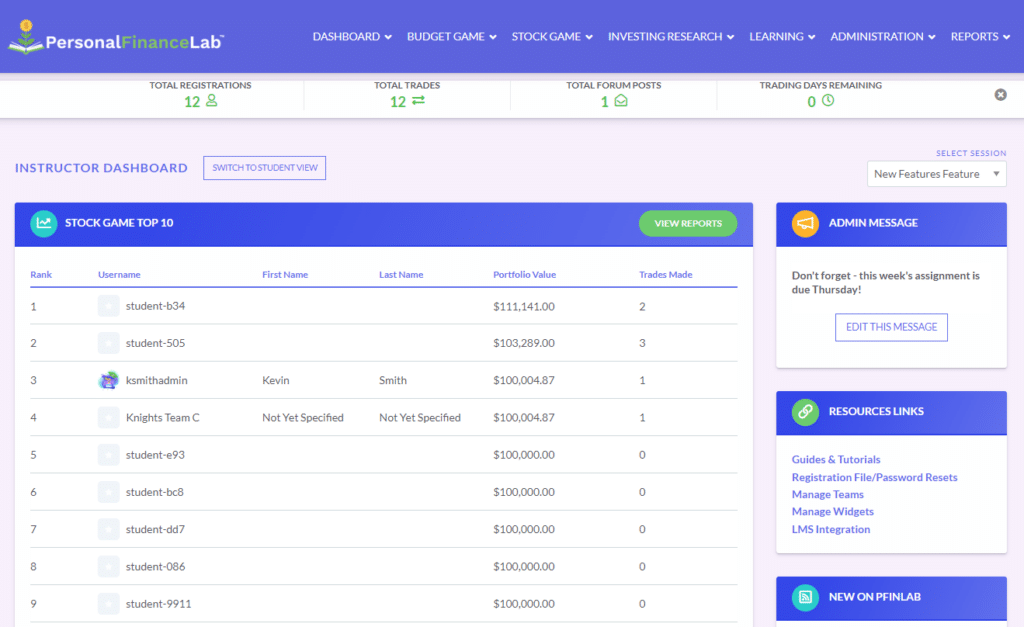

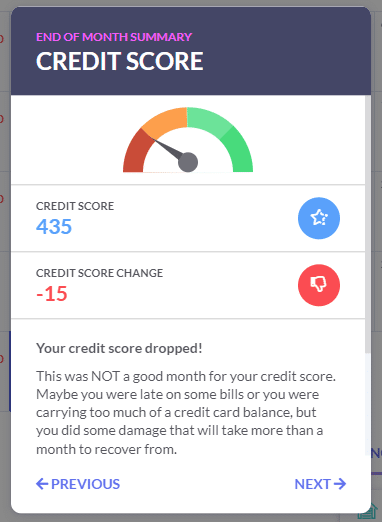

This is one of the key features of PersonalFinanceLab that Mason has been taking advantage of. He is turning on and off different settings in the Budget and Stock Games as and when his students are ready to move onto it. He’s in complete control over what his students have access to. Giving him the chance to discuss social media investing and why it’s probably not the best place to get advice from before they start using that part of the platform.

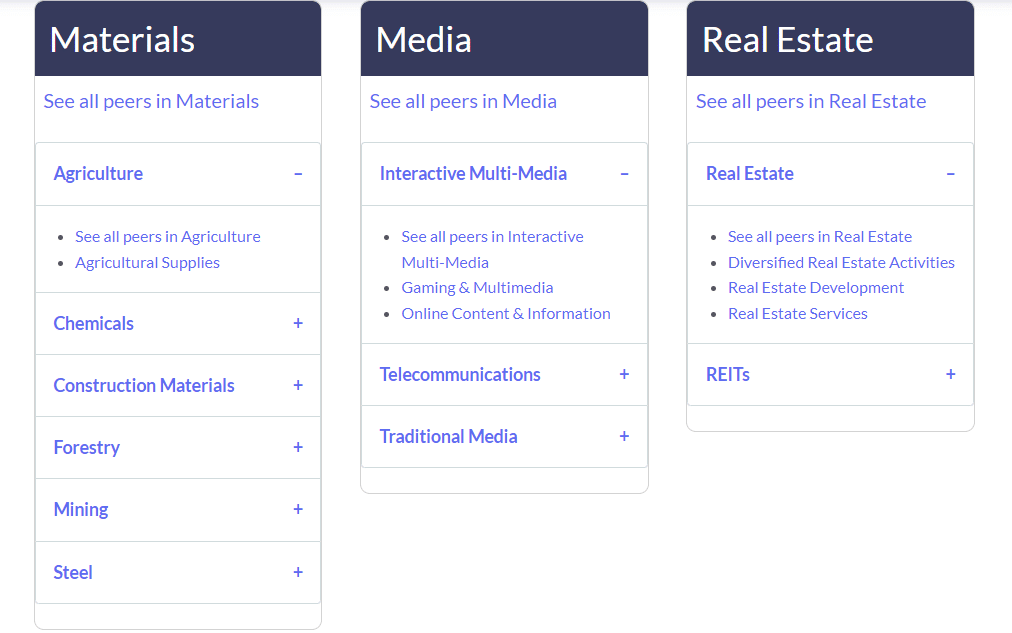

For instance, when he gets his first-year students into the Stock Game in the latter half of the school year, he will get to explain the power of diversification, and then he will be able to turn on mutual funds and ETFs at the right time.

Starting With Different Games

“For my second-year students, we start them out right away with investing, so they have a semester-long investing portfolio. They have to set-up a retirement portfolio and justify why they’re investing in them. This is my main goal, besides obviously teaching them all the state standards, the thing I really want them to understand and remember is the importance of investing when you get your first job… Put a certain amount of money away every paycheck.”

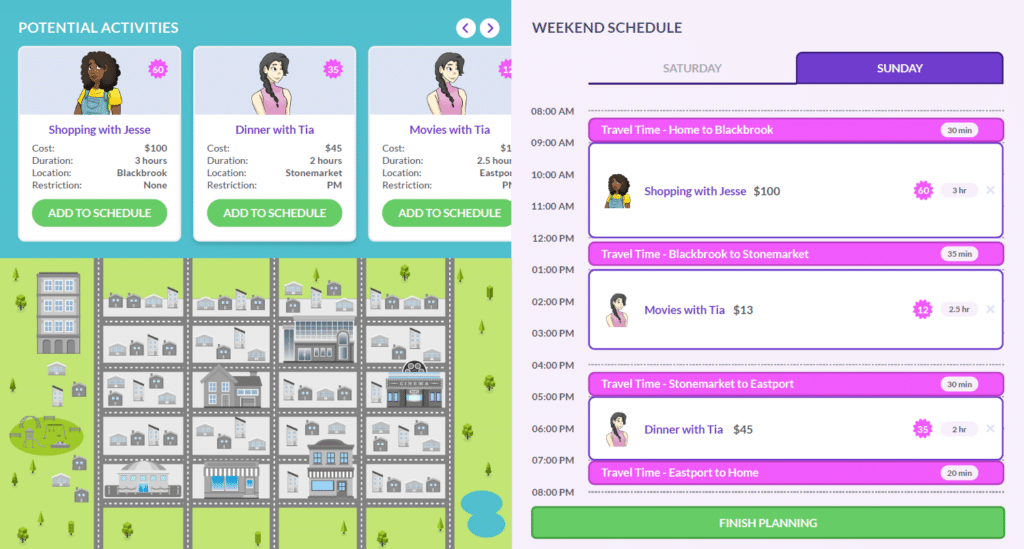

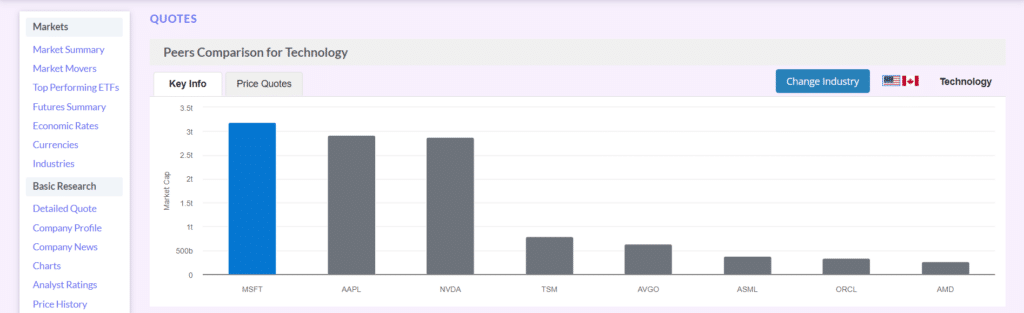

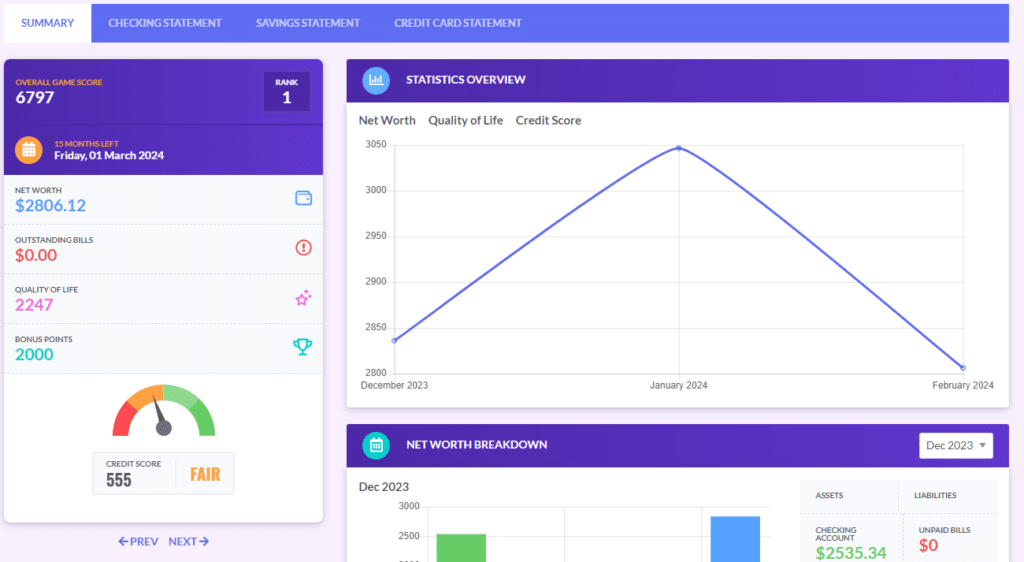

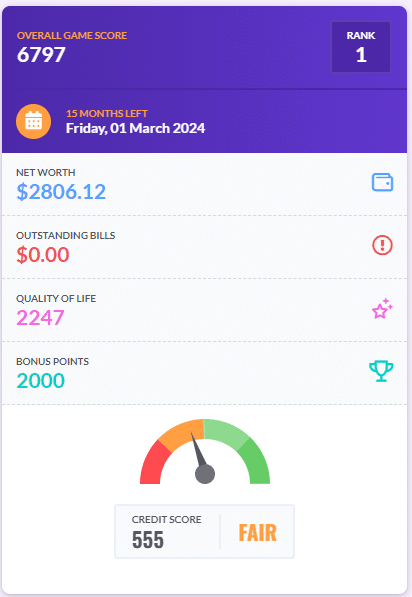

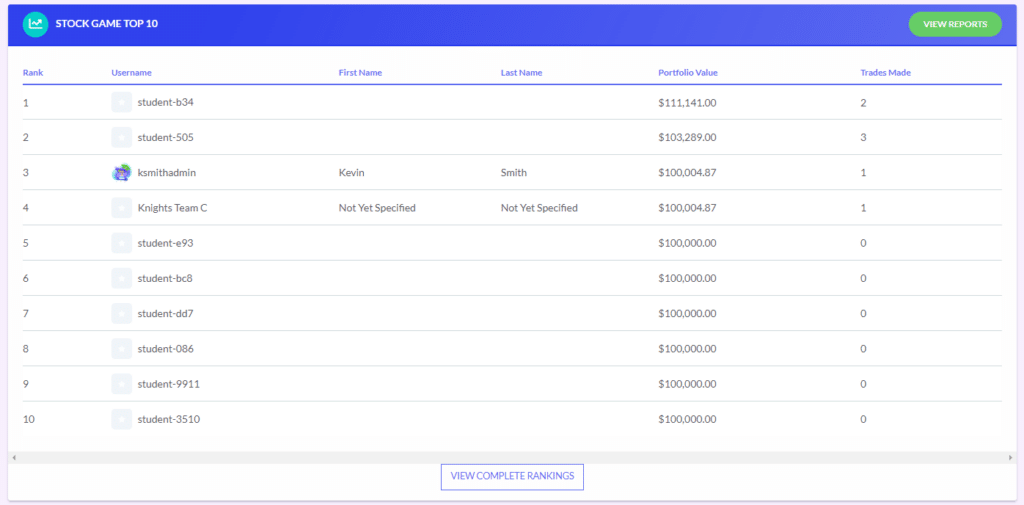

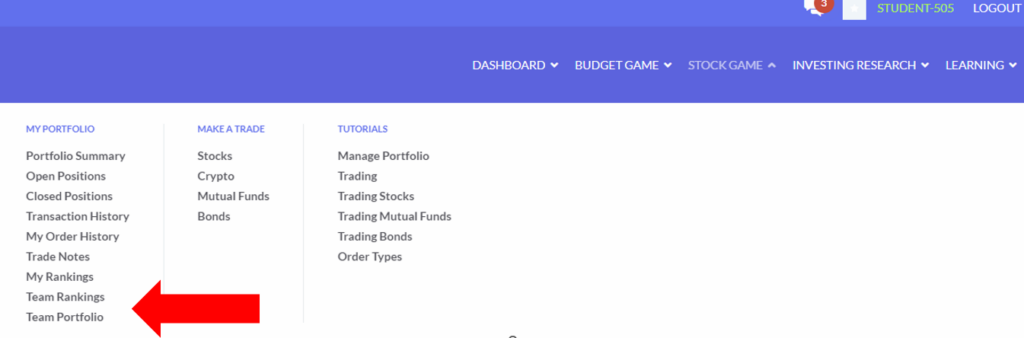

Mason has been able to have his first-year students in one class where they start with the Budget Game. Then in a separate class, his second-year students start with the Stock Game. He explained how his second-year students like, “being able to buy stuff and see it go up and down.”

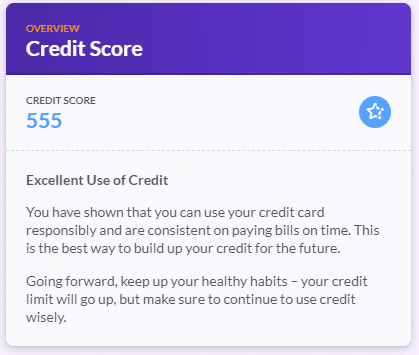

He can hear his students talking to each other about their stock picks, saying things like, “I bought Eli Lilly and it’s up, what are you going to do?” He’s hoping that the more his students get to talk about their actions in the Stock and Budget Games it can help lower the stigma about talking about finances or money in general.

Preparing for Retirement

The major project for Mason’s second-year students is to build a retirement portfolio. His students need to put themselves in the shoes of somebody who’s retired and what they want their retirement to look like:

- Do you want to travel?

- Do you want to have multiple homes?

- Do you want to help others?

“The most positive thing that I’ve had so far is that students are having that Aha moment that money isn’t just something that you use to buy stuff. It’s something that you can use to help you even when you’re not paying attention, and that’s something I hope that they take for life. That they put money in, and they don’t have to worry about it. Then when they come back later, it’s going to be bigger, and it’s going to have grown…I love it because it’s not a game… it’s very realistic, and so I like that they have the ability to go in and trade. They’re learning the mechanics of trading.”

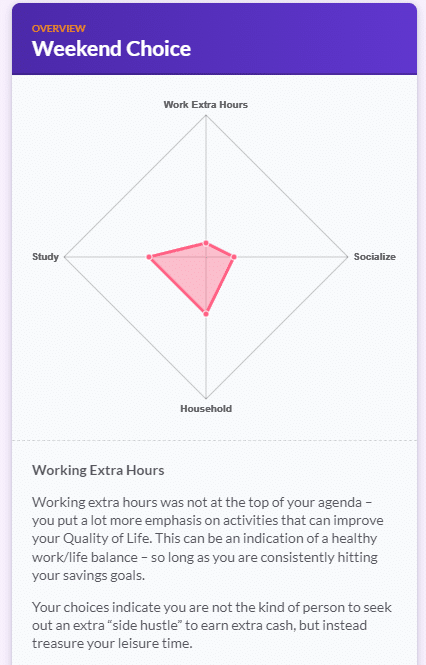

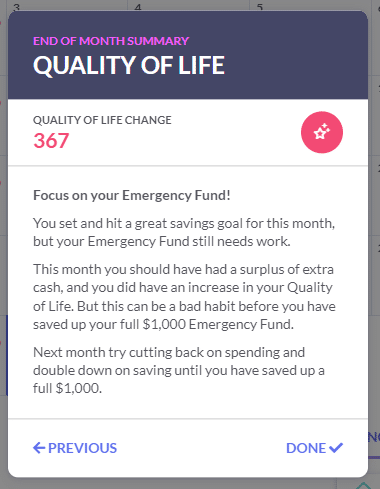

As students play the games, they’re learning to strike a balance between enjoying the present and planning for the future. By allocating their time and resources between personal fulfillment and long-term wealth building on PersonalFinancaLab, they’re gaining a valuable understanding of how to make intentional decisions that benefit their overall well-being.

“If they don’t have it, they’re set up for failure, and I’m just happy to see these types of classes being taught in high schools now before we send kids out into the real world.”

Experiencing Real World Investing

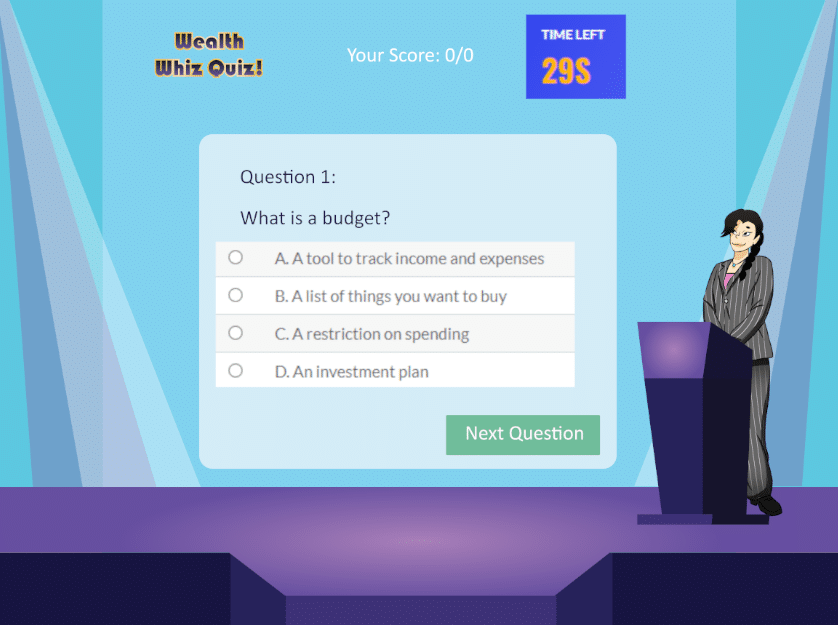

“Then the other part that we do, that I think is fantastic, is we teach them about day trading. I’m not a huge fan of day trading as a job, but I love the software because for several days, I allow them to day trade. I start with some headlines from the day, telling my students, ‘Here’s what happened,’ like when the Federal rates were starting to get lowered, ‘Here’s what’s hot in the headlines,’ then I would tell them, ‘Now go try to make money!“

Day trading is one of the features on PersonalFinanceLab that teachers like Mason can turn on or off at any time. So for the week they were doing day trading with his second-year students, he was able to unlocked everything. “I did margin trading, I did stocks, bonds, ETFs, mutual funds, cryptos…everything. Also, I unlocked every single market, and I just said, ‘Go nuts!”

“It would have never been possible to do that without PersonalFinanceLab… having that software to demonstrate real-world mechanics was fascinating, and I’m just so thankful that I have a license. Scottsdale Unified really went above and beyond by getting me a license for all my students and allowing them to do that. I was very, very, very happy about that.”

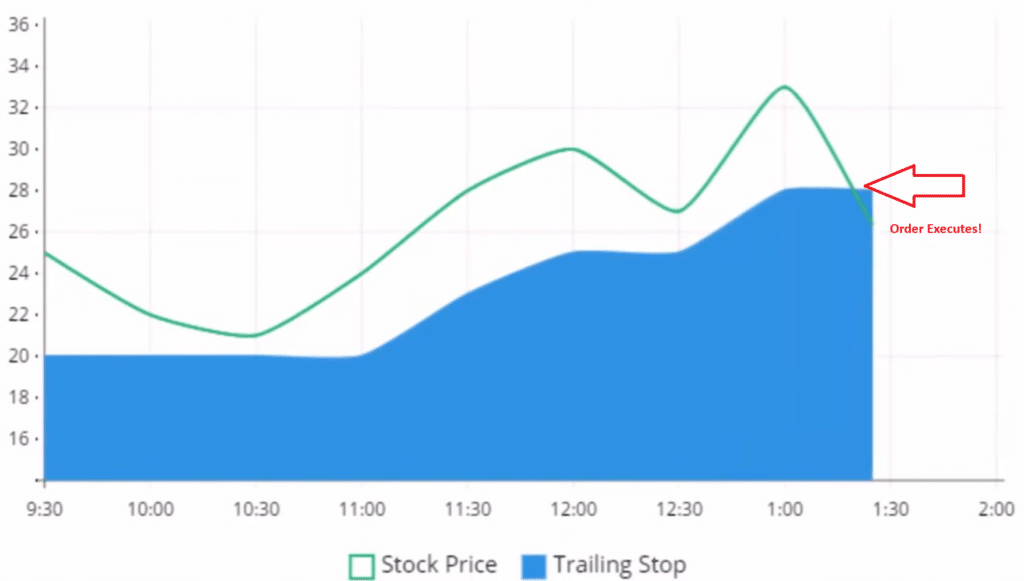

His students are getting to practice all the steps to making a trade. If they don’t want to pay more than $105 for a stock, they know they can put a limit order on it. “It’s no different then when you get to real money. So when these students open an account through Schwab, or they go through Vanguard or wherever they go, they’re not going to be lost, they’re going to go, “Oh yeah, buy stock, buy a mutual fund, buy an ETF, sell something, put a stop order on something else.”

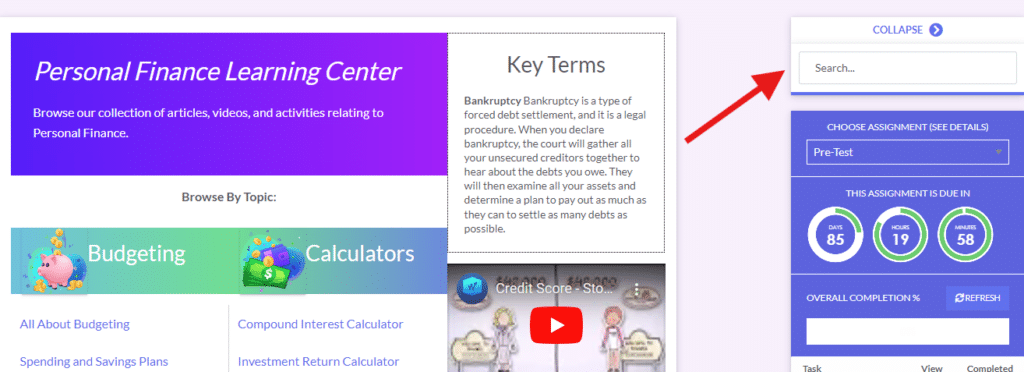

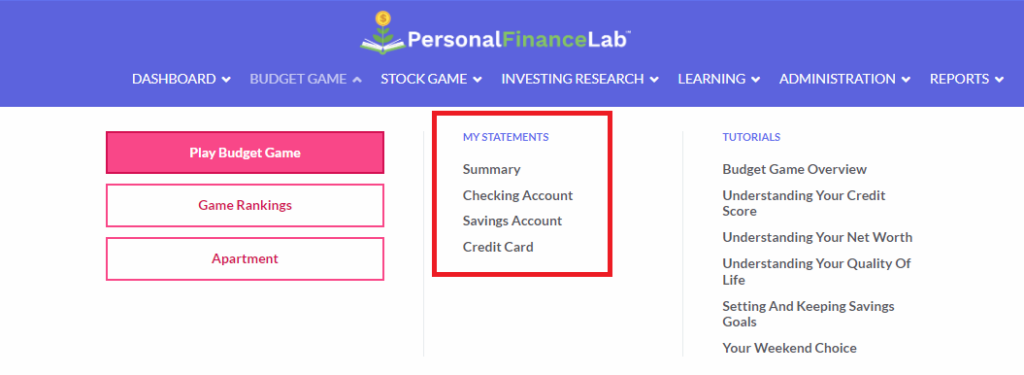

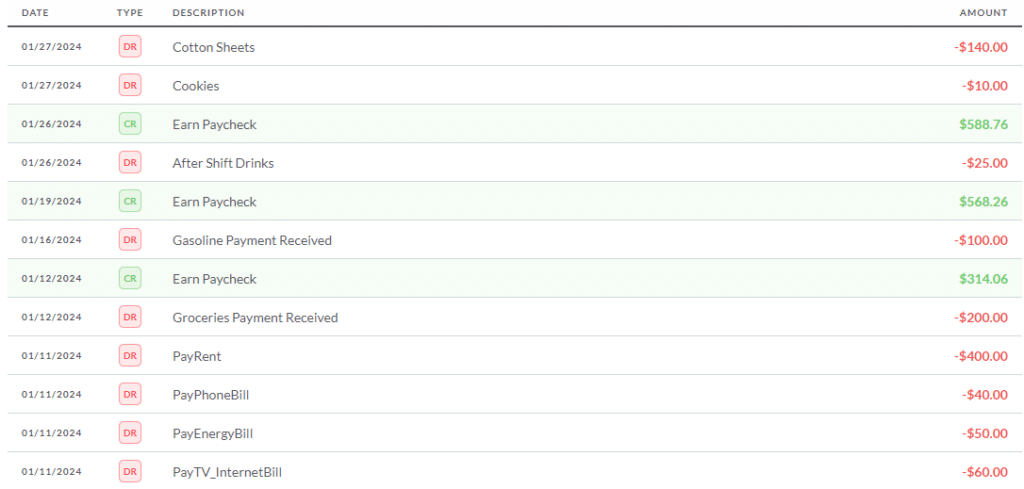

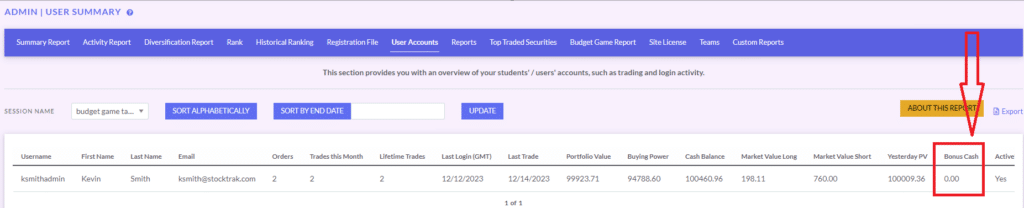

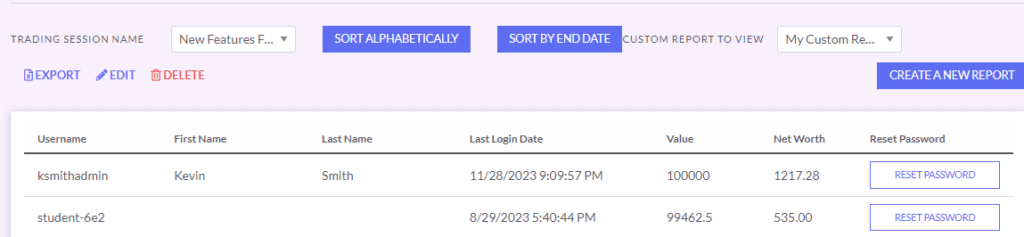

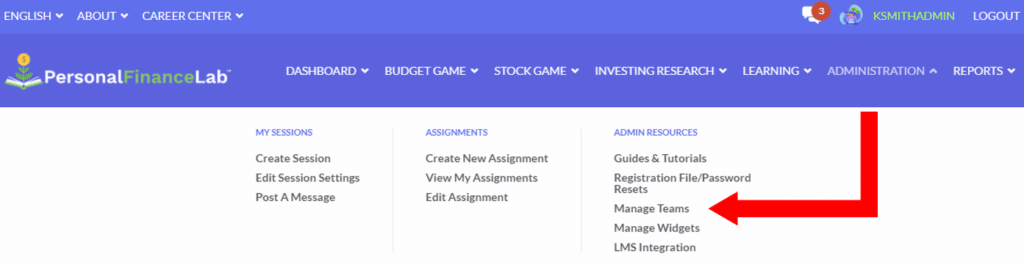

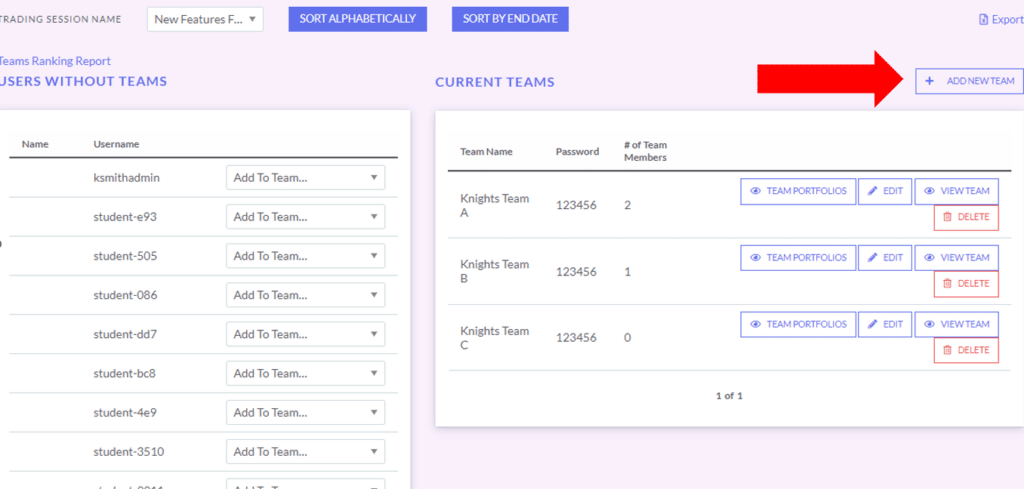

Easy to Keep Track of His Students

“My favorite feature, just purely as a teacher, is the Admin tool, so that I can see what’s going on and make sure that they’re making decent choices. It’s very easy for me to keep track of it all.”

If his student has a question, he can use his admin account to pull up their portfolio, see what they’ve invested in, so he can provide detailed feedback. Like, “’Well, you know, you bought airlines, and you bought hotels…that is not very diversified. If the market moves, you have to…”

He’s able to find out in an instant where each student is at so he can provide them better instruction for how to continue learning about the financial markets.

His advice for teachers who haven’t used it yet or are afraid to start…

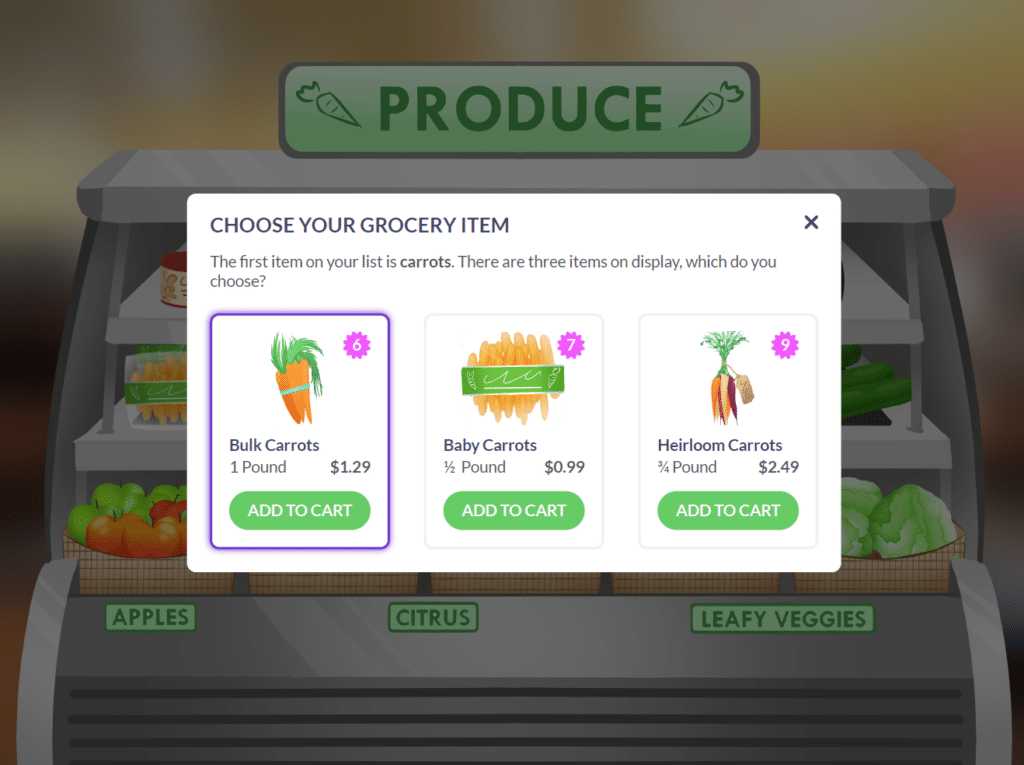

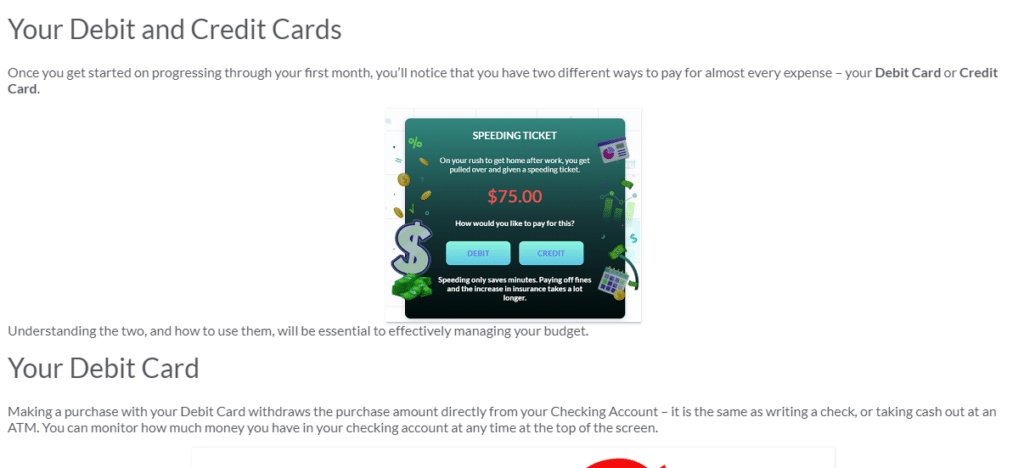

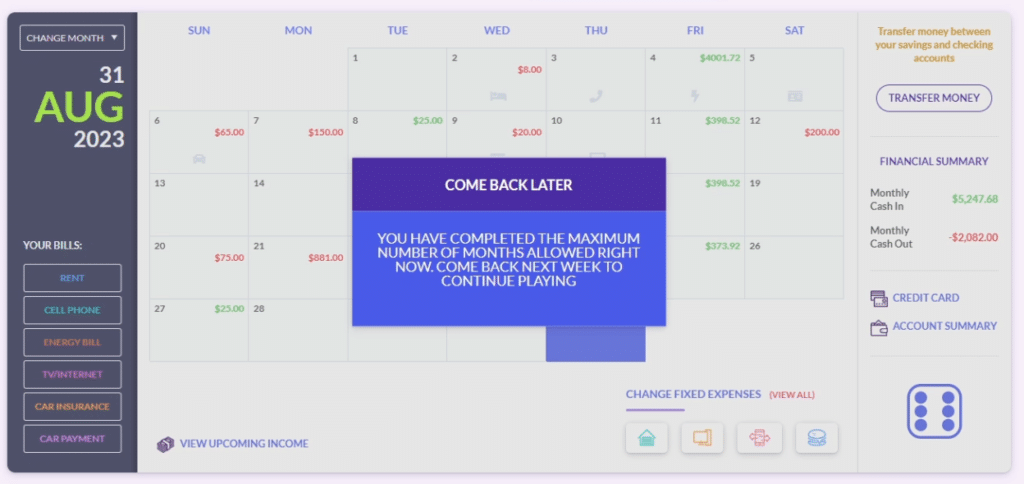

“You just have to get in there on your own, create an account, and play around with it. I sat and did the Budget Game for a few months before I did anything. I was going through and rolling the dice and looking at what it was doing, and then I switched into the Stock Game, and I realized that if it was fun for me, and here I am as a 45-year-old who’s been buying stocks for 27 years… if I’m having fun playing this, these kids are going to have fun playing it. And if they’re having fun, as long as it’s not just fun, they’re going to learn from it more.”

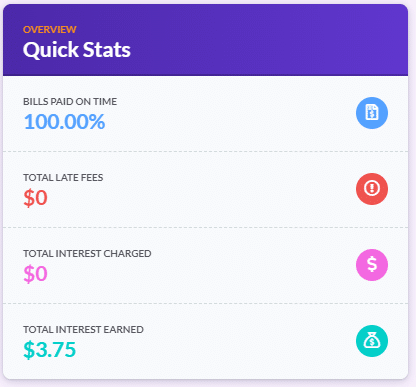

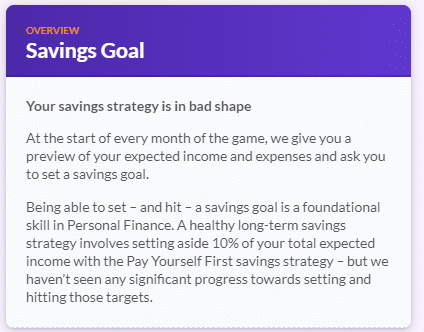

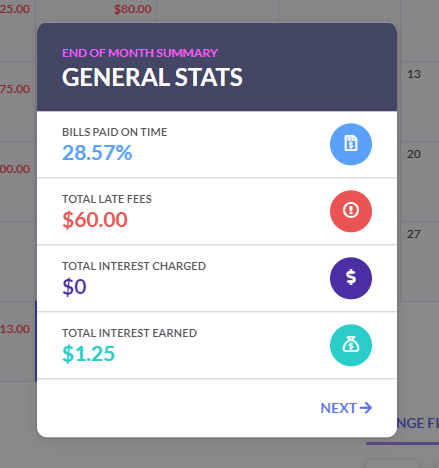

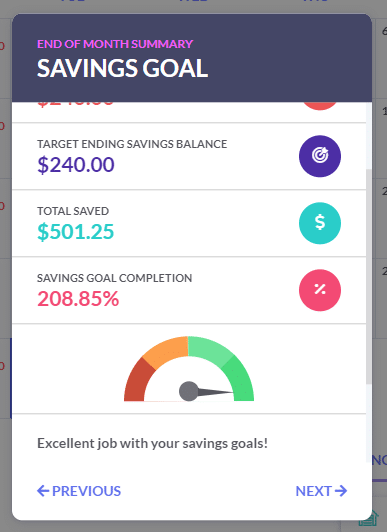

He said that once you figure out how to work it into your curriculum, “It almost runs itself.” So if you’re teaching your students about budgets, start by talking to them about the different methods. Then he suggests having your students apply them as they play the Budget Game. So, when they set their savings goals at the beginning of the month (in the game), they can follow the Pay Yourself First method. Then another month they can try the 50/30/20 rule. Allowing students to do it themselves means they get practice transferring their money into savings and developing that habit even before getting their first jobs.

As Close As You Can Get (Without Real Money)

“I think it’s just that 100% of the kids learn better through doing. I can stand up here and talk to them about it… Direct instruction, I think, is huge. There’s a lot of knowledge that I’ve built over the years that I can pass to them, but it’s not the same as them doing.”

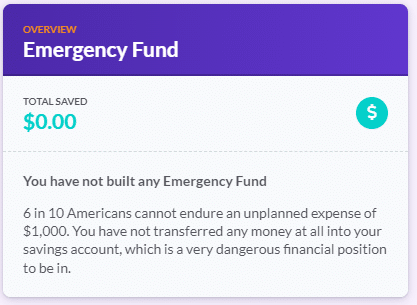

He described how his students can see the impact of putting some of their money away in the Budget Game and letting it grow. After a year or two in the simulation, they’re lifestyle is better, then they start investing in the Stock Game. He explained how it’s particularly helpful for younger students who haven’t had to deal with unexpected expenses like a leaky roof that needed repairing, or a car accident, “They haven’t had the experience yet, and so the next best thing is a simulation,” he said, “And I think PersonalFinanceLab nails it for those two things: savings and budgeting, and then investing. The rest is bonus, I mean, there’s so much more to it… but I do think those three things you got to learn through doing, and this is as close as we can get without giving them real money.”

“I think PersonalFinanceLab as a tool for the hands-on experience is helping our kids, whether they go direct to a career after high school, whether they go to trade school or whether they go into a four-year college. I think that this software is going to help every one of them, because they’re just going to be familiar when it’s real.”

Mason Renfer has already made an impact on his students, below are some of the responses his students sent into the PersonalFinanceLab team when asked why their teacher should be nominated for a prize.

Student Testimonials

I never understood credit or stocks until I came into this class. I think it really influenced my future. Seeing my grandma struggle to understand finances after her husband died made me realize I need to know how my money works. I know I will never regret signing up for this class.

Student Nomination from the Fall 2024 Financial Literacy Challenge

Mr. Renfer has allowed me to better understand all aspects of personal finance. I now understand credit, the stock market, loans, debt management, and so much more. He has done nothing but prepare me for the real world.

Student Nomination from the Fall 2024 Financial Literacy Challenge

Mr. Renfer has been an amazing teacher, introducing our class to eye opening topics. He is able to keep our class engaged and excited about the topics, and he is genuinely excited every day to teach us.

Student Nomination from the Fall 2024 Financial Literacy Challenge

Mr. Renfer is one of the best teachers I have ever had. He is patient and will give anyone extra help if it means they’ll better understand finance. There isn’t a better candidate for this position.

Student Nomination from the Fall 2024 Financial Literacy Challenge

He was able to teach me and my class on how to set up our lives for the long term and how to keep our money safe.

Student Nomination from the Fall 2024 Financial Literacy Challenge

Want your students to say the same things at your school?

Book a discovery call to find out how PersonalFinanceLab could be the solution you’ve been looking for.

Contact Info